The euro is a very practical currency, but it makes millions of victims. This article contains a simple explanation why the euro can’t work and exposes the advantages of a shift to state money.

– No, European cooperation won’t disappear without the euro!

– And yes, with state money we are much better off!

The euro has an unsolvable problem. The countries that have severe debt problems today, if they succeed in reducing these debts by cuts in public spending, will predictably slide into debt again.

This is because these countries are victims of a fundamental flaw in the euro. Before the euro started, economists have warned, that a single currency can only work when all participating countries are economically homogeneous. [1] [2] [3]

Today there is nothing that can prevent Greek consumers from preferring cheaper and better products from Germany. And when Greece imports more than it exports, its debts increase. The same is true for all less productive countries in the euro area. They can cut their public spending as much as they want and privatize all public infrastructures and services, but the next debt crisis will never be far away!

Here is why. When consumers in less productive countries prefer cheaper and better imported products, the external debt of the country increases, while the country’s productivity decreases. When the country has its own currency, it can devaluate it. This will make imported products more expensive and the country’s own products more competitive on the export markets. The debt will decrease and the productivity will increase again. Devaluations were very common before the euro started.

With the euro, devaluations are no longer possible and the countries become trapped in debt. But when countries sign to become part of the euro area, they also commit themselves to reduce their public debt below 60% of their gross national product (GNP) and their fiscal deficit must stay below 3% of GNP. If they exceed these limits the other countries consider it a threat for the wished stability of the euro. These other countries will apply sanctions to force the indebted government to take appropriate measures (as if a sustainable solution existed) and if that doesn’t work, the others will supply loans (which, by the way, will increase the external debts) accompanied by harsh conditions, like ever more cuts in public expenses – like dismissal of functionary, cuts in educational, cultural, social, health care and military spending – and an obligation to sell public possessions, infrastructures and services! (Take care when you hear politicians of richer countries say they are going to help indebted countries!)

It is not an accident that Greece, Portugal, Spain and Ireland are most severely hit today. Economically these countries can’t be compared with countries like Germany! When a crisis strikes the euro area it’s immediately apparent that the area is not homogeneous; there are strong and weak countries. Europe has many very different countries, with very different economies, having very different potential for productivity.

In fact, it is impossible to maintain a single currency in such a heterogeneous area as the 27 countries of the euro-zone. In spite of the warnings of economists, politicians pushed for the single currency. For the advocates it was just a matter of inventing rules and convincing countries to sign agreements that they would stick to these rules. Well, you can sign pieces of paper, but that does not enable what is impossible. Today, twenty out of the twenty-seven euro-countries cannot meet the agreed budget rules. [4]

The differences in productivity are not just temporary. Intrinsic differences are related to the local climate, to the geographical situation, to the fertility of soils, to the availability of water and energy, to distances to be covered, to the difficulties for transports and all other unchangeable conditions. They greatly determine success or failure of economic activity. Each country has developed its own typical economy, some relying more on agrarian production, others on industry, others on commerce or naval transports etc., which means that a one for all financial policy will never be able to suit all countries.

Dollar example?

Often the United States is mentioned as an example of a “success” of a single currency area. One crucial difference is that they all speak the same language in the U.S. and thus people can move much more easily to where successful economic activities take place. In Europe, international workforce mobility is rather limited, not just because of the language barriers, but also because we have old countries with people who are rooted in their traditions and cultures.

This said, it is very questionable if we can call the dollar a success of a single currency area. [5] Since 1973 the US has imported far more than it has exported and, with a spiraling and uncontrollable debt, it lives as a parasite of nearly all countries in the world. It is rather a proof that a single currency in a heterogeneous area can’t be done without a massive exploitation of other countries.

Out of the euro?

Understanding that the euro can’t work is one thing. The next thing is still more important. I will show that simply going back to our previous national currencies would be a very bad solution. Sure, we will need national currencies again, but if we want to avoid the errors of the past, we need money that is issued and controlled by the government (which is, by the way, how most people think it is today.)

To understand why state money is so important, we need to understand what money is and how things work. Today’s money is not issued nor controlled by the government. Instead – and for most people this may seem unbelievable – nearly all of today’s money has been secretly (and abusively) created by commercial banks. You don’t actually have any money in your bank account; you just have numbers. These numbers represent “an illusion of money”. On your bank duplicate it says what the banker owes you, but that money doesn’t exist, a part from a tiny little fraction. Of course, as long as you can pay with this fake money, you don’t mind. [6] Nevertheless, as I will expose below, it is this deception in the banking system which allows an ever-expanding money supply that endangers our society. Bankers have corrupted all currencies in the world with their concealed bookkeeping tricks. The euro is no exception.

