Many were disappointed that the EU Summit didn’t conclude with a hard number backstop for the ‘zone’s sovereign debt rolling over next year. We believe if you scratch the surface the bazooka is there.

The EU President, Herman Van Rompuy, stated in the wee hours of this morning,

As regards private-sector involvement, we have made a major change in our doctrine: from now on we will strictly adhere to the IMF principles and doctrines,” and added “or, to put it more bluntly, our first approach to PSI, which had a very negative effect on debt markets is now officially over.

We read this as an unequivocal backstop even if the official statement is not explicit.

If their PSI approach is over, that is bailing in the banks and bondholders who hold the questionable sovereign debt , the full blown bailouts, if needed, will continue. By explicitly stating PSI is over, the EU is implying the big bazooka will be there to fund any shortfalls in rolling over bond maturities.

The earthquake and severe aftershocks that has shaken even the German banking system and has increased global systemic risk has put the fear of God in the EU leaders. They now know what’s at stake but a wholesale bailout of the banks and bondholders is a hard sell to their domestic constituents and parliaments. Ditto for debt monetization and the German public.

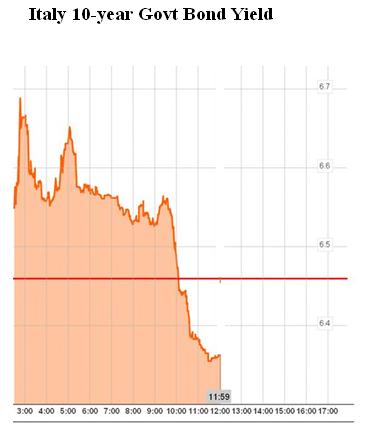

The EU may have also learned an important lesson that the markets will surely test any number they put on the bazooka. The fiscal pact is a step in the right direction and clears the way for ECB bazooka if needed, in our opinion. Furthermore, many analysts were very skeptical after the Summit concluded, yet the markets are up and sovereign spreads are slightly tighter. This is a good sign.

The structural problems are far from solved and the markets will be back to challenge the Eurozone’s resolve, but it does appear the fiscal pact has provided the fig leaf for some short-term relief, and, ironically may have camouflaged the bazooka, if you don’t look carefully. The markets may be up today because the numbers don’t add up.

Yes, Virginia, there just may be a Santa Claus rally this year and nobody believes it. We are fully aware of the S&P Grinch who could downgrade these countries next week. Should they?

A close above 1263.32, the 200-day SMA, on the S&P500 could set off the rampfest into year-end that we’re expecting. We’re mainly traders, can always could be wrong, and always use stops. Stay tuned.

Leave a Reply