Equity futures are falling again, with the dollar stronger and breaking out, Euro falling and breaking down, oil is lower and may have put in a top, gold & silver are in correction mode, and food commodities are hanging tough at that large neckline.

The hypocritical self-interested hacks who refer to themselves as the Mortgage Banker’s Association are still spewing completely not believable statistics and should, in my opinion, be shut down. The claim this week is that last week Purchase Applications fell a whopping 8.2% (in just one week – I have some swamp land for you and this is tame for their standards), while at the same time they claim that refinancing activity rose (the opposite direction) by 9.3%!! Ha, ha, that’s a 17.5% gap between the two, all in the course of just one week. Do you believe that? If so, I have a great “investment” for your retirement, contact me. Here’s Econocomplicit:

Highlights

The volume of purchase applications swung lower in the December 9 week, down 8.2 percent vs an 8.3 percent rise in the prior week. Swings in weekly data can be severe but the overall trend for purchase applications has been positive. The volume of applications for refinancing has also been positive, up 9.3 percent on top of the prior week’s 15.3 percent gain. Low mortgage rates are behind the demand with the 30-year averaging 4.12 percent, down six basis points for the lowest rate of the year.

Complete fraud, again, my opinion is that the people disseminating this data should be prosecuted – their data, I believe, is completely biased and misleading and has been so during the creation of the largest housing bubble in history that has damaged millions of lives. Their deceptive practices picked up a notch as the bubble imploded and they changed the way they report the data in order to make tracking reality more difficult. Fraud most certainly is a prosecutable offense and that should be applied to the MBA as well as the NAR, and the reporting of such statistics should be mandated to be placed in unbiased hands.

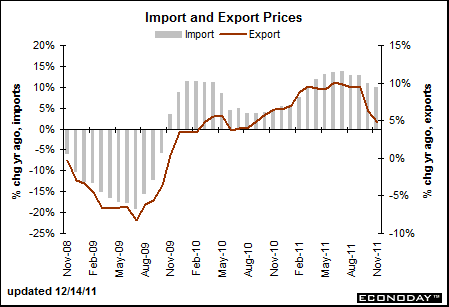

Meanwhile, the BLS says that Import prices rose in November by .7% and that Export prices rose by .1%. However, the year over year figures are showing price deceleration, here’s Econospin:

Highlights

Belying a jump at the headline level, inflationary pressures from import prices are easing. A 3.6 percent monthly surge in the price of imported petroleum products skewed total import prices 0.7 percent higher in November. But when excluding petroleum, import prices fell 0.2 percent following a 0.3 percent ex-petroleum decline in the prior month. Import prices for final goods show no more than marginal pressure, up 0.1 percent in the month for both capital goods and consumer goods. On the export side prices are also subdued, up only 0.1 percent in November following a decline in October.The rise in the dollar, which is getting a major boost from safe-haven demand tied to Europe, is a major factor helping to subdue inflationary pressures from import costs. This together with no more than moderate economic demand are preventing pass through of high energy costs. Today’s report should confirm expectations for moderate core readings for tomorrow’s producer price report and Friday’s report on the consumer side.

The mask is now completely off Europe. Despite their meetings, rumors, and supposed deals to leverage to infinity and beyond, spreads continue to blow wide and politicians are forced to concede that solutions won’t come “easily.” No kidding, that’s because the impossible math and debt saturation they created just is. In the background nations are making preparations for the day the Euro in its present form is no longer – I believe we are very close to that day, it is coming soon. There are dangers involved in the transition, of course, so we need to maintain our vigilance.

The dollar and the U.S. are no better off, we just are better at charades for the time being. The dollar in its present form is equally toast, the clock is ticking here too. Because that clock is based on the exponential math that underlies debt, time will appear to move more quickly into the future until we reach the “event horizon.” To me that is the day the dollar in its present form is done and we wind up with the next iteration… the key will be WHO is then in charge of controlling the production of the money. That is THE most important thing for a nation to get right.

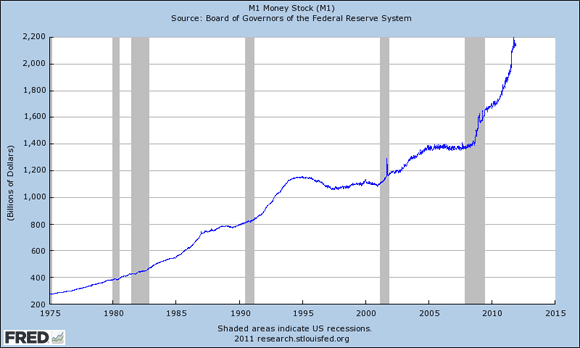

While the Europeans are having difficulty forcing more square debt into the round debt saturated black hole, criminals the world over are disappointed that the world’s Central Criminals aren’t producing massive more quantities of money, as if this were somehow not enough:

Well, it’s not enough because all the money production is going into the wrong hands – that’s a function of WHO controls the production.

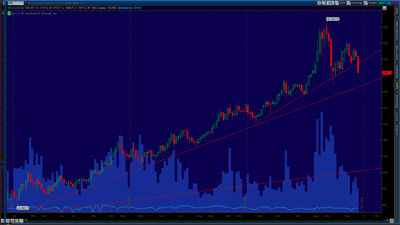

With money production completely out of control, commodities have been the place to be to shelter wealth – Waves of inflation, waves of deflation. Right now commodities are experience a wave of withdraws, but the primary trend lines are still very much in tact – let’s take a closer look.

Gold has broken its daily chart uptrend line and is definitely in correction mode. As you can see on the Daily chart below, the next area of support is in the $1,550 range:

(click to enlarge)

When we zoom out and look at the gold Weekly chart we see that next trendline pretty clearly:

(click to enlarge)

But that Weekly uptrend line is not THE primary trend line, no, that is found on the Monthly chart where it is clear that the mid $700 level is where the long term trend line resides, with an intermediate support line in the $1,100 region:

(click to enlarge)

First of all, from my perspective nothing has changed fundamentally – the world is still saturated with debt, the math is completely beyond impossible. Thus those WHO are currently in power (in charge of the production of money) ARE with great certainty going to do anything and everything they can to hold onto that power. If that means bankrupting the nation and everyone in it – consider it done. The overall trend is clear – money will be produced until all confidence is gone.

Still, if you are playing in gold, watching the corrections can make it hard to hold on. I would say that if you are a speculator with a short time horizon, then you should have sold on a break of the daily trendline, buy again at the weekly trendline. However, if you are a middle term investor, you may want to hold until the weekly trendline and see what happens. If it breaks, then use that line as your demarcation line for your in or out decision point… riding from $1,550 all the way to $1,100 or $750 would not be fun if a serious wave of deflation comes. Of course moving in and out isn’t for everyone, so if you are in it to ride all the waves out, forget about it, nothing’s changed.

Looking at the silver chart, it is also in correction mode with up slopping support in the $24 to $25 range:

(click to enlarge)

While that looks like a big correction in silver, put in perspective. Only a few short years ago the prospect of $20 silver seemed radical. Again, nothing’s changed, the fundamentals are the same, waves of inflation, waves of deflation, but in the end inflation kills the currency. In regards to precious metals and commodities, also remember that they are some of the most highly manipulated markets there are. There will be moves to intentionally make you abandon your position. One trick now commonly used is to break the trendline, then reverse. So, from my perspective nothing is safe in this environment, it is all lawless 100% of the time. The only way to ensure you end the lawlessness is to return the power of money production into the hands of the people where it properly belongs.

Leave a Reply