The secret of money

Today, less than 5% of all money is real money in the form of banknotes and coins. The rest has been artificially created by the banks and only exists as numbers in our bank accounts. When you borrow money from the bank, the banker does not lend you existing money. Instead, he simply creates a new amount of money by typing numbers into your bank account. You then have to pay interest on this new money that was “typed” into existence. Often, big amounts are involved. Usually, someone who pays back a loan for a house in 20 or 30 years pays as much in interest as the amount of his loan. In fact, he pays for two houses. One for himself, one for his banker! [7]

At the moment someone buys a house, the money of the loan is transferred to the seller. The seller will spend this money on other things. That is how the money of the loan starts to circulate in the society. All money in society started as loans. Each banker collects interest on the money he has created and all bankers combined collect interest on every single unit of money that exists. If you have money in your pocket or in your account, then there is someone somewhere paying interest on that money to a banker. When a person repays his debt to a banker, the money that was “typed into existence” for his loan is then “typed out of existence.”

So, all money is temporary. The total amount of money in the society consists of what still has to be paid back from all loans issued in the past. This means, that the total amount of money in the society is a hazardous amount. It has nothing to do with the needs in the society for the normal exchange of goods and services.

Never-ending inflation

Worse, banks supply more loans all the time, thus creating more money all the time. When more money is used to buy a same volume of goods and services, each money unit becomes less worth and prices rise. This is the well known inflation. [8] The director of this inflation is the central banker. By lowering his interest rate he signals to the banks, that they must speed up the supply of loans (at lower interest people will borrow easier and more) and, inversely, by increasing the interest rate, the growth of the money stock will slow down.

Bankers need inflation

Bankers need inflation. [9] When the money supply inflates, it becomes easier for the borrowers to earn the amount needed for their debt payments. This is an advantage for the borrowers, but for the bankers too. It guarantees fewer defaults.

The fact that the principal of the loan is worth less when the borrower pays it back doesn’t hurt the banker. The amounts paid back for the principal don’t stay in existence. Remember, the banker created the principle by typing it into existence and he will type it out of existence at the moment it is paid back.

As for the interest, that is another story. The interest wasn’t part of the money the banker created and won’t be typed out of existence when it is paid. It is the profit for the banker! Yes, due to the inflation the interest payments become worth less, but don’t feel sorry for the banker. You may be sure, he has foreseen this problem and has raised his interest rate a bit in advance.

No possibility for a sustainable society

Inflation has still another very important aspect. If you don’t want to get poorer, you will have to work harder all the time to compensate for the loss of value of your money. That is why inflation causes ever increasing economic activity. To put it another way, with an inflationary banking system, we will never be able to reach a sustainable and well balanced society.

Financial power

The ever-growing money supply creates a situation where everything can be purchased, even the state. In many countries financial groups have taken over public services to turn them into steady streams of profits: gas, electricity and water supply, public transports, post, telephone, police tasks, prisons, public health services, waste collection etc. This is an ongoing process. The bankers and the financial elite make always more investment decisions that shape our society, while government makes always less investment decisions.

This has consequences. Money and profits now determine what is “good” for our society. But that is not all. As government offers fewer services to its citizens, it will lose recognition as a natural authority. Instead of being an institution that cares for its population, the government is becoming a skeleton that needs more and more repression to enforce short term and shortsighted decisions. Instead of guaranteeing individual liberties, it now allows and promotes surveillance of all citizens by private and public organizations with thousands of cameras connected to interlinked databases. Citizens are now considered to be potential criminals who must be fingerprinted and recorded. The KGB was a kindergarten compared to the quickly expanding electronic surveillance today.

The euro

The euro is a currency that belongs to the European Central Bank (ECB) in Frankfurt. [10] The ECB is owned by the central banks of the participating countries. [11] In spite of the public looking names of these central banks (Deutsche Bundesbank*, Banque de France, etc.), all of them are independent from the governments and most of them are directed by a private council. [12] (* corrected Jan 7, 2011)

In spite of its private character, the ECB is an official organ of the European Union. By article 7 of the statute of the European System of Central Banks (ESCB) and by article 107 of the Treaty of Maastricht, the ECB enjoys complete independence. [13]

Note that this independence doesn’t come from any logical or organizational need, but derives purely from the belief that only independent central bankers can manage the monetary system correctly. Well, if we don’t question this belief today, when will we? [14]

The European government

The European Community started as the European Economic Community (EEC) in 1957. Right from the start, this institution lacked democratic rule: its parliament only had an advisory role. (This is still the case today!) The Council is composed by ministerial representatives of the member states. By contrast, the Commission does not relate to the national governments and constitutes a supranational power. EEC’s goals were economic and political cooperation between France, Germany, Italy, the Netherlands, Belgium and Luxembourg.

