Lots of Fed chatter today. Most of it points toward quantitative easing, but with a caveat: In general, we are getting a rehash of already stated views, views that should have pointed in the direction of QE3 at the last meeting.

First, San Francisco Federal Reserve President John Williams gave the following forecast:

I now expect real gross domestic product to expand by a little less than 2 percent this year and about 2¼ percent next year….

…So I expect that the unemployment rate will remain at or above 8 percent until the second half of 2013. What that means is that progress on bringing down the unemployment rate has probably slowed to a snail’s pace and perhaps even stalled.

Turning to inflation, I expect the inflation rate to come in below the Fed’s 2 percent target both this year and next….

What does this mean for the Fed? We are falling short on both our employment and price stability mandates, and I expect that we will make only very limited progress toward these goals over the next year.

The implications for monetary policy:

If further action is called for, the most effective tool would be additional purchases of longer-maturity securities, including agency mortgage-backed securities. These purchases have proven effective in lowering borrowing costs and improving financial conditions.

I have no idea why Williams insists on using the qualifier “if.” Absolutely no idea. He clearly believes the Fed is dropping the ball by falling short of the dual mandate. Thus, a simply extension of his logic should be that further action is necessary. So why hedge? (Williams is making a Pacific Northwest tour, but unfortunately I will miss him in Portland this week, so I won’t get the chance to ask this question directly.)

Williams clearly has Europe on his mind:

Over and over again, European authorities have struggled to get a grip on the crisis. One basic problem is that they’ve taken a piecemeal approach by providing rescue packages to individual countries. These steps calm markets temporarily, but don’t yield a credible, comprehensive solution to the underlying problems that Europe faces. Until such a solution is in place, I am afraid that Europe will remain vulnerable to new shocks.

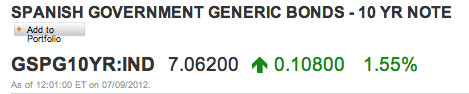

Translation: European policy making is in terrible disarray, bordering on incompetence. And to his point, we have this:

I am not even sure why I worry I will miss some critical piece of information while on vacation. We all know the script. Europe will have a summit. This will make some announcement suggesting a real breakthrough in crisis resolution efforts, like the very important idea of separating bank bailouts and soverign debt. Then it will become apparent in the next few days that they in fact reached no agreement, and even if they did, they have no idea about the details or timing. All they reached was an agreement to agree on something at some point in the future. Maybe.

No one can snatch defeat from the jaws of victory as adroitly as Europeans policymakers.

Chicago Federal Reserve President Charles Evans gave an excellent speech in Bangkok earlier today. It is worth the read. He reiterates his call for additional policy, including an explicit willingness to tolerate inflation in excess of 2%. This, again, is not really news. I like where he is going on interest rates:

…low long-term Treasury rates support the view that markets are looking for only modest economic growth with low inflation, and a there is a high degree of caution out there — which itself is an important factor holding back economic activity today…

…If the FOMC and other policymakers could engineer stronger growth policies so that the economy boomed again and unemployment fell, this would organically lead to higher real rates of return on investment and higher interest rates in general, which would benefit savers and investors throughout the world. A more vibrant economy would benefit owners of unused resources, bring unused factory capacity back on line and reengage unemployed workers. This is the policy path that is most desirable in my opinion. I also think it is most consistent with the accommodative policies I have been advocating.

Focus on policies that raise long-term rates. Novel idea, at least for the Fed.

Boston Federal Reserve President Eric Rosengren is also in Bangkok:

Despite this rather gloomy collective forecast, I actually have been more pessimistic than my colleagues. My forecast for GDP is below the central tendency, my forecast for unemployment is above the central tendency, and my forecast for inflation is at the bottom of the range of the central tendency. My pessimism is rooted in an expectation of weakness in investment, net exports, and government spending. That weakness is driven in part by concerns about economic and financial conditions in Europe, combined with restrained state and federal government spending as the U.S. (like many other countries) grapples with large budget deficits.

Sounds like he too would call like more aggressive policy. But, similar to Williams and Evans, I think he already came to this conclusion prior to the last FOMC meeting.

Finally, for completeness, we have a Bloomberg interview with serial-dissenter Richmond Federal Reserve President Jeffrey Lacker:

…in an interview with Bloomberg Radio, Lacker said “employment is close to maximum right now” given “the constellation of impediments and challenges this economy has had over the years.” Lacker, who voted against additional stimulus at the last Fed policy meeting, said the current slowdown in the economy is not fatal or tipping the economy into recession. “We are just in a situation where growth is going to fluctuate between somewhat satisfactory and disappointing,” Lacker said.

The idea that we are close to potential output/maximum employment is a minority to view at the Fed and as such is not relevant for current policy making.

Bottom Line: Lots of Fed chatter, on average pointing in the direction of additional easing, but none of it really that new, and all of which would have pointed to QE3 at the last meeting. Enough chatter, though, that it makes me suspect that the minutes from the last FOMC meeting will have plenty of talk like “several participants saw the need for additional easing.” If so, expectations for the Fed to step up in August will become even more entrenched.

Leave a Reply