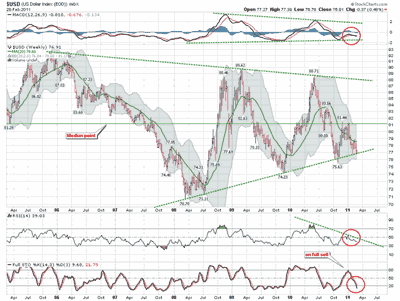

At the start of February, on Groundhog Day, the Dollar came down and tested a trendline that has provided resistance since Bear Stearns Day in 2008 (the day Bear went under). Apparently the Dollar saw its shadow when it bounced last Groundhog Day, and has remained in the winter of its discontent – it is now back to that level, a double-test in less than a month.

This trendline has provided resistance since March 2008, at lows in August 2008 as we began the great slide down, in Nov 2009 as the Hope Rally appeared to stall, and more recently in Nov 2010 at the kick-off of QE2. It is now Groundhog Day all over again for the Dollar, as it once again has come down to the critical support level (chart courtesy EWTrends):

(click to enlarge)

If it does not hold these levels, it is poised for a fall based on technical, fundamental and cyclical considerations. PIMCO even put out a comment today that the Dollar was about to lose its status as the reserve currency. SImon Black added that “the Dollar is finished.”

The primary basis for these assertions is the oil trade, which has been primarily in Dollars since a deal was cut in 1973, after Nixon went off gold. Given the Brent Crude market, an increasing quantity of oil is being bought directly with Euros, which suggest that the world’s reserve currency is moving to a basket of at least the Dollar and the Euro.

Still, these pronouncements seem grossly overblown. Sentiment is very bearish against the Buck, at similar levels to the Nov 2009 and Nov 2010 bounces, and according to the STU, the total net positions against the Dollar are at the extremes of the Bear Stearns low and the Nov 2009 low. This suggests another bounce is imminent.

A lot of folk are watching for a first-day stock bounce as we march forth to a new month. I suggest watching the Dollar instead for an indication of what is to come.

Leave a Reply