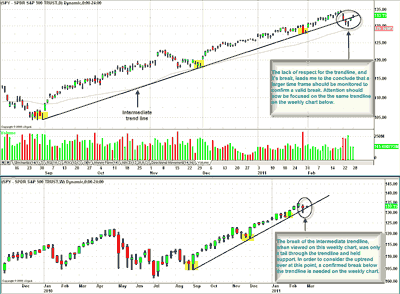

The intermediate trend line is important in determining the health of the uptrend in the SPDR S&P 500 Trust (SPY). Last week the trend line was broken, with confirmation, only to move back above the line in yesterday’s action. This lack of respect for the trend line, and it’s break, leads me to conclude that a larger time frame should be monitored to confirm a valid break. Attention should now be focused on the the same trendline on the weekly chart.

The break of the intermediate trendline, when viewed on the weekly chart, was only a tail through the trendline and held support. In order to consider the uptrend over at this point, a confirmed break below the trendline is needed on a weekly chart. Currently bulls are in control while many names are in the process of setting up for potential bearish scenarios. Below is a long idea in Mid-America Apartment Communities Inc. (MAA). It is a thin issue so be cognizant of good prices.

Chart 1: Illustrates the same intermediate trendline on both the daily and weekly charts of SPY.

(click to enlarge)

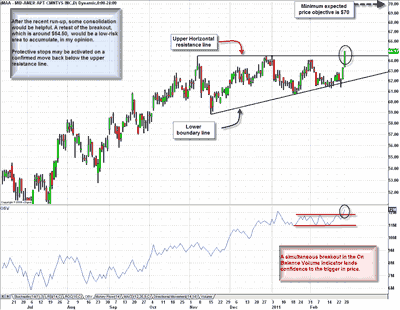

REITS broke out yesterday and were the strongest sector in the market. Mid-America Communities Inc. (MAA), is a residential REIT that broke out of an ascending triangle pattern yesterday. The pattern began developing around November 5th and measures out to a 70 dollar price objective. Another daily close above $64.50, which was the breakout, would help confirm the trigger. Consolidation above the breakout may be healthy, although not necessary, after the recent two day run-up.

Chart 2: is a daily chart of MAA outlining the ascending triangle pattern and yesterday’s breakout. Target: $70 is the minimum expected price objective. Protective stops: Confirmed move back below the upper horizontal resistance line, which is at $64.50.

(click to enlarge)

Disclosure: No positions (plan on initiating position is MAA)

Leave a Reply