Although it’s only Thursday and the Fourth of July is still two days away, there is potential for an early set of fireworks today. While this afternoon’s ECB meeting may be somewhat less interesting than usual, tomorrow’s US holiday has pushed the release of non-farm payroll data forward to today.

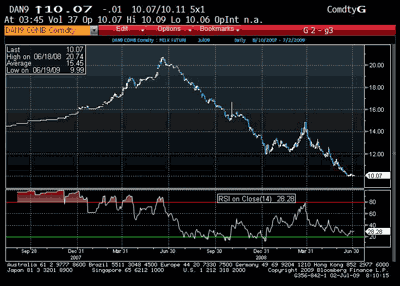

And you don’t need to be an elephant to recall what happened at the release of the last payroll report; a better-than-expected headline generated carnage in fixed income markets, though as the chart of front Dec eurodollars shows, many contracts have subsequently retraced virtually all of their post-payroll losses.

Still, positioning seems a bit lighter (or at least warier) than a month ago, and the Fed has tried to dissuade markets from expecting an early tightening. Given that yesterday’s poor ADP figure (which admittedly is as useful for projecting monthly payroll data as a bag of chicken bones and a magic 8-ball) was merrily shrugged off by equities, perhaps the fireworks could come in stock market space today? Just wonderin’….

But we’ve already had at least one firecracker today, with the Riksbank unexpectedly cutting interest rates and offering a one-year fixed rate tender at 0.40%. Naturally, many of the same analysts who wholeheartedly endorsed shagging the dollar when the Fed cut to 0.25% and engaged in QE now claim that the surprise Riksbank move doesn’t alter their (bullish) SEK forecasts. Such is the luxury of not having a P/L…

Elsewhere, the flightless bird looks like it’s been dropped out of an A380 and could be set to plunge to earth. There are ~4 bio of NZD uridashi bonds maturing this month, and the bulk appear unlikely to be rolled over. Meanwhile, the price of milk continues to drop; the latest Fonterra auction shows milk prices dropping 15% from May.

(The chart below shows US milk prices, but the trend is very similar.)

Elsewhere, the good news keeps on rolling for housing. It appears that the agencies have decided that the best way to deal with a global crisis caused by too much leverage in the housing market is to…..increase leverage in the housing market by offering 125% mortgages!

WTF? Can it really be that these clowns still don’t have a Scooby this deep into the crisis?

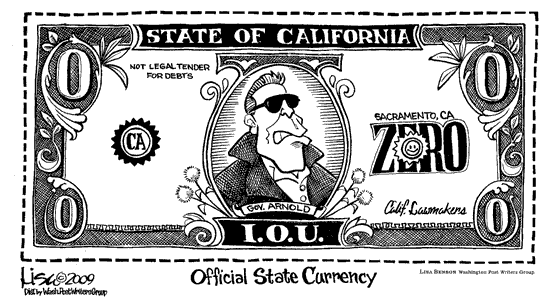

As always, the solution appears to be throw debt and leverage at the problem and worry about who pays later. Sadly for the state of California, the time to pay is now, and the well is dry. Perhaps receiving a non-legal tender IOU from the Terminator (not personally autographed, alas) instead of a tax refund check won’t affect consumption….but then again, maybe it will.

Hmmmm. Perhaps California should consider paying for Chinese imports into Long Beach Port with Arnie-bucks? After all, the Chinese clearly want an alternative to the dollar (which they’re either pushing or not for discussion at the forthcoming G8 meeting); given that no major banks are accepting Arnie-bucks, California’s IOUs are clearly a distinct instrument. C’mon, Arnie, make it happen: everyone’s a winner!

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply