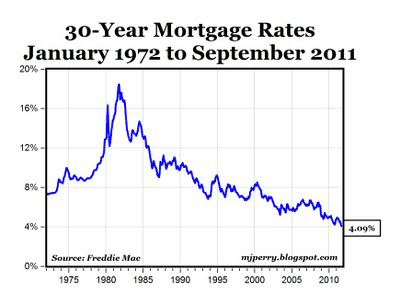

To purchase a median priced existing home at $174,000 (most recent data available is for July) with a 20% down payment, the monthly payments at 4.09% would be $671.80. In 2008, when the median priced home averaged $198,100 and the 30-year mortgage rate averaged 6.04%, the monthly payments (with 20% down) would be $954.25, or 42% higher than the current monthly payment of $671.80.

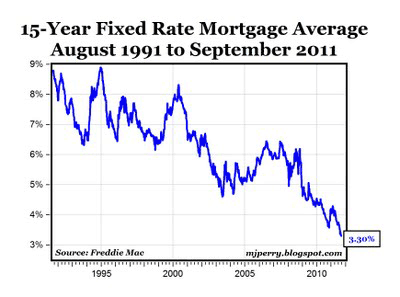

With rates so low, and home prices stable or falling, there’s probably never been a better time to buy or refinance a home. With annual inflation of 3.8% through August, getting a 4.09% 30-year fixed rate mortgage is basically “free money” at close to a 0% real rate (assuming inflation remains at 3.8%). If you lock in at 4.09% and inflation rises above that rate for some part of the next 30 years, you’ll have a negative real rate of interest and you’ll pay back less in real dollars than the amount you borrowed – the best of all possible worlds for a borrower. With a 15-year fixed rate of 3.30% and 3.80% inflation, you’re starting out with a negative real rate of -.50% (assuming inflation continues at 3.8%).

If you can borrow $100 and pay back $98 in inflation-adjusted dollars, you’re getting paid by the bank to be in debt. (In that case, it’s just like a “negative price” for goods, where you get free merchandise and some cash on the way out of the store – the ideal outcome for consumers.)

Bottom Line: The record low mortgage rates and possible negative real interest rates are a great deal for borrowers, but a terrible deal for lenders – are we headed for another S&L crisis?

Leave a Reply