Bear markets are famously difficult to trade. Why is that? Perhaps it’s because most investors are natural buyers and owners of risk assets, so the secular market direction leaves them out of pocket and damaged psychologically. Thus when the faintest whiff of a trend reversal, however temporary, materializes, they are naturally inclined to jump all over it, generating out-sized short-term returns. This is why Macro Man asserted yesterday that 10% daily rallies don’t occur in bull markets.

Of course, when reality sets in once again and the underlying bear emerges from his hibernation, risk asset longs are left more out of pocket and more discouraged than before. Lather, rinse, repeat.

In any event, it seems that the dawning of the latest bear market rally is here. Perhaps it’s driven by month-end rebalancing considerations. Perhaps it’s driven by the forthcoming election of St. Barack. Or perhaps it’s just driven by bear fatigue. Yesterday’s late session swoon by US equities notwithstanding, it does seem like it’s here. (Of course, there’s also been news…but since when did that matter?)

Of the three explanations above, Macro Man favours the first and the third. The first speaks for itself and should pass within the next few trading days. The third represents a waning downside momentum as sellers of risk assets received a deteriorating marginal bang for their buck. Positive divergence (rising momentum with lower prices) has been observed in both the SPX….

…and the AUD, among a host of other currencies. With market liquidity getting worse by the day (who knew that markets would join Wal-Mart in starting the Christmas season before Halloween?), it doesn’t take a whole lot to push things a long way. Currency markets are now in full-fledged “buy back your risk currency shorts” mode; USD/CAD has fallen as far as 8.5% from Tuesday’s high!

So what do you do from here? Stick to your risk-asset shorts and wear the short-term pain, which might be very substantial indeed? Or go long risk for a rental and hope you can sell out to someone else before the music stops? For Macro Man, the answer is “neither.” Bear market rallies are like bad oysters; if you partake, you’ve gotta be pretty lucky not to end up being sick. He’ll pass, thanks, trim his bear market risk and concentrate on stuff with a more powerful, long-term macro theme (oh, and where he has his risk in limited-loss strategies.)

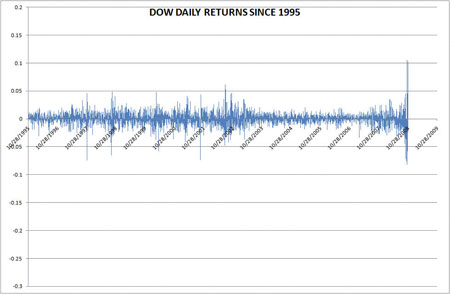

Macro Man decided to pursue yesterday’s line of historical enquiry a bit further to try and get a sense of how the current market stacks up to history. The chart below shows every daily return in the Dow since 1995. Two things quickly emerge from the chart: 1) how quiet the market was from 2003-2006, and 2) the degree to which recent volatility has significantly exceeded that observed by anyone who’s younger than, say, 45.

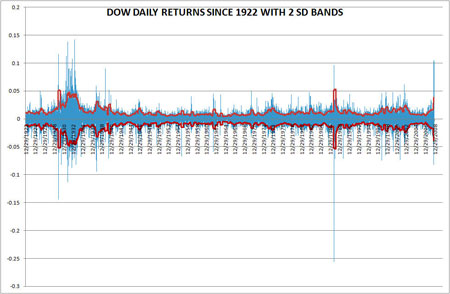

So how long do exaggerated periods of volatility last? The chart below shows daily Dow returns going all the way back to 1922, along with two standard deviation bands around zero. (Six months of rolling data were used to calculate the bands.) Here you can see how the recent upside volatility is unprecedented since the Depression. What’s interesting to observe is that, ’87 crash excepted, volatility (as expressed by the width of the SD cone) does seem to trend over multi-year periods. It’s hard to escape the conclusion that even when things “normalize”, markets will carry a significantly higher risk premium than they have over the past few years.

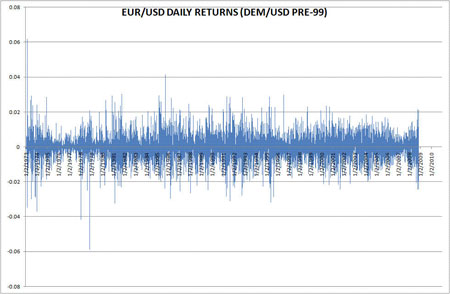

Finally, Macro Man thought it would be interesting to put recent activity in currency markets into perspective. The dollar’s uber-rally (against everything but the yen) has certainly seemed impressive, but doesn’t look particularly extraordinary in the context of the entire post-Bretton Woods era. To be sure, it has risen dramatically from the bum-clenchingly low volatility of 2006, but doesn’t particularly stand out when compared to the heady days of the 1980’s, for example.

For choice, Macro Man expects the dollar’s strength to eventually re-emerge; it will take more than an equity bounce and a few swap lines to quench the market’s thirst for dollars as the shorts of the past few years are bought back. But as with equities, it’s likely to be a bumpier ride than many folk are used to.

Leave a Reply