Futures are up a bit this morning as German and French GDP came in better than an analyst expectations. The numbers weren’t stellar, but no one was expecting them to be. The Euro strengthened as the Yen weakened on the news.

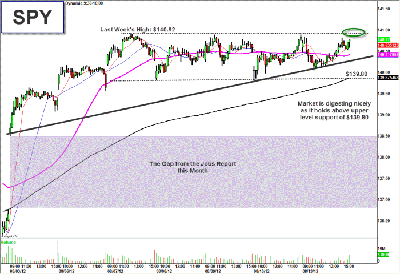

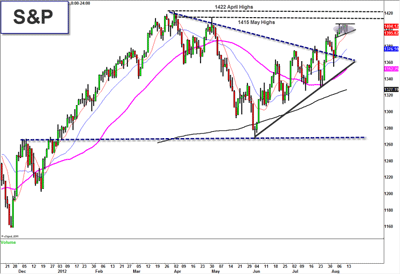

Markets continue to digest higher as today the upper pivot will be tested again. The micro battle ground in the S&P is 1405-1407 (in the S&P ETF (SPY), it is the $141 level), and if we get a 60min and, even more significantly, a daily close above that level, the next spot is the highs of the year at 1415-1422. Although the market is at upper levels, and buying breakouts in indices hasn’t worked much this year, the 8 and 21 day MA’s have been given time to catch up as we digest. In our trading courses, we teach strategies to effectively tier into breakout trades to limit risk and maximize exposure when the meaty move should happen.

(click to enlarge)

Some fundamental market commentators think Technicians don’t understand all the “smart bearish arguments”. Most of us do, but we’d rather focus on what is actually going on. Ned Davis said it best, “Do you want to be “right”, or make money?” While there are global economic issues, and the market is slow this August, there is a lot to like in the equity markets on every time frame.

(click to enlarge)

I wear two hats. One, I make my living, the significant majority of my income, trading the markets. Second, I am the Chief Strategic Officer for T3Live that serves as the Offense and Defensive Coordinator for those interested in running routes and getting involved. Some times I’m more involved in the market than others depending on all my demands. You need to figure out what balance works for you.

Let’s get to a little stock specific news.

Groupon (GRPN) is down 23% this morning after a very disappointing earnings report. The company has been a popular target for short-sellers since its IPO under the premise that the company is ripe for competition and has no real intrinsic value. The stock will open today at all-time lows below $6.

Home-Depot (HD) shares are up 1.5% pre-market after beating on EPS estimates but falling just short on revenues. The stock has been on an incredible run since August 2011, nearly doubling in value. Jim Cramer, on his Mad Money program this week, said he would still buy HD at these levels.

Michael Kors (KORS) is also up, around 6%, pre-market after surpassing earnings expectations. The retail sector as a whole has performed well despite the slow economy, but there have been some problems in high-end retail. The best performers in the space has been the big box discount retailers like Target (TGT) and Wal-Mart (WMT), but KORS appears insulated from that trend to this point. All three have been listed previously on our T3Live Off the Charts newsletter.

Finally, Apple (AAPL) is set to open higher once again as expectations are firmly in place for a September 12 iPhone 5 announcement and September 21 hard release. Investors expect rapid demand for the phone after seeing the outstanding sales numbers for the iPhone 4S. The newest model of Apple’s smartphone is expected to have significant upgrades, including 4G LTE network capabilities for the first time and a larger screen. If you don’t already, you should learn how to trade Apple.

Disclosure: Scott Redler is long AAPL, GOOG, GS. Short SPY

Leave a Reply