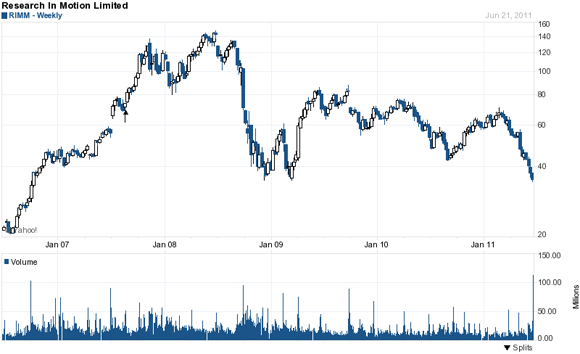

Microsoft (MSFT) and Dell (DELL) may acquire Research in Motion (RIMM) following RIM’s drop in value, reports Bloomberg News. RIM, once worth $83 billion, or $144.56 a share from its record highs three years ago, took a pounding last week as investors reacted to the company’s negative earnings report and forecast. The Waterloo, Ontario-based RIM said quarterly sales may drop for the first time in nine years.

Since peaking in June 16, 2008, RIM’s shareholders have seen the stock loose almost $70 billion, leaving it currently with a market cap of less than $15 billion. As of 11:30 a.m. ET, shares of RIM were down 41 cents, or 1.44%, to $28 a piece, currently trading at 4.7x earnings next year, which is less than any communications-equipment provider, according to data compiled by Bloomberg.

Given RIM’s deterioration of the stock price, its need for a software platform and in particular, Microsoft’s ability to buy the company for a 50% premium, the site notes that that alone will cause interest and may prove difficult for the Redmond, Wa – based Microsoft to resist.

[From Bberg]: “[Considering] how significant the deterioration of the stock price has been, that alone will cause interest,” said Paul Taylor, who oversees $14.5 billion, including RIM shares, as chief investment officer at BMO Harris in Toronto. “RIM still has meaningful market share in the U.S. and meaningful market share internationally…It’s not hard to envision a stock price that’s somewhere between $40 and $50 a share” in an acquisition, he said.According to Taylor by acquiring Research In Motion, “Microsoft could build its share in smartphones and gain a device to complement its Windows Phone 7 mobile-phone platform.”

“RIM’s customer base will increase to 77 million by the end of next fiscal year, from 42 million last year, Bernstein’s Ferragu said. Almost a quarter of those customers will be corporate users.

Microsoft lost almost half of its own market share for mobile operating systems in the first quarter, falling to 3.6 percent from 6.8 percent a year earlier, according to Gartner Inc. The decline comes after the world’s largest software maker already failed with its Kin smartphone, scrapping the model last year after less than two months on the market.

RIM would “would bring more critical mass” to Microsoft’s smartphones, said Scott Sutherland at Wedbush Securities Inc. in San Francisco. “From a valuation perspective and given their market exposure, it does become interesting at these levels.”

It remains to be seen however, if Jim Balsillie and Mike Lazaridis, RIM’s co-chief executive officers who said last week that their commitment to RIM is “stronger than ever,” would resist to a takeover and turn this into a M’soft – Yahoo (YHOO) type fiasco.

RIMM currently trades at a trailing P/E of 4.44, a forward multiple of 5.14 and a P/E to growth ratio of 0.44.

During Wednesday’s trading session, RIM shares have lost nearly 2 percent, printing a new LOD of $27.62. MSFT is down fractionally to $24.74 and DELL has added 0.34% to $16.39.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply