The news out China seems to be getting worse.

Last week the NY Times reported about China’s huge inventory build of unsold goods,

GUANGZHOU, China — After three decades of torrid growth, China is encountering an unfamiliar problem with its newly struggling economy: a huge buildup of unsold goods that is cluttering shop floors, clogging car dealerships and filling factory warehouses.

The glut of everything from steel and household appliances to cars and apartments is hampering China’s efforts to emerge from a sharp economic slowdown. It has also produced a series of price wars and has led manufacturers to redouble efforts to export what they cannot sell at home.

The severity of China’s inventory overhang has been carefully masked by the blocking or adjusting of economic data by the Chinese government — all part of an effort to prop up confidence in the economy among business managers and investors.

This followed the disappointing flash manufacturing PMI report, which showed a rapid deterioration in China’s industrial sector with the index falling to a 9-month low.

What is happening to all the unsold goods piling up in China and why isn’t the market working to clear the excess supply? Government manipulation and good old fashion channel stuffing.

Writing for Forbes, Gordon Chang notes,

It’s hard to see how manufacturing will recover soon. Manufactured goods are stockpiled at record highs across China. “My supplier’s inventory is huge because he cannot cut production—he doesn’t want to miss out on sales when the demand comes back,” said Wu Weiqing to the New York Times.

Perhaps that explanation makes sense, but it’s far more likely that Wu’s supplier, which makes sinks and faucets, had been told by the local government to keep production lines going no matter what. And why would city and municipal officials do that? For one thing, local officials don’t want to deal with unrest that idle workers cause. Moreover, lower-level cadres are judged by growth in their districts. The value of a sink sitting in a factory’s inventory, even if never sold, is counted as gross domestic product. Mr. Wu’s employer, a wholesaler, has seen its sales fall 30% over the course of the last year.

The steel and auto industry are also being hit hard,

The past for Chinese steel is unclear, but the future is certain. The signs for the remainder of the year are, unfortunately, uniformly bad. The price of benchmark hot rolled steel has fallen 19% since April. In the first half of this year, the profits of steel companies dropped 96% from the corresponding period in 2011. Steelmakers have been defaulting on their obligations to purchase iron ore, a sure sign production will tumble soon. Daily output this month, according to the analysts at Mirae Assets Securities, could be as low as 1.85 million tons. Record production in the face of weak demand suggests inventories must be rising.

Carmakers have solved their inventory problems by forcing dealers to take autos they cannot sell. Inventories at the dealers in the first six months of the year increased 900,000 units. These retailers are now carrying 2.2 million cars in their showrooms. Even with dealers taking unneeded cars, the manufacturers are operating at around 65% of capacity when 80% is thought to be the breakeven point. Eventually, the automakers will have to slam on the brakes: retail sales of cars are probably declining at this moment.

And why do we not know for sure? Censors have stopped the release of statistics on car registrations, and fictitious reporting has hidden the size of the inventory buildup across China’s manufacturing sector. Yet government statisticians were unmasked by the HSBC Flash PMI. The inventory buildup this month was the fastest ever recorded by the survey, which began in April 2004.

Anyone who thinks the slowdown in China will not affect growth and corporate earnings in the U.S. and elsewhere is, well, should we say, smoking crack.

Chang does note, however, because of government “can kicking” (sorry about that) the inventory buildup, imbalances and disequilibrium in China’s economy can go on longer than many think it can,

Censors have stopped the release of statistics on car registrations, and fictitious reporting has hidden the size of the inventory buildup across China’s manufacturing sector. Yet government statisticians were unmasked by the HSBC Flash PMI. The inventory buildup this month was the fastest ever recorded by the survey, which began in April 2004.

In free-market economies, the sustained rise of inventories is a prelude to recession. In China, on the other hand, inventory accumulation can go on for years before it negatively affects growth.

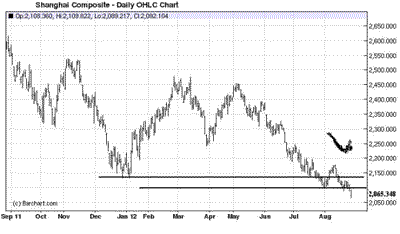

The Shanghai Composite stock index is not fooled, however, and continues its swan dive.

(click to enlarge)

As markets pin their hopes on the Magic Draghi of the West it would behoove traders and investors to keep a close eye on the Dragon of the East. The shock of a shrinking China and unstable political economy would be the tipping point for the global economy.

Leave a Reply