So far in 2011, emerging markets as an asset class have underperformed developed stock markets like the US and Western Europe. Numerous reasons have been given by analysts and pundits for the reason. Worries about overheating economies, rising inflation, and the anticipated slowdown from rising interest rates. While these area all possible reasons, the questions remains if now is the time to begin accumulating them after the recent sell-off. After all, emerging markets certainly have the fundamentals on their side with rising incomes contributing to a better standard of living for hundreds of millions of people.

Just because this secular trend is expected to continue for the foreseeable future, does not necessarily make these stocks a lock as we have seen recently. Brazil (EWZ) down 4%, Chile -12%, China (FXI) -5%, and India (INP) -17%. This despite ample global liquidity thanks to wordwide money printing by the world’s major central banks.

The recent lagging in emerging markets should be no surprise to readers of this blog as we have covered Marc Faber’s suggestion that this would occur. See here: Marc Faber’s “Crack-Up Boom” Could Be Ruinous for Emerging Markets. Faber, as usual has been proven correct so far this year.

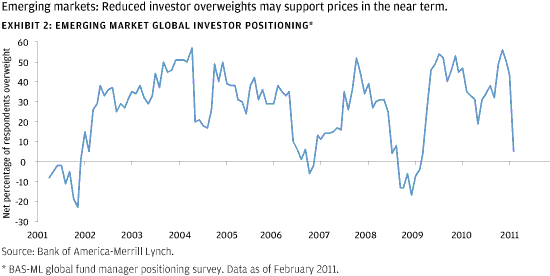

The chart below is courtesy of JP (We Stole Taxpayer Money and got away with it) Morgan. It shows the global positioning of investors with respect to emerging markets. You can see that the euphoria we saw for emerging markets in 2010 has quickly faded. This just shows the schizophrenic type market we have where risk on positions (long emerging markets, commodities, etc) can be dumped in days by the hot money momentum crowd, chasing returns. It is evident that emerging markets are no longer that favored by global investors despite promising fundamentals and only a modest sell-off from recent highs.

For bulls on emerging markets. this should be considered a contrary signal as it means that the market is working off any froth we saw in emerging market stocks last year. It is hard to have a bubble in an asset class when large institutional investors are not heavily overweight sector.

My only concern for emerging markets right now is that I expect a general sell-off in developed markets, which will likely hit emerging stocks. I would want to wait to establish new positions until this correction occurs. But after this, it looks like emerging markets may have a good 2011 after all, despite current concerns by investors.

Leave a Reply