A report released Tuesday by the Office of the Comptroller of the Currency (OCC) and the Office of Thrift Supervision (OTS) shows home delinquencies, foreclosures on first-lien residential mortgages, and loan modifications continued to increase during q1 of this year.

The OCC and OTS Mortgage Metrics report said that the size of the combined national bank and thrift servicing portfolio decreased slightly during q1’09, ending the period with just more than 34 million loans totaling about $6 trillion in unpaid principal balances. The portfolio included 67% prime, 10% Alt-A, 8% subprime, and 14% other loans.

About 90 percent of all mortgages in the portfolio were current and performing at the end of the first quarter of 2009, about the same percentage as the previous quarter.

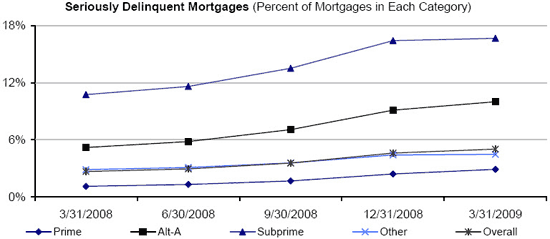

Despite that steady performance overall, serious delinquencies—loans 60 or more days past due and loans to delinquent bankrupt borrowers—increased by nearly 9 percent from the previous quarter to 5 percent of all mortgages in the portfolio at the end of the quarter.

…

Foreclosures in process rose to 844,389 and represented 2.5 percent of all serviced loans, as a variety of moratoria on foreclosures expired during the first quarter of 2009 and the recession continued to exert pressure on borrowers. The increase in the number of foreclosures in process represented a 21.8 percent jump from the previous quarter and 72.6 percent rise from the first quarter of 2008.

The report also noted that prime loans, which represented two-thirds of all mortgages in the portfolio, experienced the highest percentage increase in serious delinquencies, climbing to 20.3% from the prior quarter to 2.9% of prime mortgages.

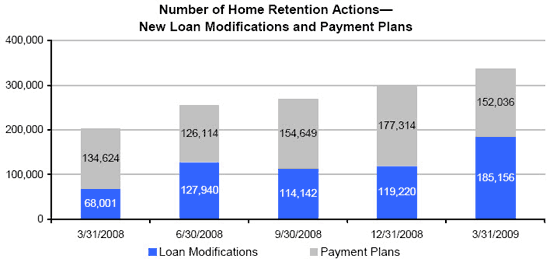

In terms of loan modifications : the report shows the number of newly initiated loan modifications reached 185,156 during the quarter—rising by 55.3% from the previous quarter and 172.3% on a y/y basis. The impact of this increase in modifications on reducing foreclosures and enabling borrowers to remain current on their loans, noted the report, will only be seen in future data.

Overall, newly initiated home retention actions increased to 337,192 during the quarter—rising by 13.7 percent from the previous quarter and by 66.4 percent from the first quarter of 2008 in volume.

Graphs: OCC

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply