The earnings love-in rolls on, with another sea of green “beats” on the old Bloomberg earnings report monitor. More than 76% of companies reporting thus far have met or exceeded EPS estimates, a higher than usual ratio. This, in turn, has led to a flurry of upgrades and a “race to the top” which has even sucked in some of the top-down strategists.

A slight cause for pause is the fact the top-line revenues have been less impressive. Indeed, less than half of companies reporting this far have met or exceeded revenue forecasts. Now, perhaps this is indicative of a healthy degree of operating leverage in corporate America, or that ruthless cost-cutting is payind dividends. Then again, it could just mean that they are lying moe than usual to massage headline EPS figures through consensus. The reality probably involves a bit of both.

Regardless, attention switches back to the macro today, with Bernanke’s testimony in front of Congress. He set out his stall in today’s WSJ, sketching out how the Fed’s exit strategy will work while stressing that it is far from imminent. No doubt more will emerge from the prepared remarks and especially the Q&A, but BB has probably defused a worst-case outcome by getting his thoughts out in the paper.

Perhaps more interesting than anything that the Fed can say or do have been the first rumblings of an exit strategy from the Chinese. The head of the China Banking Regulatory Commission noted that strong risk mangement will be required from China’s banks in the wake of the orgy of fresh lending in H1.

While trailing NPL data looks healthy for China’s banks, as does provisioning, it is probably safe to assume that it’s too early for some of the recent loans to go bad. But have a read of Michael Pettis’s latest post; it doesn’t bode particularly well for the returns on huge swathes of real estate investment.

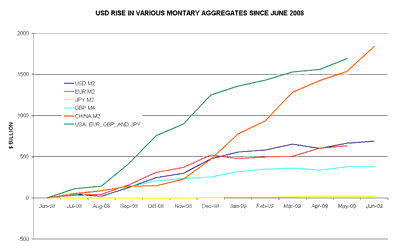

At the same time, it’s worth commenting again on just how substantial China’s money creation has been; by Macro Man’s calculations, over the past year, Chinese M2 growth (in dollar terms) has exceeded that of the US, Eurozone, Japan, and UK….combined.

Now that the recovery is in place and the stock market’s recovered, perhaps the authorities will turn an eye to mitigating the inflation and NPL threats that loom on the horizon. If they do, it could provide a nasty hiccup to Chinese equities.

Of more immediate concern to local punters is the looming in full solar eclipse in China tomorrow. Known locally as (Macro Man’s not making this up) “sky dog eat the dragon’s eye”, it is traditonally associated with bad news….riots, famines, political upheaval, etc. Evidently, one onshore house is forecasting that the ol’ sky dog will bring with it a secular bear market to the Shanghai Comp.

There you go, ladies and gentlemen, there’s the lynchpin of your global economic and market recovery. Out-of-control bank lending and real estate speculation cannot put a dent in Chinese equities, but a “sky dog” can generate a secular reversal in trend. Good luck with that….

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply