Brad DeLong might be right. At the recent AEA meetings he said something to the effect that America has a housing shortage, as many families are doubling up. I thought it was a clever, counter-intuitive way of thinking about the aggregate demand shortfall.

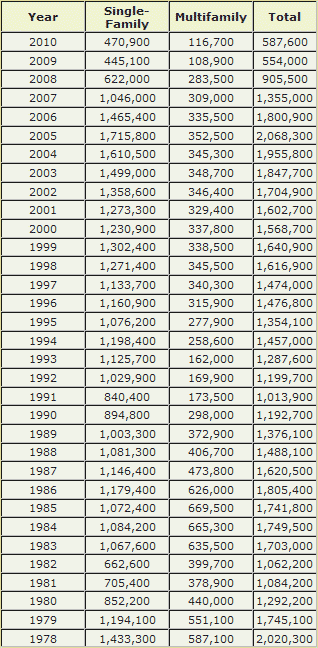

This got me wondering about the commentators who insist that easy money caused America to build a vastly excessive number of housing units, and that’s why there are record housing vacancies today. It seems to me that when you look at the data, housing construction has not been excessive in the period beginning in 2002, when the Fed allegedly cut rates too low. See what you think, and as you do so keep in mind that America had 220 million people in 1978, and 300 million by 2008. So construction in per capita terms has actually had a slight downward trend since 1978 (the earliest figures I could find.)

Source: U.S. Census Bureau

Here’s my assumption. Housing construction normally seems to fluctuate between one and two million units. Let’s take 1.5 million as roughly the trend rate which keeps up with population. Yes, it’s true that we exceeded that number every single year from 2002 to 2006, and the total excess production was about 1.87 million units. That’s a lot. But over the next four years there was a shortfall of about 2.6 million units. So why do we seem to have a hugely excessive number of homes, if we are actually 730,000 short?

One answer is a decline in immigration. A year ago I suggested that the decline in immigration might have played a role in the housing crash. I think it’s fair to say my theory wasn’t met with widespread acclaim. So if that’s why I’m wrong today, if less immigration explains our housing surplus, I’ll take it. At least I would have been right last year, on a point all the pundits missed.

But I doubt that’s big enough to make a major difference. Even last year I merely suggested it was a contributing factor in the Southwest. A more likely explanation is that the sharp fall in NGDP led to mass unemployment, especially among the young. This caused them to start living with their parents, even when in their 20s (something I couldn’t even imagine doing when I was young.) In that case the problem isn’t that too many houses were built (well actually a few too many were, but they should have been quickly absorbed in a country with 120 million units) but rather too little demand, because people have too little money. And who determines how much money there is in the economy?

There’s a way to test my theory. If the other side is right, and we have all these vacant homes because we built way too many in the middle of the decade, then the number of vacant home should have dropped rapidly during the last three years, and especially during the last two years. The year 2008 was the first year below a million since my records began in 1978 (and probably much earlier.) That’s clearly below any reasonable estimate of normal absorption. Then in 2009 and 2010 we were down close to a half million units, a mind-boggling low rate of construction. Vacancies should be plunging under any reasonable estimate of market absorption. But guess what, over the past three years there has been no decline in housing vacancies (assuming I am reading the 5 year version of this graph correctly); vacancies have leveled off since March 2008 at just under 19 million units, up from 16 million in early 2006.

Given ultra-low construction, and US population growth of about 3 million/year, there is only one explanation for that pattern. Astoundingly low demand for housing. Do young people actually enjoy living with their parents, or might America be experiencing an aggregate demand shortfall?

Another reason we need more NGDP.

This was spurred by a Chicago alumni magazine article that made the following claim:

Economic recovery will be slow, [Erik] Hurst says, because the massive misallocation of resources that the housing boom created cannot be quickly remedied. During the ten years after 1997, he said, 40 percent more housing was constructed in the United States than in any decade on record. Today 2.3 percent of single-family homes are vacant, an increase of more than 64 percent since 2005.

The housing oversupply, in turn, has contributed significantly to high unemployment. As the construction industry boomed, much of the American workforce shifted to housing-related industries, on both the construction and banking sides. Now, of 3 million open jobs in the United States, only 65,000 are in housing-related fields, Hurst said. Thus, many unemployed workers are qualified for jobs that are no longer available—jobs, he predicts, that won’t come back.

This is completely inaccurate. As you can see from the table, housing construction in 1998-2007 was only 8.4% above the levels of 1978-87. And it was much lower in per capita terms. The 2.3 million single family homes that are vacant are probably little changed from a few years ago, whereas the number should be plunging with low construction. There is no reason construction jobs shouldn’t come back, unless we shoot ourselves in the foot. As I showed, housing construction in the past decade has been below normal. If all you knew was the housing construction data from the noughties, you’d expect another 1.5 million homes a year to be built in the teens, just like other decades. I’m not saying that will happen. Indeed I think it won’t happen. But if it doesn’t there will only be two possible explanations; a crackdown on immigration or a prolonged NGDP deficiency (perhaps combined with supply-side problems with the labor market.) It won’t be because we built too many houses in the 2000s. We didn’t.

PS. Please do not tell me about local housing markets. I am claiming America has too few homes; I completely agree that Detroit and Vegas have too many.

It made good sense for America to build lots of homes around 2002-06

When the tech bubble burst the Wicksellian equilibrium real rate fell to very low levels. In that situation, the Fed must cut interest rates sharply to prevent a sharp fall in NGDP and a depression. They did so. Whether they then raised them fast enough in the middle of the decade is a harder issue, and there are good arguments on both sides. But I’d like to focus on arguments for a housing boom in 2002.

In a classical world (on the PPF) less business investment should lead to more residential investment. Some commenters object when I call housing construction “investment.” Just like real men eat steak and not sushi, real investment is supposed to be factories and infrastructure, not houses. They see houses as a sort of consumption. America consumes too much, and houses are exhibit A. I think this is totally wrong; there is almost no entity that is more “capital-like” than houses.

A can of beer is a capital good that depreciates rapidly as you drink it. Hence we call it a “consumption good.” The longer-lived an asset, the more capital-like it is. In a recent comment section Mark Sadowski made this point:

Isn’t the real consumption of useful capital taking place right now? Menzie Chinn recently alluded to the fact that growth in potential RGDP has probably slowed in the face of a persistent and massive output gap. And I keep reading local news stories about well maintained manufacturing facilities that were highly profitable until just three years ago being torn down because no one expects sufficient demand to come back anytime soon.

This reminded me of just how short the useful life of many so-called “capital goods” really is. Think computers. Or factories. Or even stadiums and basketball arenas. They actually tear down perfectly good arenas that I recall being touted as new and modernistic in the 1970s. (Meanwhile the Roman Coliseum is still standing.) In contrast, my house is 90 years old and perfectly fine. Around me are many houses 100, 150 even 250 years old. All still in good shape. All still producing housing service “output.”

Suppose you were a central planner, deciding what America should do in 2002 to keep people busy (idle hands are the devil’s workshop.) Business investment is out because of the tech crash. Two percent of Americans can feed us all. It used to take 30 percent to make manufactured goods, but even without imports we’d need a far lower number today due to technology. Soon only about 5% of Americans will be able to produce all the manufactured stuff we need. Most Americans already have the refrigerators and washers and cars they want. If I were a central planner, I suggest two uses of labor; more houses and more fun. People love nice houses with granite countertops (when I remodeled in 1997 I put in formica, and I bitterly regret it every day of my life.) We all see pictures of dream houses we’d love. And if we have the things we need, then more services. Restaurants, hotels and hospitality. Service jobs. More houses and more services would seem to have been the best way to keep people busy and boost living standards after business investment crashed in 2002.

It boggles my mind that so many people wring their hands that we might have built a couple of million too many houses over a few years, in a country with 120 million units. In the grand scheme of this does it really matter all that much if a house built in Phoenix is only occupied for 145 years of its 150 year life, instead of 150 years of its 150 year life?

Some would say “what about the banking crisis, the recession?” What about them? Yes, those are the big problems we should worry about. But they have little to do with building a few too many houses. Those failed mortgages were mostly re-fis, as people used their houses as ATMs. Or mortgages on the purchase of existing homes. The losses to the financial system from people not paying back their mortgage on a newly-built house are way too small to explain the great financial crisis of 2008. And I already showed the housing slump doesn’t explain the recession, as it occurred way too soon.

It seems like the misallocation of capital into housing construction was a disaster. Actually it was a minor problem that was correlated with two major disasters, horrible mis-regulation of our financial system that allowed risky loans with tax-insured dollars, and really bad monetary policy that allowed NGDP expectations to fall sharply in 2008.

Those are some really nice new houses out there. Now let’s print some money so that people can enjoy them. (But only enough money to get proper NGDP growth, not enough to bail out all the bad investments.)

Leave a Reply