The Wall Street Journal ran an interesting piece on Sunday, showing how Goldman Sachs (NYSE:GS) stock analysts are essentially giving preferred clients preferred access to selective information.

The Journal, which through author Susanne Craig is clearly bringing some of the Goldman’s dirty laundry to the front page, directs the reader’s attention to an episode that took place in 2008.

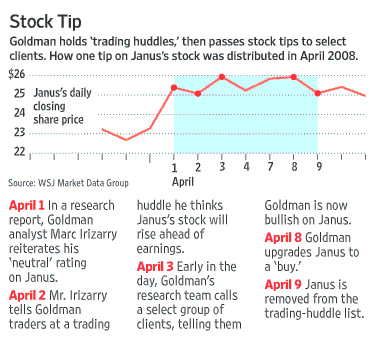

Goldman Sachs…research analyst Marc Irizarry’s published rating on mutual-fund manager Janus Capital Group…was a lackluster “neutral” in early April 2008. But at an internal meeting that month, the analyst told dozens of Goldman’s traders the stock was likely to head higher, company documents show.

The next day, research-department employees at Goldman called about 50 favored clients of the big securities firm with the same tip, including hedge-fund companies Citadel Investment Group and SAC Capital Advisors, the documents indicate. Readers of Mr. Irizarry’s research didn’t find out he was bullish until his written report was issued six days later, after Janus shares had jumped 5.8%.

Every week, Goldman analysts offer stock tips at a gathering the firm calls a “trading huddle.” But few of the thousands of clients who receive Goldman’s written research reports ever hear about the recommendations. [emphasis added]

Goldman’s lame justification of the “trading huddles” is that these meetings are consistent with the research the firm is broadly disseminating and are a further indication that the bank is not treating its clients in a selective and preferential way. According to Steven Strongin, Goldman’s stock research chief, no one gains an unfair advantage from the “huddles.” Strongin argues that the short-term-trading ideas are not contrary to the longer-term stock forecasts in analysts written research. Others however, disagree with that characterization and see the practice quite differently. Their argument is that Goldman’s distribution of the trading ideas only to its own traders and preferred top clients hurts other customers who aren’t given the same opportunity to trade on the same trading tips. Since the “huddles” began about two years ago, Goldman, notes the Journal, has supplied in advance “trading ideas” on hundreds of stocks to the traders and top clients.

Goldman spokesman Edward Canaday admits the trading tips usually go to top clients who have expressed interest in having short-term investment horizons, and says Goldman is doing what it does because it doesn’t want to overload other clients with information that isn’t relevant to them. “Information that isnt’ relevant to them?!” I’d call this a weak argument. Let’s just call this for what it really is, “front-running”, simple as that. You have clients within the same firm knowingly benefiting from advance knowledge on a particular ticker and others unknowingly being harmed by delayed or no knowledge at all.

Goldman spokesman Edward Canaday admits the trading tips usually go to top clients who have expressed interest in having short-term investment horizons, and says Goldman is doing what it does because it doesn’t want to overload other clients with information that isn’t relevant to them. “Information that isnt’ relevant to them?!” I’d call this a weak argument. Let’s just call this for what it really is, “front-running”, simple as that. You have clients within the same firm knowingly benefiting from advance knowledge on a particular ticker and others unknowingly being harmed by delayed or no knowledge at all.

In any event, and stating the obvious here – these type of Wall Street practices are not a bit surprising. Allowing one set of clients to front-run another set of clients is unfortunately, the norm in Wall Street. What this story will do however, I think, is bring more unwanted attention to Goldman Sachs who continues to face unfavorable media stories.

Graph: WSJ

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply