Today’s rally in front of the Merkel/Sarkozy cup of tea surprised many, including us. We’re not expecting much from the meeting, but you never know, and the market may have set itself up for disappointment. Looking at the action in the dollar and commodities, including gold, it feels the market is expecting a monetary blast from Fed Chairman Ben Bernanke’s August 26th speech at the Jackson Hole conference. The S&P was bid today and with sellers scarce you know exactly what the shorts were reaching for.

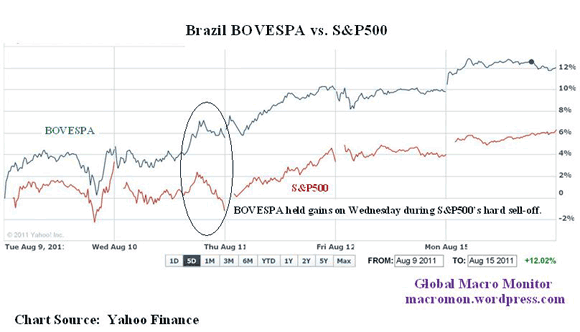

We’re watching an interesting development in Brazilian equities. Over the past five trading sessions the BOVESPA has doubled the performance of the S&P500, up 12 percent vs 6 percent. The Brazilian index is the worst year-to-date performer of the global indices we monitor so this may just be a “first of the worst” rally, where those down the most rally the most. In fact, Bespoke put out some interesting research today showing that the best performing individual stocks in the rally that began on August 8th are those that were hit the hardest during the downdraft.

Leave a Reply