Minneapolis Fed President Narayana Kocherlakota made some comments today explaining the role of equity markets in Fed policy. Michael Derby at the Wall Street Journal has the story:

In gauging the success of the Federal Reserve Treasury bond buying program commonly known as QE2, officials like Chairman Ben Bernanke have pointed to a rising stock market as a sign of policy making success.

Against the long course of Federal Reserve history, however, that’s a strange way to justify doing business. For many years, central bankers have declined to comment on the performance of stock markets, and have instead justified their actions in purely economic terms. To the extent financial markets entered into it, central bankers were most mindful of bond markets as the mechanism that translated changes in monetary policy into credit availability for businesses and households….

…. It isn’t clear whether Bernanke’s shift in focus represents a change in how the Fed does business, or whether his comments represent an effort to justify a policy that hasn’t worked as planned, leaving the chairman to support it in whatever way he can….

To start, I will agree that there is an effort on the part of Federal Reserve officials to not appear as if they are targeting the stock market directly. And I understand that Bernanke’s comment incited those who already believed the Fed targets stock prices. But officials certainly recognized long ago that the interest rate channel is not the only policy channel. Nor have they been afraid to acknowledge alternative channels. Refer to this 2003 speech by then-Governor Ben Bernanke:

The link between monetary policy and the stock market is of particular interest. Stock prices are among the most closely watched asset prices in the economy and are viewed as being highly sensitive to economic conditions. Stock prices have also been known to swing rather widely, leading to concerns about possible “bubbles” or other deviations of stock prices from fundamental values that may have adverse implications for the economy. It is of great interest, then, to understand more precisely how monetary policy and the stock market are related….

…In our research, Kuttner and I asked two questions. First, by how much do changes in monetary policy affect equity prices? As you will see, we focus on changes in monetary policy that are unanticipated by market participants because anticipated changes in policy should already be discounted by stock market investors and, hence, are unlikely to affect equity prices at the time they are announced. We find an effect of moderate size: Monetary policy matters for the stock market but, on the other hand, it is not one of the major influences on equity prices.

Our second question, both more interesting and more difficult, is, why do changes in monetary policy affect stock prices? We come up with a rather surprising answer, at least one that was surprising to us. We find that unanticipated changes in monetary policy affect stock prices not so much by influencing expected dividends or the risk-free real interest rate, but rather by affecting the perceived riskiness of stocks. A tightening of monetary policy, for example, leads investors to view stocks as riskier investments and thus to demand a higher return to hold stocks. For a given path of expected dividends, a higher expected return can be achieved only by a fall in the current stock price. As we will see, this finding has interesting implications for several issues, including the role of stock prices in transmitting the effects of monetary policy actions to the broader economy and the potential effectiveness of monetary policy in “pricking” putative bubbles in the stock market. I will come back to these issues at the end of my talk…

It is evident that Bernanke has put a little bit of thought into the relationship between monetary policy and stock prices. No secrets there. As to Derby’s contention that Bernanke was just trying to justify a failed policy, go back to the Chairman’s February 8 speech. First he lays out the expected outcomes from the decision to expand the balance sheet:

Although large-scale purchases of longer-term securities are a different monetary policy tool than the more familiar approach of targeting the federal funds rate, the two types of policies affect the economy in similar ways. Conventional monetary policy easing works by lowering market expectations for the future path of short-term interest rates, which, in turn, reduces the current level of longer-term interest rates and contributes to an easing in broader financial conditions. These changes, by reducing borrowing costs and raising asset prices, bolster household and business spending and thus increase economic activity. By comparison, the Federal Reserve’s purchases of longer-term securities have not affected very short-term interest rates, which remain close to zero, but instead put downward pressure directly on longer-term interest rates. By easing conditions in credit and financial markets, these actions encourage spending by households and businesses through essentially the same channels as conventional monetary policy, thereby supporting the economic recovery.

Next, he confirms those outcomes:

A wide range of market indicators supports the view that the Federal Reserve’s securities purchases have been effective at easing financial conditions. For example, since August, when we announced our policy of reinvesting maturing securities and signaled we were considering more purchases, equity prices have risen significantly, volatility in the equity market has fallen, corporate bond spreads have narrowed, and inflation compensation as measured in the market for inflation-indexed securities has risen from low to more normal levels. Yields on 5- to 10-year Treasury securities initially declined markedly as markets priced in prospective Fed purchases; these yields subsequently rose, however, as investors became more optimistic about economic growth and as traders scaled back their expectations of future securities purchases. All of these developments are what one would expect to see when monetary policy becomes more accommodative, whether through conventional or less conventional means. Interestingly, these developments are also remarkably similar to those that occurred during the earlier episode of policy easing, notably in the months following our March 2009 announcement of a significant expansion in securities purchases. The fact that financial markets responded in very similar ways to each of these policy actions lends credence to the view that these actions had the expected effects on markets and are thereby providing significant support to job creation and the economy.

