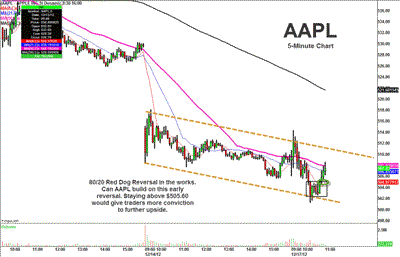

Before-and-After: Today’s 80/20 Red Dog Reversal trade in AAPL

Before the market opened today, Apple (AAPL) was trading all over the map. It dropped as low as $496 before rallying narrowly into positive territory by the open. After very heavy action in the stock last week, it was hard to have an edge either direction. Without a clear-cut set-up, it was hard to short a stock that was down $50 last week, but also hard to get long such an under-performer. The new point of reference was $505.58. AAPL saw a quick push lower through that level, and turned into an 80/20 Red Dog Reversal strategy when it traded back up through it. Stops were then placed at the morning low of $501.23. The chart below was tweeted around 11:00am ET to alert traders about a potential reversal. The key for AAPL today was its ability to build on early morning strength.

(click to enlarge)

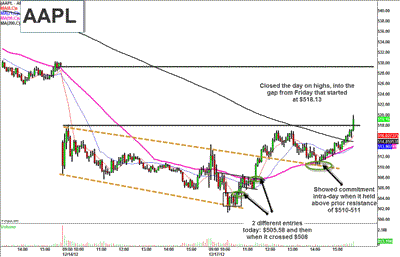

Apple showed commitment throughout the session on a 5-minute chart. The first entry was $505.58 and once AAPL held above that level, it gave traders another entry once it broke above the flag pattern at $508. AAPL closed the day on highs, up 1.77% and in the gap from Friday that started at $518.13. Today’s action is constructive as it relieves some of the oversold pressure on this stock.

(click to enlarge)

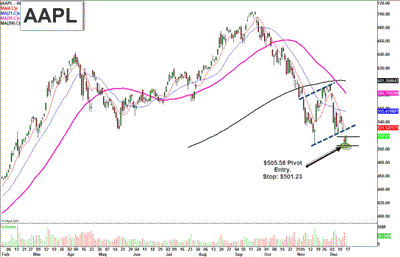

The AAPL Red Dog Reversal provided a great cash-flow trade, but what will it lead to? The stock now needs to now build on that intra-day strength and show commitment on the daily chart. At this point, AAPL is a broken stock and has a lot to prove going forward. Tomorrow’s action will be key to judge the overall validity of today’s move.

(click to enlarge)

By Scott Redler and Victoria Haddow

Disclosure: Scott Redler is long AAPL

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply