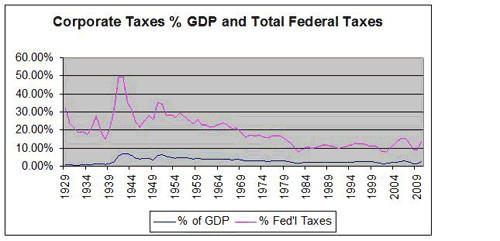

Currently, the U.S. has a very high level of corporate tax rates. However, the tax code is so riddled with loopholes, preferences and exclusions, that most companies actually pay very low effective tax rates. Corporate taxes have been declining as both a share of GDP and of federal revenues for years now (see graph below). There have been many calls to get rid of many of the loopholes and bring down rates.

I have a better idea: Why don’t we just get rid of the corporate income tax altogether? However, if we do that, we will have to make some other very significant changes to the tax code, but ones that I think would greatly simplify the tax code and greatly reduce the role of government in “picking winners and losers.”

Ultimately, corporations are not real people (regardless of what the Supreme Court says about their ability to give money to campaigns). If Exxon (XOM) or Apple (AAPL) are taxed, ultimately that money comes out of some “real” person’s (y’know, the type of person with a heartbeat) pocket.

Unfortunately it is very difficult to tell just who exactly is paying the tax. Is it the shareholders, the employees (and if the employees, is it the CEO or the people at the low end of the pyramid) or the customers? It is hard to tell and probably varies from industry to industry. Corporate income taxes are somewhat popular with politicians because they are a form of hidden taxation — one that people with heartbeats don’t notice but still pay, and which they think that someone else is paying.

However, even companies that pay nothing or next to nothing in actual taxes still pay a high price. To find all the deductions and loopholes that allow them to pay so little, they have to hire small armies of accountants and tax lawyers. They have to structure their economic decisions with one eye on the tax code. Eliminating the corporate income tax altogether would reduce those deadweight costs.

Here’s How It Would Work

In return for getting rid of taxes at the corporate level, dividends would have to be taxed at the same rate as ordinary income. The key rationale for a lower tax on dividends is that dividends are “double-taxed” — first at the corporate level and then again at the shareholder level. Eliminate the corporate level and double taxation goes away — no reason to prefer income from capital over income from labor.

I could perhaps go along with an exclusion of say $2,000 on dividends. Thus if you had a $100,000 portfolio (outside of an IRA or 401-k) that had a yield of 2%, you would pay $0 on those dividends. If you had a $150,000 portfolio, and were in the 35% bracket, then you would pay $350, or an effective 11.67% rate on your dividend income — still less than you are paying at today’s 15% rate with no exclusion.

The dividend exclusion would be very significant to small investors, and thus encourage people to invest and participate in the market, but would be insignificant to the hedge fund crowd. Also, if the taxes on dividends were to stay at 15%, with corporate income taxes removed, it would make sense for me to turn myself into Dirk van Dijk, Inc. and have Zacks hire the company.

The company would then have a 100% payout ratio to me, its sole shareholder. Presto change-o, the maximum individual tax rate would become the current dividend rate of 15%.

Of course if you did that alone, then companies might stop paying dividends and instead channel that money into share repurchases. Economically, a dividend and the repurchase of stock look very similar.

Just think of a company that paid out a cash dividend but all the shareholders were enrolled in a dividend reinvestment (DRIP) plan. I would thus make preferential capital gains rates available only for true long-term holdings. Up until five years, capital gains would be paid at ordinary income rates; between five and ten years, you would pay the lesser of your ordinary tax rate or 25%, and only after a 10-year holding period would you pay 15%. The lower rate over long periods of time would compensate for the portion of your capital gains that was really inflation, not “real” capital gains.

The same objective could be achieved more exactly if the cost basis of each investment were indexed to inflation, but that would be a bookkeeping nightmare. Smaller gradations between five and ten years might also be possible — say, reducing the rate by 2% per year, to 23% after 6 years, 21% after seven, etc.

How It Would Help

This change would have the added benefit of focusing investors on, well, being investors — not just players at the casino. It would, however, be bad news for firms like E-Trade (ETFC) and Schwab (SCHW) that depend on the volume of trades. It would not affect the day-trader types, since they are already taxed at ordinary income rates for holdings of less than a year.

As it stands now, one of the biggest areas where the government picks winners and losers is the tax code. If there are special tax breaks that only apply to, say, the oil and gas industry, then the government is favoring that industry over industries that don’t get special breaks.

The tax-writing committees of Congress are always the most heavily lobbied for just that reason. Generally what happens is that big companies that can afford lots of lobbyists are the ones that get the breaks. Small businesses, historically the biggest job creators in this country, well they just have to sit there and take it.

As it stands now, big corporations have billions and billions sitting overseas. If they bring it back here they get taxed on it, so they don’t and they invest over there.

A tax holiday has been proposed by some, where we would lower the rate on repatriated profits to, say, 5 or 10% for a year to get companies to bring their money back home. However, that just trains companies to always keep as much overseas as they can and wait for the next tax holiday. They can then bring the cash home and give it out in dividends or share repurchases — they don’t even have to invest it in new plant and equipment or new hiring.

To a large extent, that is what happened in 2004 when we had one of those tax holidays. If the corporate tax were eliminated altogether, they would have every incentive in the world to bring the cash home and invest it. It would only get taxed if they paid it out in dividends or bought back stock.

It Would Also Clear Things Up

This change would also clarify just exactly who is paying the tax — the shareholders. Since stock market equity wealth is extremely concentrated, it would also make the tax code much more progressive. No longer would we have the awful injustice of the 400 taxpayers with the highest incomes in the country paying an effective rate of just 17.5%.

Minimum-wage earners currently pay 13.3% through the payroll tax (a bit more than half of which is hidden and accounted for as a tax on corporations, but economically it is a tax on labor. A tax is the difference between what one side pays and what the other receives). Unless the cut in the payroll tax in renewed, that tax will be 15.3% next year.

The reason that happens is that really, really big incomes almost always have a big capital gains or dividend component to them. Most of the payroll tax disappears after you earn $106,000 for the year. In other words, the CEO-types and the hedge fund crowd are done paying it before they have fully recovered from their New Year’s Eve hangover.

Getting Real About Who Pays Taxes

Those who use the talking point that 50% of Americans pay no income tax always seem to forget about the payroll tax (and sales taxes and property taxes, etc.). It is sort of like making the claim that practicing Mormons don’t pay any taxes. That is true if the only taxes you are talking about are the excise taxes on alcohol and cigarettes.

That argument has always irked me, because effectively what that talking point is saying is that the after-tax incomes of the poorest people in the country are too high. After all, it is the poor who don’t earn enough to pay income taxes. With the top 1% earning almost 24% of all the income in the country, I don’t see that as a serious economic problem.

Indeed, one of our biggest economic problems is that wages for the vast majority of people have been stagnant in real terms for over a decade now, and the poor and the middle class simply do not have enough income to demand products and bring down unemployment. That was, in part, papered over during the housing bubble as people borrowed against the equity in their houses to try to keep up. With the plunge in housing prices, most of those people are now underwater on their homes and at grave risk of foreclosure.

This plan would only work if it were a package deal. Just eliminating the corporate tax without the other changes would simply further lower revenues and make the deficit much worse. It would also be grossly unfair. However, as a package, it would clarify who is paying the tax, make the tax code much simpler, and would make it fairer.

It would have the added effect of making the economy more efficient as the deadweight costs of all those tax lawyers and accountants would be removed. Not good for their employment prospects, I suppose, but they tend to be very bright, well-educated people who should be able to find other employment. Employment that would actually grow the economic pie, rather than just shift the size of the pie slices.

No corporate tax might also eliminate the need for lobbyists and political donations and various corruptions of the political system. Great idea!