Note also that this was not the first time Bernanke cited stock prices as evidence that monetary policy was effective. From April 7, 2010:

Overall, the policy actions implemented over the past two and a half years by the Federal Reserve and other agencies in the United States and abroad have helped stabilize key global financial markets: Short-term funding markets are essentially back to normal, corporate bond issuance has been strong, and stock prices have partially recovered….

In short, in the context of the full array of outcomes one might expect from easier policy – either conventional or nonconventional – I think Bernanke’s reference to equity prices as evidence of the effectiveness of monetary policy was innocuous and consistent with previously stated views. Derby continues:

It’s a potentially dangerous policy stance, because if stocks were to undergo an extended period of losses, it could argue for the Fed to keep policy easier than it may want to.

I honestly don’t understand this, as an extended period of equity declines would likely be a signal of some underlying economic disturbance to which the Fed should respond with easier policy. Why would they not want to? If anything, an effort to avoid appearing as if they are responding to equity markets is more disconcerting, as it suggests they will delay a necessary policy response.

On to Kocherlakota:

For Federal Reserve Bank of Minneapolis President Narayana Kocherlakota, the increased prominence of asset prices as a focus of monetary policy is not so much an enduring shift in how policy is made, as it is a recognition of what caused the huge economic and financial problems of recent years.

“This recession and the relatively slow recovery we’ve gone through, a lot of it can be traced back to net worth,” Kocherlakota told reporters after a speech in New York Wednesday. “The fall in net worth is what drove us into recession” and “in those circumstances you can see why asset values, both for land and for stocks, are really going to be a central ingredient in the recovery process,” he said.

Here, I think Derby has the story backwards – Kocherlakota’s comments sound a lot less innocuous than Bernanke’s. Bernanke is simply repeating already acknowledged understanding of monetary transmission mechanisms. Nothing new here, move along. Kocherlakota is moving closer – a lot closer – to suggesting the Fed is targeting asset prices directly. More:

To ensure the recovery will take hold, it’s important for the Fed to help re-flate asset prices and given households and businesses a chance to rebuild and rebalance their respective financial positions, the official explained.

“In this kind of post financial crisis, post net worth driven recession, it makes sense to be thinking about asset value as a way to try to generate more stimulus than you do in a typical recession,” Kocherlakota said.

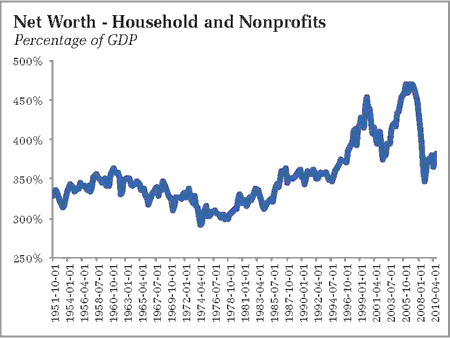

Consider this in context of the swing in net worth this past decade:

It sure looks like net worth, as a percentage of GDP, is just above its long run average. And it sure looks like one can identify two bubbles in the series that were instrumental not to the recession, but to the prior expansion. Is Kocherlakota really suggesting the Fed deliberately fuel another asset bubble in the economy? That the Fed should endeavor to support asset prices at some level not justified by underlying economic fundamentals? I don’t think so – it seems unlikely that he really hopes to reflate asset prices to bubble levels. But I think it is a lot easier to interpret his remarks than Bernanke’s in this light. Bernanke is not saying the Fed is targeting asset prices, only that asset prices are one channel via which monetary policy operates. Kocherlakota seems to be suggesting the Fed should target asset prices themselves – which sounds like moving the Fed more explicitly to where many believe the Fed is anyway, managing the economy via bubble-blowing.

Truth be told, I am not reading anything remarkable into either Bernanke or Kocherlakota. Asset prices will always move in line with the broader economy. As a consequence, Federal Reserve stimulus will always appear to be a reaction to falling asset prices, even though it is the broader economic condition, the threat to achieving the dual mandate, to which they are responding.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Why is one central banking authority attempting to reshape the market as they see fit? This is in contrast to the ideals of a Free Market. The FED is 100% attempting to reinflate, or at least stop the bleeding of, asset prices. “Economic Activity” is a very vague and potentially harmful term. Costs of neccessities increase, savings decrease, and we are supposed to be thankful for the increased activity? Equity prices rise b/c of low bond/debt rates and the devaluation of the USD and the FED congratulates themselves? What sick twisted reality must we exist in to believe we are participants of a Free Market Economy!?!?! Well I suppose as long as the banks and investment banks are turning a profit off of free money we should all be thankful of the FED. For they are advocates of “Economic Activity” and we should therefore be eternally grateful… Banks up, Jobs down.