From the Wall Street Journal last week:

As measured by Treasury bonds, inflation expectations are falling amid heightened concerns that the discord in Europe will threaten U.S. growth. Some observers say that the lowered outlook for inflation gives the Federal Reserve more leeway to stimulate the economy, possibly through another round of quantitative easing. In “QE,” the Fed pumps money into the financial system through asset purchases.

Financial market participants are anticipating Fed action. Are monetary policymakers on the same page? St. Louis Federal Reserve President James Bullard last week:

Bullard said he believes the European Central Bank is committed to backing the continent’s brittle banking system, and therefore the risks to the U.S. economy are smaller than some analysts perceive.

Indeed, Bullard added he expects the U.S. economy to perform better than many forecasters anticipate and that the Fed will therefore need to raise interest rates in late 2013, not late 2014 as its policy committee is currently indicating.

Minneapolis Federal Reserve President Narayana Kocherlakota last week:

“I see these changes as a signal that our country’s current labor-market performance is much closer to ‘maximum employment,’ given the tools available to the [Fed], than the post-World War II U.S. data alone would suggest,” Kocherlakota said. “As I’ve argued in the past, appropriate policy should be responsive to such signals.”…

…Earlier in May, Kocherlakota said the Fed should start looking at tightening monetary policy in the next six to nine months. He said he saw inflation at around 2% this year and 2.3% in 2013, numbers that signal the need to start exiting the central bank’s current ultra-easy policy.

Arguably, neither Bullard not Kocherlakota are critical voices in the FOMC. More interesting are today’s comments from New York Federal Reserve President Wiliam Dudley. From the Wall Street Journal:

Expectations for U.S. economic growth, while “pretty disappointing” at around 2.4%, is sufficient to keep the central bank from easing monetary policy, Federal Reserve Bank of New York President William Dudley said.

“My view is that, if we continue to see improvement in the economy, in terms of using up the slack in available resources, then I think it’s hard to argue that we absolutely must do something more in terms of the monetary policy front,” Dudley said in an interview with CNBC, aired Thursday.

Dudley is considered part of the inner circle; if he doesn’t think the Fed needs to do something more, the baseline scenario should be that QE3 is not on the table.

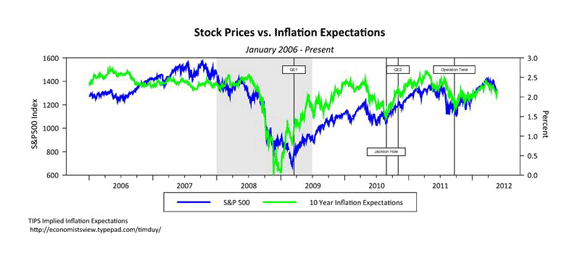

At least for the moment. Simply put, I think market participants are getting ahead of the Fed. My suspicion is that the Fed will need to see a weaker data flow in the months ahead to justify getting back into the game. And I don’t think the TIPS-derived inflation expectations are lower enough to trigger action either. I think we need to go down at least another 25bp if not 50bp until the Fed pulls the trigger:

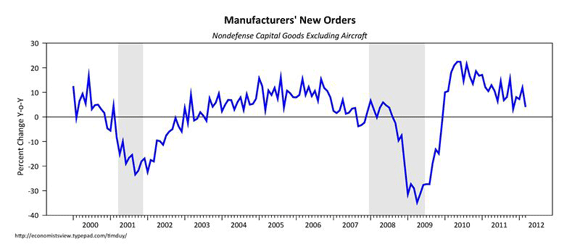

That said, of course the risks to the outlook could shift by the June meeting. The trend in new orders for nondefense, nonair durable goods suggests that some of the global weakness is catching up with the US:

That said, no clear sign that industrial demand has rolled over. Overall, it seems unlikely that the data flow as a whole will turn fast enough to prompt the Fed into easing next month. Only the next employment report stands out as a potential deal breaker. In general, though, I would think you need at a minimum the Q2 GDP report to justify additional easing – which pushes us out to the July/August meeting at least.

So if we take the US data off the table, then we are looking for financial disruption, which is obviously a possibility given the current unpleasantness in Europe. Indeed, we should not be surprised if the Fed needs to further improve dollar liquidity abroad (an action that is sure to be taken as a sign that QE3 is imminent; expect Fed speakers to deny a policy shift is afoot). And note that the next FOMC meeting is just 2 days after the June 17 Greek vote – and that could be the vote heard round the financial world that prompts the Fed to act.

Bottom Line: The data flow is soft, but Dudley indicates it is not soft enough to ease. And while some are pointing to falling TIPS-derived inflation as given the Fed room to move, they have traditionally delayed until conditions are more dire (they are not exactly prone to overshooting in the first place). The Fed doesn’t think they will ease further; they think their next move will be to tighten. Which means that financial conditions will need to deteriorate dramatically to prompt action in June. So if you are looking for the Fed to ease in just four weeks, you are looking for financial markets to turn very, very ugly. Lehman ugly. And I wish that I could say that it won’t happen, but European policymakers are hell-bent to push their economies to the wall while worshipping at the alter of moral hazard.

Leave a Reply