Bernstein’s Craig Moffett is telling his clients to go bargain hunting in the Pre-Paid Wireless space this morning.

– Moffett is upgrading MetroPCS (NYSE:PCS) to Outperform from Market Perform with a $16 price target.

He writes:

The sell-off in telecom stocks has been nothing short of breathtaking in recent weeks, with many stocks in the sector down 40% or more. The pre-paid wireless operators have been particularly hard hit. Since July 1, a month before it reported Q2 results, Metro’s stock price has declined -47.5%. Leap Wireless is down a mind-bending -58.9%. The S&P 500 has fallen -12.5% during the same timeframe.

Sector concerns are not unwarranted (we ourselves have been among the most bearish). But of all the stocks that have sold off in the telecom sector, MetroPCS looks to us to be uniquely oversold, and we believe it presents the best buying opportunity. In this report we take a fresh look at the pre-paid players. We’ve scrubbed our models from top to bottom, refreshed our valuations, and closely examined the segment’s recent performance.

– The pre-paid segment appears less profitable than it once had, as the margins associated with smartphones are lower than the voice-only margins of old. But the pre-paid operators continue to gain share, and the prepaid market does not look like it is fundamentally broken. Pre-paid and reseller captured 60% of industry net additions in Q2, 390 bps better than Q2 last year, and MetroPCS remains by far the industry’s standout performer on a footprint-adjusted basis.

– By Bernstein’s estimates, Metro’s forward EBITDA multiple (just 3.9x 2012 EBITDA) is the lowest it has ever been on an absolute basis, and surprisingly, it is lower than Leap’s.

– In contrast, Leap Wireless’s outlook is far more uncertain, and its valuation far less flattering. Given its enormous effective leverage, optimistic scenarios could yield spectacular upside. But firm’s valuations suggest that even in their base case scenario, there could still be additional downside to the name, and more pessimistic assumptions yield outcomes with no equity value at all.

Of all the stocks that have sold off in the sector, MetroPCS looks to be uniquely oversold, and Bernstein believes it presents the best buying opportunity for intrepid investors.

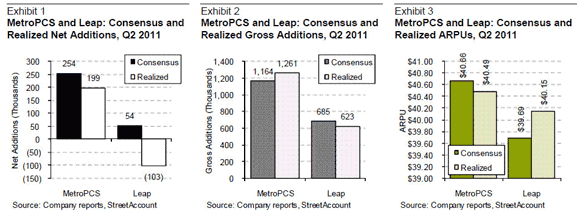

By most measures, MetroPCS posted Q2 results that only modestly missed investor expectations; certainly, its business shows no sign of existential distress. Indeed, it appears well positioned to benefit from a continued trade-down from high priced post-paid wireless plans into its discounted pre-paid plans. PCS’s numbers were unquestionably far better than that of unlimited pre-paid peer Leap Wireless’s. To be sure, both MetroPCS and Leap missed consensus net additions, but Metro by a far smaller margin. And irrespective of the miss, Metro’s net additions were still a healthy positive number; Leap’s were – 103K (voice net adds of 29K and broadband net losses of -132K, compared to expectations of 89K and – 34K, respectively). And gross additions at MetroPCS actually beat expectations, in a clear sign of sustained strong demand (Leap’s gross addition results, by contrast, fell short). ARPU was also close to expectations, missing by a narrow $0.17, while Leap actually outperformed, beating expectations by $0.46.

All in all, these results felt like ones that would normally have dinged MetroPCS’s stock price by several percentage points, but probably not much more. (Leap’s results were worse, and given their volatile trading history one might reasonably have expected a bigger drop).

As anyone who follows the space is surely aware, things did not exactly pan out that way.

…..

To be continued. This is a 32 pg. note so I can only pass on the broad stroaks.

Notablecalls: So Moffett is telling people to buy PCS, which has according to him has gotten unjustly punished.

Given he has been among the most cautious on the Pre-Paid space his change of heart will likely generate enough attention to get PCS moving up.

I’m guessing upwards to $10 in the n-t.

This may prove to be a significant call.

Leave a Reply