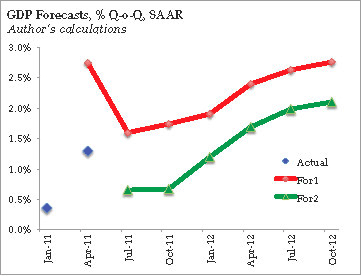

I updated my very simple GDP model with revised data. This is a simple, data-driven approach – use with caution (I use it to form a baseline and track the impact of evolving data on the medium-term outlook). That said, the model definitely did not like the new take on the US economy:

For1 was the forecast with data through 1Q2011 (pre-revision); For 2 extends the data through 2Q2011. While the general consensus is that weak growth in the first half of the year means a stronger second half, the model is telling a different story – the “stronger” second quarter was a bounce from the “weak” first quarter. Think about that a little, and you will get depressed.

I very much doubt near term consensus forecasts will be this low (0.6 and 0.7 percent, respectively, for the final two quarters of the year). The tendency instead will be to add back sectors that dragged on the headline – turn the negative drag from auto production into a positive boost, for instance. There is logic to such an approach, and I wouldn’t dismiss it entirely. At the same time, at least the first major report of the month – the ISM manufacturing survey – is a red flag that the underlying weakness is more pervasive and less temporary than the general consensus believes.

The simple model always reminds me of the ongoing precariousness of the US economic situation. Perhaps we will start to see some upside surprises, but for now the data is just not supportive of a solid growth dynamic emerging. And lacking such a dynamic, initiating fiscal contraction seems foolhardy. But here we go anyway.

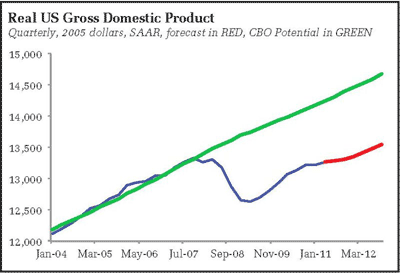

Note also that the revised data and forecast implications suggest the CBO-based estimate of the output gap is set to widen further:

Note that the model does not have a trend reversion mechanism; if the economy doesn’t bounce back to potential on its own, the model will just put GDP on the path of what it estimates to be the average rate of growth. Which is another of of saying that if the economy doesn’t snap back to potential like in a pre-1990 recovery, is there any reason to expect it will do so at all? What is going to drive such growth?

It is reasonable to expect that a widening output gap would again place downward pressure on inflation, putting the Fed back in play. But there are many steps between hear and there – don’t expect the monetary or fiscal policy to be proactive here. Despite a clear justification in the data for more policy stimulus on the basis of existing data, policymakers will instead wait for at least the next round of data, if not the round after that.

Very frustrating environment, both economically and politically. Those confidence fairies need to get here soon.

Leave a Reply