Though the week is only half over, I’m going to nominate Stan Humphries and Zillow as bearers of the week’s most distressing economic news:

“Home values fell three percent in the first quarter of this year, marking a pace of decline not seen since 2008 when the housing recession was at its worst. Home values fell one percent between February and March and 8.2 percent from March 2010.”

Calculated Risk provides a handy table of how prices have affected equity values in homes by locale, as the Zillow Real Estate Research blog predicts the price-decline end is not so near:

“Previously, we anticipated a bottom in home values by the end of 2011. But with values falling by about 1 percent per month so far, it’s unlikely that will happen. We now believe a bottom will come in 2012, at the earliest.”

At The Curious Capitalist, on the other hand, Stephen Gandel says he’s not so sure:

“To be sure, housing prices have fallen this year. But the Zillow numbers out today make the housing market look worse than it is. The problem is with how Zillow tracks home prices. Unlike other measures of the housing market, Zillow’s numbers are not based on actual sales, but on estimates of what its model thinks your house, along with every other house in America is worth. Zillow’s model is similar to how an appraiser figures out what your house is worth. It looks at past sales of houses that are similar to yours and then guesses what your house is worth. But by the time those sales are fed into Zillow’s system they are months old. … If the housing market is turning, Zillow is going to miss it.”

Is the housing market turning, particularly with respect to prices? Tough to say. If you want your glass half full, these words from the New York Fed’s Liberty Street Economics might be the tonic for your tastes:

“This post gives our summary of the 2011:Q1 Quarterly Report on Household Debt and Credit, released today by the New York Fed. The report shows signs of healing in household balance sheets in the United States and the region, as measured by consumer debt levels, delinquency rates, foreclosure starts, and bankruptcies…

“Delinquency rates are generally down…

“New foreclosures fell nationally and in the region. About 368,000 individuals in the United States had a foreclosure notation added to their credit report between December 31 and March 31, a 17.7 percent decrease from the 2010:Q4 level. New foreclosure rates fell from 0.19 percent to 0.15 percent for all individuals nationwide…”

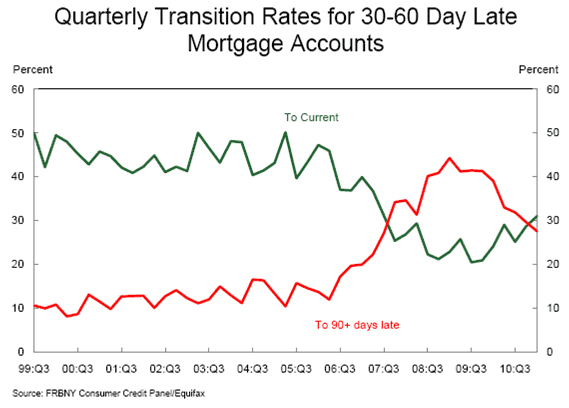

What may be the most important aspect of the report is highlighted by the Financial Times‘s Robin Harding: “…fewer new mortgages going bad, and some bad mortgages getting better.” In fact, for the first time since the crisis began, the percentage of mortgages transitioning from 30 to 90 days delinquent to current exceeds the percentage transitioning to seriously delinquent (90-plus days).

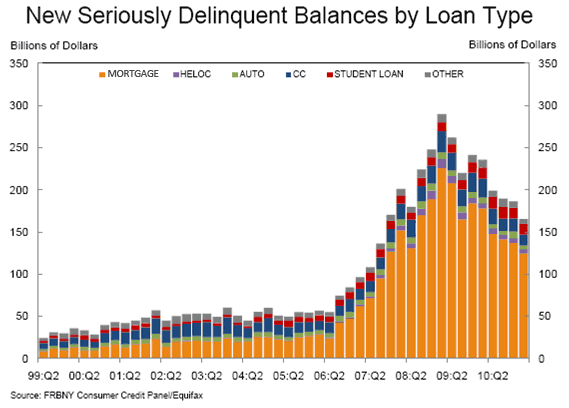

There is, of course, plenty of material for the housing-price bears. For example, the flow of seriously delinquent mortgages is quite elevated.

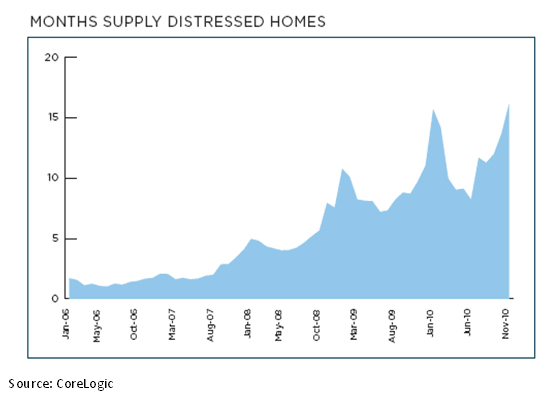

According to estimates from CoreLogic, the supply of “distressed” homes is greater than 15 months at the current pace of sales:

Kevin Drum thinks this all adds up to problems for the recovery (hat tip Free Exchange):

“Most analysts now expect that the housing market won’t bottom out until sometime next year. Until that happens, it’s unlikely that that the sluggish economic recovery we’re seeing right now will improve much.”

The view here at the Atlanta Fed—and the answer to the question posed in the title of this post—was provided earlier today by our president, Dennis Lockhart, in a speech given to the Atlanta Council for Quality Growth:

“…can we have high-quality growth while the residential real estate and commercial real estate sectors continue to be so weak? Not completely, in my opinion. The recovery will progress, but it will not be robust until we work through the economy’s serious imbalances, including those in the real estate sector.

“As I look ahead, I think the most reasonable assumption is that improvement of the real estate sector will lag an otherwise improving economy. But I am encouraged by the fact that the economy is increasingly on firmer footing.”

I will let you decide whether that glass is half-empty or half-full.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply