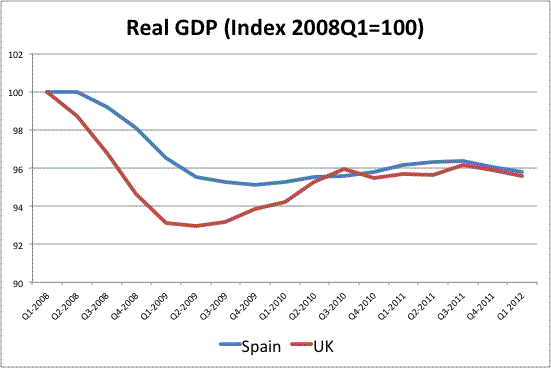

UK GDP contracted faster than previously announced in the first quarter of 2012. What would the evolution of GDP have looked like during this crisis if the UK had been part of the Euro area? Impossible to tell as we cannot do a proper counterfactual exercise. But here is a potentially interesting comparison: the evolution of the UK and Spanish economies since the beginning of the crisis.

Spain and the UK are both large (by European standards) economies. Both of them started the crisis with current account deficits and suffered a real estate bubble prior to the crisis. There are, of course, differences: the UK financial sector is larger than that of Spain; the real estate bubble was larger in Spain,… But the difference that tends to be highlighted more by economic commentary is the Euro membership. Spain could not depreciate its currency as the UK did, Spain cannot resolve its government debt problems by relying on its central bank, and Spain could not lower the interest rate to zero as the UK did. Are these factors visible in the evolution of GDP from the beginning of the crisis to today?

Not obvious. If we take the end of 2007 as the beginning of the crisis, real GDP is today at the same relative level in both economies. The UK suffered more in the first quarters and then recovered. The Spanish economy was doing better earlier and then fell faster. Since the second quarter of 2010 both economies have been moving in parallel.

This is clearly not a scientific proof that Euro membership has not made a large difference (I am not controlling for all the other factors). But at a minimum, it raises questions about the statement that membership in the Euro area is a key factor to understand the performance of Euro members during the crisis.

Leave a Reply