There has been a fierce counterattack to Federal Reserve Chairman Ben Bernanke’s assertion that he is indeed the same Professor Bernanke that advised the Bank of Japan a decade ago. See, for example, Brad DeLong, David Beckworth, and Ryan Avent. DeLong identifies this 1999 Bernanke quote:

[Si]nce 1991 inflation has exceeded 1% only twice… the slow or even negative rate of price increase points strongly to a diagnosis of aggregate demand deficiency…. [C]ountries that currently target inflation… have tended to set their goals for inflation in the 2-3% range, with the floor of the range as important a constraint as the ceiling….

and concludes that Bernanke previously believed the inflation target should be between 2 and 3 percent, with 2 percent being a floor. One could infer, then, that Bernake at one point believed in a symmetric objective around 2.5 percent, with a hard floor and ceiling on 50bp of either side of that objective. Now the Fed has sanctified a 2 percent target.

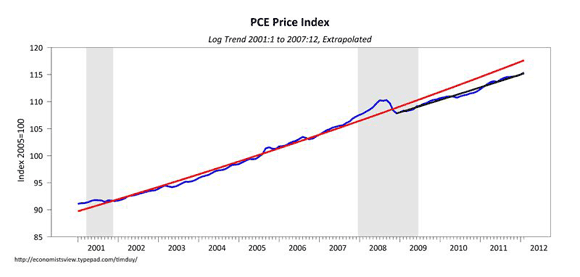

This shift is important and evident in the path of inflation, and was my point in this post. Prior to the recession, headline PCE inflation was running about 2.4 percent a year.* Now the trend is a smidgen above 2 percent:

DeLong, in another post, does a similar picture using core-CPI. I have tended to shift to headline number number because that is the Fed’s stated target and there is widespread misunderstanding about the relevance of core-inflation in the policymaking process. Indeed, the belief that policymakers are somehow misleading the public about the true path of inflation runs deep in the Fed itself. Note that Beckworth takes a different direction, focusing on the path of nominal demand rather than inflation and reaches a similar conclusion – the we are witnessing an attack of the body snatchers.

I think we can conclude, by Bernanke’s statement’s in the past and the actual path of inflation now, that Bernanke has embraced the recession as yet another exercise in opportunitistic disinflation in which the Fed can knock another 40bp off the expected rate of inflation.

The story gets more interesting. In his press conference, Bernanke says:

So it’s not a ceiling, it’s a symmetric objective and we tend to bring inflation close to 2 percent. And in particular, if inflation were to jump for whatever reason and we don’t have, obviously, don’t have perfect control of inflation, we’ll try to return inflation to 2 percent at a pace which takes into account the situation with respect to unemployment.

Avent rightly calls foul on this claim:

Perhaps more telling, the Fed gives a range for projected inflation over the next three years with 2% as the upper extent. If the Fed does indeed have a symmetric approach to the target, as Mr Bernanke asserted yesterday, one would expect 2% to be at the middle of the range, not the top. This is particularly damning as the Fed’s estimate of the natural rate of unemployment doesn’t appear at all in the projected unemployment-rate range over the next three years; the closest the Fed comes to meeting that side of the mandate is in 2014, when the bottom end of the projected unemployment-rate range gets within 0.7 percentage points of the top end of the natural-rate range.

Bernanke is clearly misleading us when he claims the target is symmetric as the Fed’s own projections clearly treat the target as a hard ceiling. The next words out of Bernanke’s mouth are also telling:

The risk of higher inflation, you say 2-1/2 percent, well, 2-1/2 percent expected change might involve a distribution of outcomes. Some of which might be much higher than 2-1/2 percent.

This was the topic my post earlier this week. Monetary policy is not neutral with regards to the distribution of income and wealth. The Fed does not want inflation to exceed the 2 percent inflation target as that will result in a new distribution. The subsequent alterations to the outcomes will not be symmetric; some will gain more than 2.5 percent, some will lose more.

Note – and I think this is important – when Bernanke’s Fed took the opportunity to shift down the path of inflation by sanctifying the 2 percent target, they were comfortable with the subsequent shift in the distribution of outcomes. And consider that shift. At a time when households were overwhelmed with excessive debt, the Fed deliberately chose to increase the real burden of the debt by changing the inflation trajectory.

Why one would use a balance sheet recession to shift downward the path of prices is certainly something of a mystery. But it does imply that the Fed wanted to induce a new distibution of outcomes, even knowing that the beneficiaries would not be households.

Bottom Line: Bernanke is being disingenous in his defence. Despite his claims that his earlier views only applied to deflation, his writings still appear at odds with his willingness to embrace a new price and aggregate demand paths. Moreover, the Fed’s own forecasts clearly do not support his contention that the target is symmetric, but indeed a hard ceiling. The Fed must also know that the by reducing the path of inflation they have knowing altered the distribution of outcomes in a way that is likely to slow the pace of recovery. Finally, with inflation near 2 percent, I suspect the bar toward another round of QE is higher than many believe.

* I noticed an error in the original post that slightly underestimated the inflation rate in the 2001-2007 period. The error is corrected in the new chart.

Leave a Reply