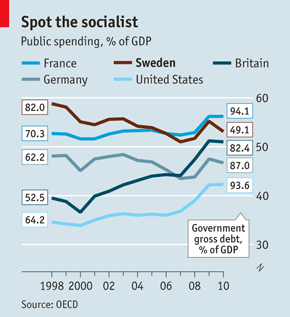

A recent article in The Economist provides a graph that illustrates the destructive nature of Gordon Brown’s economic policies:

When Labour took power in 1997, public spending was about 19 percentage points lower than in Sweden (58% vs. 39%.) Tony Blair and his chancellor of the Exchequer Gordon Brown initially tried to reassure markets with a responsible fiscal policy. But in their second term Brown started raising spending as a share of GDP. Today UK spending is only about 2 percentage points behind Sweden (53% vs. 51%.) Some progressives excuse this performance by pointing to the fact that spending normally rises in recessions. But this argument fails for several reasons. First, if true then spending should fall as a share of GDP during good times. But Brown did exactly the opposite during the preceding boom years. He ran the same sort of deficits that Krugman excoriated Bush for running, but Brown received praise from Krugman. Not only did spending not decline as a share of GDP during the boom years–it actually rose. And of course Britain also had many of the same dysfunctional banking policies as the US, such as privatizing gains and socializing losses.

When Labour took power in 1997, public spending was about 19 percentage points lower than in Sweden (58% vs. 39%.) Tony Blair and his chancellor of the Exchequer Gordon Brown initially tried to reassure markets with a responsible fiscal policy. But in their second term Brown started raising spending as a share of GDP. Today UK spending is only about 2 percentage points behind Sweden (53% vs. 51%.) Some progressives excuse this performance by pointing to the fact that spending normally rises in recessions. But this argument fails for several reasons. First, if true then spending should fall as a share of GDP during good times. But Brown did exactly the opposite during the preceding boom years. He ran the same sort of deficits that Krugman excoriated Bush for running, but Brown received praise from Krugman. Not only did spending not decline as a share of GDP during the boom years–it actually rose. And of course Britain also had many of the same dysfunctional banking policies as the US, such as privatizing gains and socializing losses.

There is another problem with the recession excuse for high UK spending; it isn’t clear that the UK will recover from the recession. This may be the new normal. And that’s because the huge expansion of the British state has damaged the supply-side of the UK economy, leading many economists to predict trend growth for the foreseeable future. No wonder the Cameron government sees a need to restrain spending.

Some might argue that the British state is still slightly smaller than the Swedish state, and Sweden is doing relatively well. Yes, but Sweden has much more pro-market policies in many other areas, and indeed is moving towards capitalism as the UK becomes more socialistic. Here are some examples from the article in The Economist:

Without dumping the generous Swedish social model, the government has tweaked it in the direction of lower taxes and smaller welfare benefits. Mr Borg calls this “reinforcing the work ethic”. Mr Reinfeldt talks simply of making work pay.

The results have been spectacular. After long being a case study in jobless growth (except in the bloated public sector), Sweden has become a big creator of private-sector jobs. The government has narrowed the “tax wedge” that deters employment and whittled away at sickness benefits: Sweden no longer stands out for welfare excesses. The retirement age has risen to 67. Inheritance and wealth taxes have gone. Mr Borg and Mr Reinfeldt believe firmly in ownership as a driver of prosperity. . . .

Unlike Britain, Sweden is happy to let private schools and hospitals make profits from taxpayer-financed services if outcomes are better. . . .

Some 40 years after becoming the only continental European country to switch its motoring from left to right, Sweden is making a similar political shift. By 2014 Mr Reinfeldt will have been in power for eight years. Given the economy’s strength, few would bet against his winning again. To many on Europe’s left, Social Democratic Sweden was once a statist paradise. Now it is the right that looks north for inspiration.

Cameron is a fan of the Swedish center-right government, and would like to move the UK in that direction. But he will probably fail. British voters have no stomach for the savage inequalities of Swedish-style laissez-faire. They won’t tolerate public money going to for-profit schools or health care. Instead, Cameron has signed on to increasing the top rate of income taxes from 40% to 50%. Eliminate inheritance taxes? I don’t think so. Follow Denmark in privatizing firefighting? Don’t make me laugh. The British public likes big government, and they are going to get it.

BTW, some progressives blame Britain’s problems on fiscal austerity. In the next post I’ll show why that argument is false.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply