Keynesians are bemoaning the new budget deal. Cutting federal spending when the economy is soft will further weaken us, according to textbook economics. There are some economists who dismiss Keynesian theory. I’m not quite there; I think the theory has validity. However, I believe that the magnitude of the impact is much smaller than most people think, certainly smaller than one would get judging the size of newspaper headlines or the shrillness of Washington pundits.

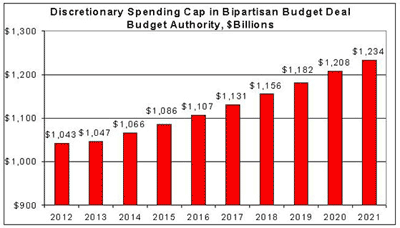

So I think it’s important to the economic outlook to understand just how much government spending is being cut. The first estimate I’ve found is from the Cato Institute’s Chris Edwards (hat tip to Tyler

Cowen.) Here’s his chart:

Well, fiscal 2013 certainly looks flat compared to 2012. Thereafter the increases are … increases, not decreases.

I have not verified Edwards’s calculations; if you see contrary opinion from a credible source, please post in the comments.

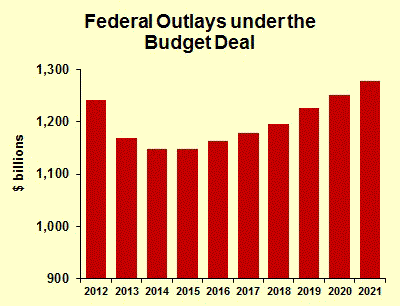

New content: Edwards’s material is a bit misleading, I learned. The source of his data is the Congressional Budget Office’s report on the Budget Deal, which is credible. However, Edwards’s chart shows “budget authority” rather than outlays. It makes a difference. Here’s the story on outlays:

This shows a definite decline in the fiscal years 2012-2014. Why the difference?

Budget authority is authorization to spend. Imagine we tell a general that he can spend a $6 million on a tank. If he can find a tank ready to buy this year, then the actual outlay is equal to the budget authority: $6 million. However, if the general has to place an order and wait for delivery, the outlay may occur in a later year even though the budget authority occurs this year. That’s why the two charts are different: budget authority is not the same as outlays.

Which concept is more appropriate for thinking about the impact on the economy? Outlays is of primary importance. It constitutes the actual spending. Budget authority is of some importance, as contractors prepare for outlays, but it’s clearly secondary to outlays.

So look at that decline from 2012 to 2014. That’s $93 billion, or a 7.5 percent decline. As a percentage of GDP the decline is 0.7%. That’s enough to have a small impact on the economy. The Wall Street Journal reports private sector estimates of 0.1 to 0.2 percent slower growth of GDP, with a left-wing think tank estimating 0.3 percent. Those numbers are less than the margin of error in anyone’s economic forecast. The negative Keynesian effects may be offset by private sector relief that the deficit trajectory is not as bad as it previously had been. Maybe.

My conclusion for the economic forecast: this isn’t a stimulus, but neither is it a big enough negative to have much impact on my forecast. Which, by the way, I’ll update in a blog post next week.

Leave a Reply