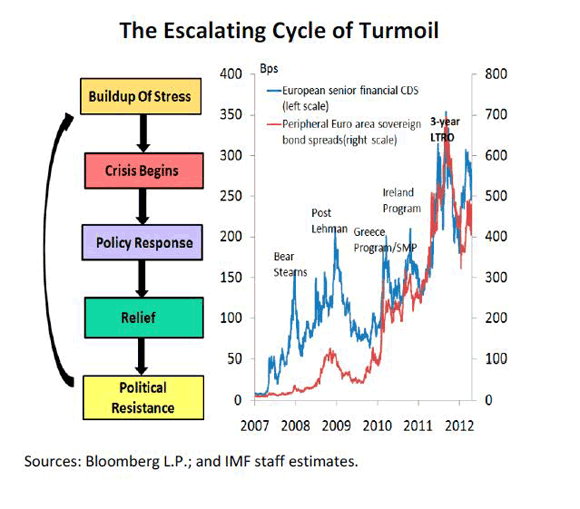

Great graphic from the IMF, which nails the policy paralysis in the Eurozone. Similar, but more rigorous, to the “meet and discuss” cycle we wrote about last December,

Their modus operendi seems to be: meet and discuss, wait for a crisis, generate a massive short squeeze, meet and discuss, wait for the next crisis, generate a massive short squeeze, meet and discuss, wait for the next crisis…

The IMF exhorts Eurozone policymakers in their update to the Global Financial Stability Report,

– Policymakers must resolve the uncertainty about bank asset quality and support the strengthening of banks’ balance sheets. Bank capital or funding structures in many institutions remain weak and insufficient to restore market confidence. In some cases, bank recapitalizations and restructurings need to be pursued, including through direct equity injections from the ESM into weak but viable banks once the single supervisory mechanism is established.

– Countries must also deliver on their previously agreed policy commitments to strengthen public finances and enact sweeping structural reforms.

The ultimate question is how binding will the political constraints be on structural reform? Stay tuned.

Leave a Reply