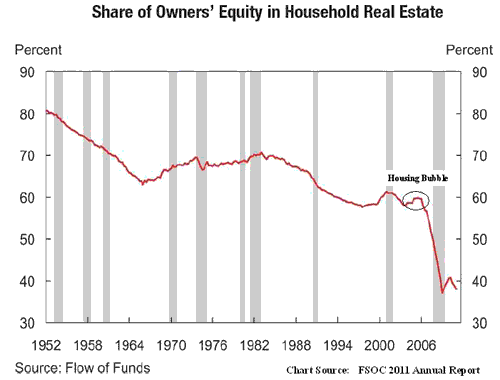

We stumbled upon this interesting chart from the Financial Stability Oversight Council’s 2011 Annual report which shows the share of owner equity in household real estate. It surprised us, not so much in that it is at record lows, but that owner equity showed only a blip upward during the housing bubble. The secular decline in owner equity is also an eye opener.

The no down payment, “liar loan,” option ARM fueled housing bubble inflated real estate values, which allowed the economy to take on even more debt collateralized by “fake” equity. Talk about a deceptive positive feedback loop!

The housing ATM fueled consumption, growth, a massive U.S. current account deficit and huge increase in the global monetary base as foreign central banks intervened to prevent their currencies from appreciating.

Debt financed consumption doesn’t create new aggregate demand it just moves it forward and borrows it from the future. Now we pay. And the younger generation represented in the Occupy Wall Street crowd is not happy and looking for heads.

Leave a Reply