In 1967 a concentration of powers took place when the EEC absorbed Euratom and the European Coal and Steel Community. Also, the veto-rights of individual member states were abolished in many fields. Once this was done, the bankers stepped in. In 1970 Pierre Werner, an influential banker from Luxembourg [15] , drew the plans for the single currency.

Bretton Woods

Pierre Werner had been one of the participants at the Bretton Woods Conference in 1944 that was greatly influenced by the aggressive spirit of the Second World War. During this conference the principles for world finance and trade were created. Countries would now have to peg their currency to the dollar and keep their exchange rates stabel. That was beneficial for international trade and finance. In fact, what this principle expresses is that the ease for international trade and finance is more important than the ability of countries to adapt themselves to changes in the international environment. Also, through this agreement the US was virtually proclaimed “master of the world”, since all countries would have to adapt their currencies to the dollar, while the US could do what it liked!

At the same conference the IMF was set up as well as the predecessors of the World Bank and the World Trade Organization. The gentlemen at Bretton Woods clearly knew that the weaker countries would suffer as a result of their plans. The IMF, and later also the World Bank, was given the role to supply loans to these countries. These loans came with conditions that included severe cuts in public spending, with consequences for education and public health. In practice, the IMF and World Bank buried developing countries in debt. So much debt that they would never be able to pay back the interest, let alone the principal. And once the country was in inescapable position, it was forced to sell whatever it had (in particular ores and oil), most often to US-corporations. [16]

Foreign loans

Although the employees of the World Bank were taught otherwise, loans from abroad are the worst way to “help” countries in trouble. The only thing they can do with foreign money is to buy goods abroad and get further into debt. [17]

Only when a country really needs a machine or something else it cannot make for itself, and when the supplier refuses that country’s currency, is a loan in foreign currency justified.

Free movement of capital

And what would Euroland mean for the bankers? The bankers would lose an important source of income: the provisions on the exchange of the many national currencies. But they would gain a much bigger source of income: the free movement of capital. This was a precondition for the single currency. This would allow the bankers to easily supply loans in any spot where profits could be made.

The housing boom in South-Europe

Internationally, bankers have agreed with a set of rules for themselves, that “limits” the amount of loans they are entitled to supply in relation to their capital. The standard is that they should have 8 euro of capital for each 100 euro of outstanding loans in commerce and industry. However, when the loans are for housing, they may lend out twice as much and thus collect twice as much interest. [18] Until recently, bankers thought house prices would always rise and so loans on houses seemed virtually without risks. That is how the house construction booms arose in Spain, Portugal, Ireland and elsewhere. What the bankers forgot is that when there is not enough economic activity, people can’t pay for these houses. But to finance economic activities like industry and commerce, they get half as much interest…

Help!

Greece is already experiencing what it is like to have European “friends” who come up with loans while imposing extreme cuts in the country’s budget. These friends have so much faith in their solution, that they let the mad rescue dog IMF in to have its share in the Greek tragedy. [19] By the way, this also means that the euro is now “assisted” by the IMF. Funny, if it wasn’t such a tragic reality.

Ireland, Portugal and Spain are now in trouble too. As long as they stay within the euro, they can’t devalue their currency. The euro now works as an invisible and imposed exchange rate between countries. These countries have a double problem now. In the first place they must reduce the debt to the agreed European level and secondly they must prevent new debts in the future.

The first problem is generally solved by harsh measures like severe cuts in social, cultural, educational, medical spending and dismissal of public employees, with privatizations of public infrastructures (like Spanish airports) and public services and a steep raise in taxes. These measures are aggressive and very unjust for the common people, who have no responsibility whatsoever in this tragedy. Many people will fall into poverty. Do they have any chance to get out of it again?

Can things get better?

To have an idea about that, let us look at the second problem. How can you prevent the less productive euro-countries from getting into debt again? Well, you cannot. There is no way to prevent populations of less productive countries from importing more than they export. There is even some logic to suppose that they will prefer cheaper and better products imported from more productive euro-countries. It is a fundamental flaw of a single currency in a single market composed by very heterogeneous economies.

In my opinion, the harsh measures these countries are taking today are completely useless if these countries don’t leave the euro.

Bad solutions

One bad solution would be to return to the situation prior to the euro, and let the bankers create and inflate the currency of the country again.

