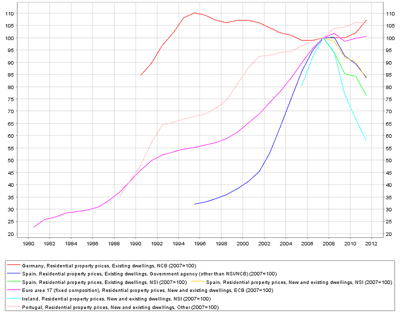

Just as in the United States, many European countries have had large run-ups and crashes in house

prices. Consider the data from the European Central Bank below: one sees in particular large price increases and declines in Spain and Ireland.

(click to enlarge)

Remarkably, default rates in Ireland and Spain in 2009, while high by historical standards at 3.6 and 2.9 percent respectively, were substantially lower than in the United States, where the default rate was 13 percent (see Fiorante and Mortgage Bankers Association of America). Dwight Jaffee has argued that this difference in performance is the result of the fact that mortgages in Europe give lenders recourse to the borrower. I find it plausible that recourse matters, but not that it matters quite so much. For example, while purchase money loans in California are non-recourse, refinance loans are not. The preponderance of mortgages in California are refinance loans, and California’s default rate is extraordinarily high.

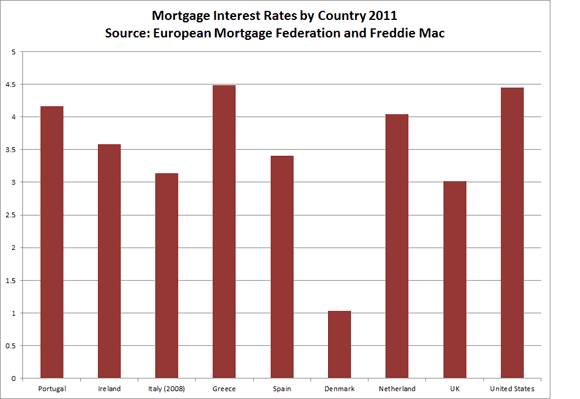

So why haven’t borrowers in Spain and Ireland defaulted more? According to the European Mortgage Federation, more than 80 percent of loans in Spain and Ireland are variable rate mortgages. As a consequence, as market interest rates fell, so too did mortgage interest rates. The typical mortgage borrower in Ireland and Spain is currently paying considerable less than 4 percent on their mortgage.

This has almost certainly been beneficial to Europeans, and suggests that robust TARP 2 program, where underwater borrowers can refinance their loans at lower interest rates, could help mitigate default. On the other hand, as interest rates rise in Europe, we might have reason to become very, very concerned about defaults there in the months to come.

Leave a Reply