The US Treasury released the February TIC data. It is worth pointing out the methodolgical change in the data construction in recent months. Previously, the Treasury used an annual survey of custodians, brokers, etc. to estimate foreign holdings of Treasuries and built on these estimates with monthly transactions data. This led to persistent “transactions bias” errors over the year, particularly a buildup of Treasury securities in the UK that were really attributable to other nations, notably China.

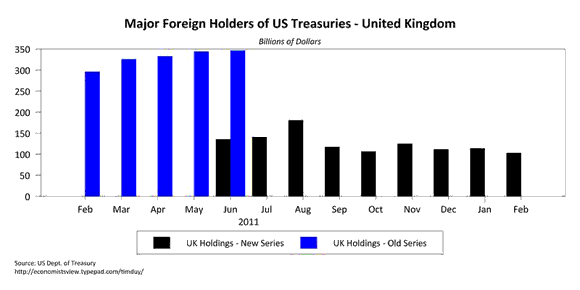

Treasury initiated more frequent surveys last year in September and December (in addition to the regular June survey), and now the surveys are monthly. We are no longer seeing the steady growth in UK holdings as a result:

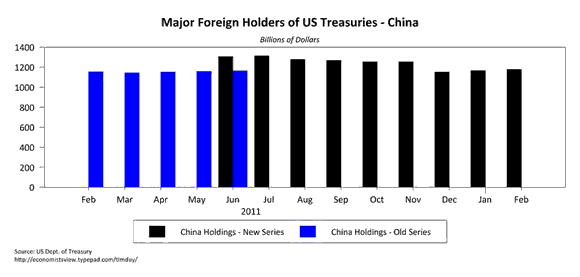

We see the usual drop ($211 billion in June 2011) in the new series with the June revision and an increase in August that is subsequently reversed. One offset to the downward UK revision is the upward China revision ($142 billion):

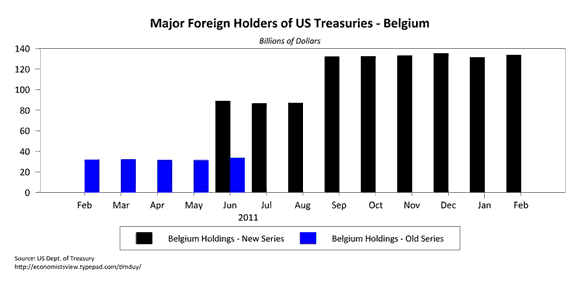

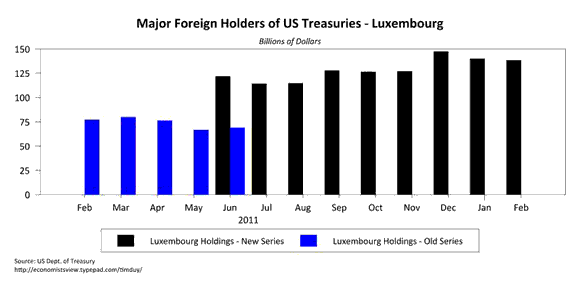

China, however, was not the only upward revision. Interesting upward revisions are also observe in Continental Europe money centers:

The Belgium numbers see two large upward jumps, one each for the June and September surveys. Note that the more frequent survey does not eliminate the “custodial bias” in the data. We don’t necessarily know the end owner of each security. From the US Treasury:

Some foreign owners entrust the safekeeping of their securities to institutions that are neither in the United States nor in the owner’s country of residence. For example, a German investor may buy a U.S. security and place it in the custody of a Swiss bank. In both the SLT and the periodic surveys of holdings of long-term securities, such a holding will typically be recorded vis-a-vis Switzerland rather than Germany. This “custodial bias” contributes to the large recorded holdings in major custodial centers including Belgium, the Caribbean banking centers, Luxembourg, Switzerland, and the United Kingdom.

While we don’t know actual final holder of the security, the upward revisions to the Luxemberg and Belgium are possibly another consequence of the acceleration of the European financial crisis and the scramble for Dollar assets last fall. It will be interesting to see if these holdings increase further as a result of the most recent flare-up in that never-ending saga.

Leave a Reply