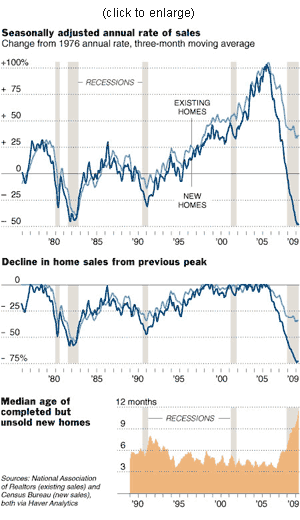

Housing affordability is at its highest levels in nearly 40 years. But despite deals on new and existing homes to be had throughout the market, many potential homebuyers appear reticent to jump in. Floyd Norris at the NY Times takes a closer look at the overbuilt aspect of the slumping new home market, and how new sales have fallen far more than sales of existing homes:

From the NYT: For more than three decades, the sales volume of existing single-family homes and newly built houses tended to rise and fall by about the same percentage, as can be seen in the accompanying charts. To be sure, sales of new homes did tend to do a little worse during recessions, but the difference was small and short-lived.

…

At the peak of the housing boom in 2005, sales of both existing and new homes were running at twice the 1976 rate. This year, the sales rate for existing homes seems to have stabilized at about one-third higher than the 1976 rate. New-home sales also seem to have stabilized, but at about half the 1976 rate. New-home prices, while they have fallen sharply, do not appear to have declined as far as prices of existing homes. At the worst point this year, the median price of existing homes was off 29 percent from the peak, while the largest drop for new-home prices was 23 percent.Median home price figures need to be used with caution… But in past recessions, new-home prices have tended to be weaker than existing-home prices, the opposite of what has happened in this cycle.

The present influidity in the housing market, will persist and eventually continue to force builders to cut prices even more to sell some houses — houses that, as Norris rightly points out, “in retrospect, probably should never have been built at all.”

Graph: NYT

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply