Why has total current dollar spending been so anemic? Even after accounting for the run up in nominal spending during the housing boom, it is still below trend and continues to be a drag on the recovery. A useful way to answer this question is to look at three components of nominal spending: the monetary base, the money multiplier, and velocity

The monetary base is simply the stock of money assets directly created by the Fed. The money multiplier shows to what extent the monetary base is supporting expansion of other more commonly used money assets like checking, saving, and money market accounts. If the monetary base is not supporting an expansion of these other money assets it is because there is an elevated demand for the monetary base and vice versa. The money multiplier, therefore, is an indicator of the demand for the monetary base. Velocity shows how often the more commonly used money assets like checking, saving, and money accounts are used in transactions. The lower the velocity the less these money assets are being used for spending and vice versa. Velocity, then, is an indicator of the demand for these broader measures of money assets which we call the money supply.

By definition the product of these components makes up total current dollar spending or nominal GDP:

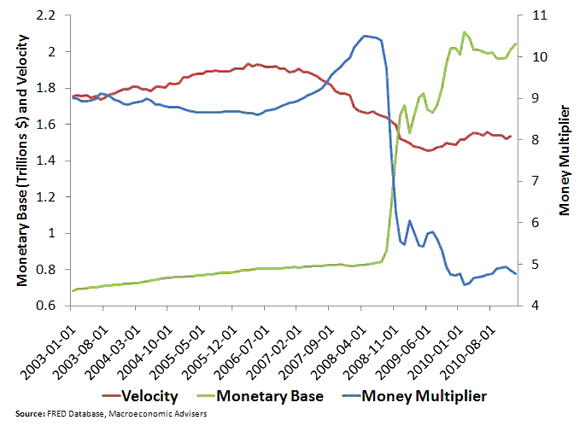

BmV = PY, where B is the monetary base, m is the money multiplier, V is velocity, P = price level, Y = real GDP, and PY = nominal GDP. (Note that this identity is just an expanded version of the equation of exchange. where the money supply , M , is M = Bm.) Using the MZM money supply measure and monthly nominal GDP from Macroeconomic Advisers to construct velocity and the money multiplier, the left-hand side of the above identity is plotted below:

This figure indicates that declines in the money multiplier and velocity have both been weighing down nominal GDP ever since the collapse in late 2008. Excess demand for the monetary base and the money supply thus continues to be a problem. The sustained decline in the money multiplier presumably reflects the ongoing reluctance of banks to lend given the relative safety of parking excess reserves at the Fed and earning 0.25%. The sustained decline in the velocity indicates that the rise in real money demand has yet to return to pre-recession levels. This figure also shows that the Federal Reserve dramatically increased the monetary base, which should, all else equal, have put upward pressure on nominal spending. However, all else is not equal as the movements in the money multiplier and the monetary base mostly offset each other. This offset is no coincidence, as most of the monetary base increase was the result of the Fed’s attempt to save the financial system under QE1. The figure indicates the problem with QE1 is that it was so focused on saving the financial system it ignored the fall in velocity. QE2 is an imperfect attempt to address this oversight by the Fed.

So the reason for the ongoing weakness in nominal spending is that money demand remains elevated and continues to be a drag.

Leave a Reply