We at the Lusk Center put out the Casden Forecast for apartment economics in Southern California every spring. When we put out our San Diego numbers last week, we presented a result that confused people–we expect both rents and vacancies to rise in the next year.

The reason this can (and often does) happen is that real estate markets operate with lags, and feature “natural” rates of vacancy. The “natural” rate is the rate at which real rents stay constant–if vacancies fall below the natural rate, real rents rise; if they rise above, rents fall. Stuart Gabriel and Frank Nothaft did a nice paper on this some time ago.

Consider a tinker toy model of rents that is characterized by two equations (the ts in parentheses are subscripts for time):

Vac(t) = Vac(t-1)+(Rent(t-1)-1)*.05

and

Rent(t) = Rent(t-1)-(Vac(t-1)-.05)*Rent(t-1)

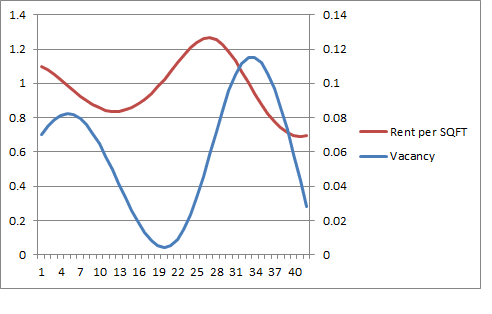

So when rents fall below $1, absorption picks up, otherwise it falls; the natural vacancy rate (the rate at which real rents rise or fall) is 5 percent. This produces the following picture of rents and vacancies:

As one can see, this simple model shows periods where rents and vacancies rise and fall together.

Of course, this is all in real terms. When there is inflation, nominal rents can rise even when the vacancy rate is above the natural rate, because rising nominal rents are masking real falling rents.

Leave a Reply