Alan Blinder helped instigate the “cash for clunkers“, with his July 2008 op-ed piece in the New York Times. This gave a one-time boost to car sellers as the subsidy mainly went into a rise in auto prices, and by destroying over 500k working substitute cars. If you measure a government program by its price tag it was a huge success, as it cost taxpayers $3 billion. You see, the ‘G’ in the famous Keynesian top-down measure of aggregate demand C+I+G and therefore output, so all a government has to do is spend more and output rises! The indirect effects–like higher prices for used-car buyers in Blinder’s last genius plan–don’t exist because they are too subtle for the big picture that is captured via macro aggregates like C, I and G. Indirect costs, opportunity costs, are too hard to measure, so conveniently assumed to be zero, while the transactions are meticulously counted from initial expenditure to the next and present valued (you can see how pointless the conversation can become via Keynesian logic, see here for more). The obvious benefits of government spending has been proven mathematically (in partial equilibrium) 2,423 times in peer-reviewed journals, which is why the revolutionary Keynesian model has always been so popular, as it rationalized what many have always wanted.

As a good Keynesian Blinder today defends the eternal Keynesian solution when he defends deficit spending in today’s WSJ:

When the government borrows to finance spending, that pushes interest rates up, which dissuades some businesses from investing. Thus falling private investment destroys jobs just as rising government spending is creating them.

There are times when this “crowding-out” argument is relevant. But not today. The Federal Reserve has been holding interest rates at ultra-low levels for several years, and will continue to do so. If interest rates don’t rise, you don’t get crowding out.

If crowding-out can only occur when interest rates rise, does that mean that the fiscal stimulus could not have created any jobs because the unemployment rate is still so high? The Keynesian line was that prior stimulus created millions of jobs when compared to the hypothetical basket case that would have occurred were it not for spending. I’m not trying to be a hobgoblin of foolish consistency, but it seems Keynesians believe stimulus works via the ‘back from the brink‘ hypothetical narrative, but that the same ‘more extreme’ hypothetical is not allowed for crowding out?

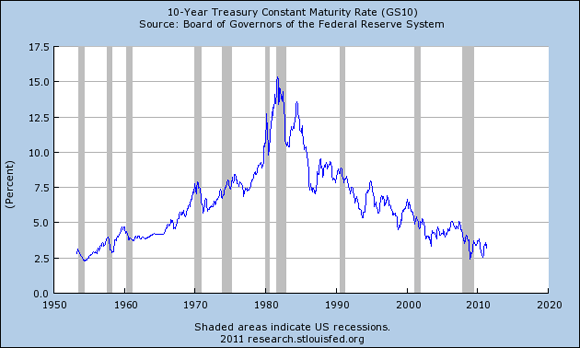

Interest rates are currently lower than their 5-year average, but know one really knows what they should be, or what is considered ‘low’. When they were rising from 1955 to 1980 they seemed ‘too high’ the whole way up, and most economists were wrong the whole way (see graph below). As rates fell, they then seemed too low the whole way down, and I remember in 1988 and in 1994 listening to most smart macroeconomists think that rates would revert to their 5 year moving average. People think the past 5 or 10 year average is the right level, intuitively. Thus, it’s easy to say today’s current rates are ‘low’, but are they really as low as they would have been without the massive US deficit and QE2 policies? I doubt it, and these policies are simply non sustainable.

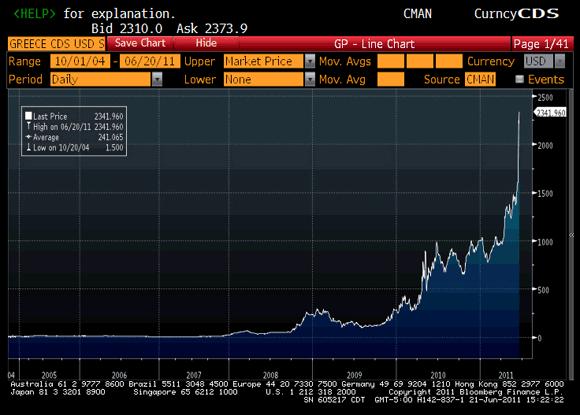

The problem, is the graph below (click to enlarge). Greece enjoyed virtually limitless borrowing at riskless rates until 2008 when problems appeared. The line is the Greek sovereign credit spread since 2005, and the white spike on the right is the straight line up to the current level of 25%, which basically means they can’t borrow from the market any more, just governments and their central banks.

The biggest mistakes are the ones everyone makes, because it’s easy to dismiss criticisms because there are many smart people doing what you are doing. Smart, however, just means you can articulate your beliefs well, not that they are correct. In this case, the US government, the states, the counties, and the major cities, have all been spending more than they take in for years. Once the Fed stops printing money to buy our debt (end of this month!), and the Chinese realize they have better ways to invest, the march towards sovereign bankruptcy seems inevitable. As asset markets have stagnated revealing overoptimistic pension fund assumptions, the problem becomes a positive feedback loop. Blinder wants to spend out of this mess, as the fiscal multiplier implies that government spending money on anything not only creates jobs but decreases the present value of debt, an idea that’s so stupid only a professional economist could entertain it.

It goes without saying that economists–especially macroeconomists–have a poor track record on big historical trends (eg, most economists in the 1950s believed that socialism was more productive yet less polluting than capitalism, that a permanent trade-off between inflation and unemployment existed, that the third world would grow dramatically after colonialism, that dynamic programming would be useful for fiscal policy, or more recently, that requiring 20% down payment to get a home mortgage was merely a pretext for racism and should be abolished, to name but a few).

Too many believe in the naive Marxist fantasy about a life of dilettantish activities unrelated to economic scarcity. How many times are programs justified by the fact that ‘The US is the richest country in the world’ or some corporation has billion of dollars, as if that capital was sitting there, unused and probably stolen.

Bankruptcy will make us a better society because currently many people think that solutions are as simple as creating a mountain of debt (Bill Gross estimates it at 500% our GDP) to create make-work or new economic rights, and those sinecures don’t create what Arthur Brooks calls perceived earned success, the satisfaction that comes from work that is appreciated both by your boss, who compares your cost to alternatives, and your customers, who compare your value to alternatives. There are no shortcuts to the rewards of the virtuous life, as a person or a society.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply