If history had turned out differently, the USSR would’ve taken home the most Olympic medals this year, as the total awarded to athletes from the area was 163, according to a blog on Foreign Policy’s website. As we all know, the Wall came down, the Soviet Union collapsed, and now Russia has to be content with its third-place position of 82 medals. Athletes from the United States were awarded the most medals (104), followed by participants from China, who took home 88.

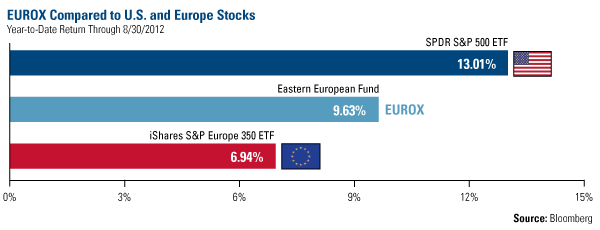

In another contest, the U.S. stock market outperformed many developed and emerging equity markets for the year as of the end of August. Despite the negativity surrounding corporate earnings, lower economic growth and ongoing political uncertainty, the S&P 500 ETF rallied, climbing 13 percent through August 30.

By comparison, the iShares S&P Europe 350 ETF only rose 6.9 percent.

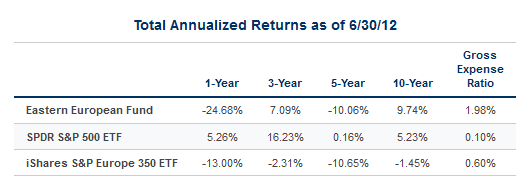

What seems to be overlooked by investors is the fact that stocks in Emerging Europe have also seen noteworthy results. As you can see in the chart below, the Eastern European Fund (EUROX) rose nearly 10 percent over the same time frame. Turkey was a significant contributor to those results, with stocks in the country climbing almost 40 percent; Russian stocks only advanced about 4 percent.

With the underperformance of the iShares S&P Europe 350 ETF, many investors have interpreted this as a contrarian sign to hunt for bargains in developed Europe. However, if you believe that Europe will see better days ahead, greater opportunity may lie to the east.

Here are three reasons to look at Emerging Europe stocks today:

1. Better GDP Growth Potential

The companies in the Eastern European area are located in countries set to grow faster than the U.S. and countries in Europe. Russia and Turkey are projected to have a GDP of about 4 percent this year, while Poland’s GDP growth is expected to be 2 to 3 percent.

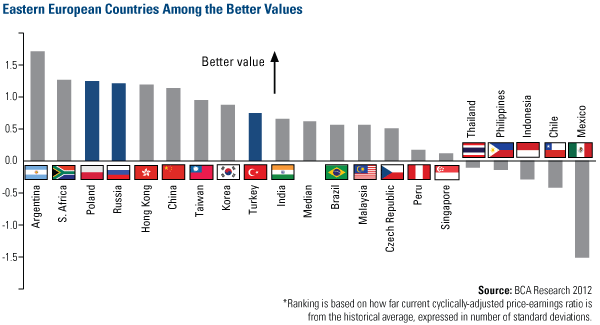

2. Stocks are Undervalued

Along with benefiting from higher GDP growth, many of these stocks are historically undervalued. BCA Research looked at certain value metrics of several emerging market countries, including the trailing and forward price-to-earnings ratio and price-to-book ratios and compared these figures to the historical average going back to the early 1990s. Poland has a reading of about 1.2, which means that today’s price-to-earnings and price-to-book ratios are 1.2 standard deviations below the historical mean. Conversely, Mexico’s reading of -1.5 indicates that stocks in this country are historically overvalued.

Among emerging countries, Poland, Russia and Turkey are the better values, says BCA.

BCA also looked at the emerging markets where growth was expected to improve over the next five years compared to the previous two years. Among “the most favorably-placed markets” for valuation and economic growth were Russia and Poland.

3. Attractive Dividend Yields

Many Eastern European stocks pay attractive dividends, allowing investors to benefit from income and potential appreciation. As of June 30, 2012, the stocks in the EUROX portfolio had an average dividend yield of more than 5 percent.

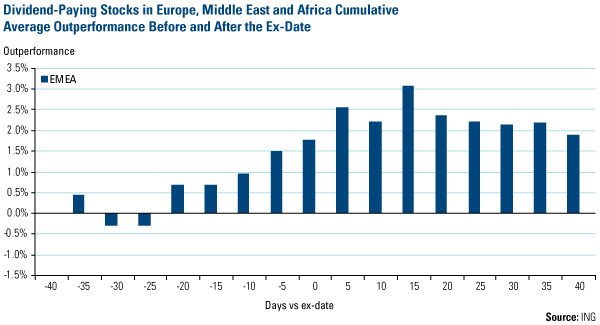

Dividend income may not be the only benefit: According to research from ING Bank, there appears to be a healthy dividend effect on stock outperformance in emerging Europe.

The chart below shows the cumulative average outperformance 40 days before and 40 days after the ex-date among dividend-paying stocks in Europe, Middle East and Africa (EMEA) countries. The outperformance has historically started about 10 days before the ex-date and continues throughout the next 40 days. The ex-date is the day on or after which a security is traded without a previously declared dividend or distribution.

While this effect is seen throughout the EMEA countries, “Turkish stocks appear to be most attractive dividend effect plays with outperformance of 5 percent on average,” according to ING.

In today’s low yielding environment, dividends have been particularly attractive to investors. Martin Barnes, chief economist at BCA Research, writes to subscribers that he believes that in today’s uncertain environment, investors can still “build an equity portfolio of global companies with strong balance sheets, powerful brands and paying reliable and decent dividends. Not the most exciting investment strategy perhaps, but one that should pay off in the long-run.”

Price Reversal Indicates Attractive Entry Point?

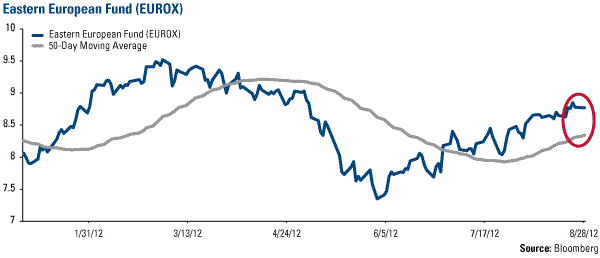

As you can see below, over the past month, EUROX has moved above its 50-day moving average. This indicates to us that there is growing strength in the Eastern European area and an attractive entry point for investors.

The Eastern European Fund isn’t the only fund signaling a potential price reversal—all equity funds at U.S. Global Investors are above their 50-day moving average. Click here to see the charts.

Leave a Reply