Some people think that if the bankers were not allowed to create fake money by “typing it into our bank accounts”, inflation would stop. The only thing that would stop is the money multiplying effect of these balances. [20] It is true that we would have real money in our accounts instead of empty numbers, but remember: bankers need inflation. So they would still continue to expand the number of loans, but instead of creating the money out of thin air, they would have to borrow it from the central bank. (The central bank can create money indefinitely.) Of course the bankers would make their customers pay for this extra cost. Loans would become more expensive, but the constant inflation of the money supply would not stop. (Nor would the inevitable “price inflation” that follows.)

Another bad solution would be to choose a currency backed by gold reserves. Although such currencies have been used in the past (in the US until 1971), money based on gold has many disadvantages. Countries without gold mines would have to buy gold (which means deliver goods and services to the gold mining countries) for the only purpose of disposing of a national means of payment. Each time when more gold comes on the market, they will be obliged to buy more of it, to prevent their currency from devaluating against currencies of countries with increasing gold stocks. The gold mining industries would, in many aspects, get supranational power, even more than the Federal Reserve today. Gold has no stable value. Its pricing can be influenced by holders of big stocks, like the gold mining industries and central banks. Even big numbers of small buyers and sellers, when triggered by fear or greed can influence its price. All these price fluctuations can form a danger for any economy that has its money pegged to gold. Still more than today, gold would trigger conflicts, oppression and wars.

Any backing of money by commodities, like gold, silver or others, will severely impact that currency as well as the prices of the chosen commodities.

The state money solution

Most people think that money belongs to the state. That is the way it ought to be. Money should belong to the society and not to the banks. It is the only way to obtain a fair money system and the only way to have a government that does not depend on the banks.

Today we have a very expensive monetary system, with banks that increase their capital each year by tremendous benefits. The bankers will tell you they need the capital in case they suffer losses. The losses would be deducted from the capital. Well, their capital is, objectively speaking, tremendous, but at the same time it only covers a tiny little percentage of their outstanding loans. If the losses are too big, the capital is gone. But if we take a closer look at the international agreements between the bankers, they cannot use their required capital at all. If they deduct an amount for losses, there will be about twenty times as many loans on their balance sheet that lack the backing of sufficient capital. So what we have today are bankers who, instead of bearing their losses, simply tell the ministers of finance that they need fresh money, because otherwise they haven’t enough capital!

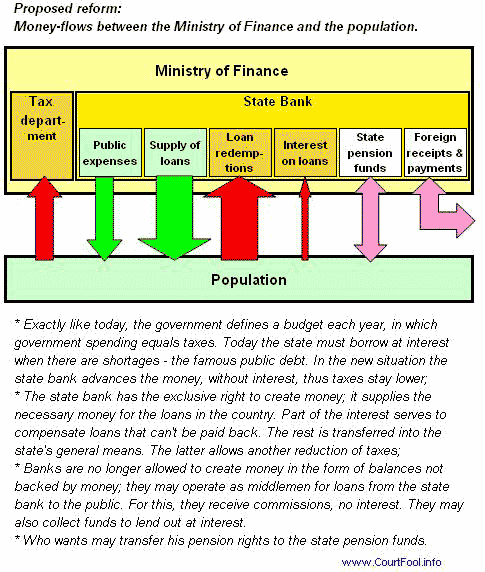

-State bank

Well, we can end this expensive and abusive system, by creating a state bank that will be the only bank in the country to create money. It will create all the necessary money for the loans in the country, as well as for the advance for expenses of the government. Furthermore, the bankers would no longer be allowed to create bank-account balances that are not covered by real money. If bankers want, they may operate as middlemen between the state bank and the population for the supply of loans. For this, they would receive provisions, no interest. Also, they may manage the accounts of their customers on behalf of the state bank. This way, everyone can keep his bank accounts and except for the conversion into the national currency, there won’t be any interruption in the payment system. (And if the bankers don’t want to cooperate, the state will have to create its own counters, for instance in tax offices.)

Next to their new function as middlemen for loans from the state, bankers may still collect (existing) money to form funds that can be lent out at interest. Since this is existing money, the loans will not cause inflation.

-Inflation stop

With this reform the government has the means to stop inflation. Having the means doesn’t imply it has to. It is more likely that governments will slow down inflation only very progressively, when step by step the “greed is beautiful” philosophy is bent into “care for the environment and the future.” And whatever form that takes, we won’t have to work harder all the time just because the bankers want us to.

-No more public debt

If the government can create the money we need, the public debt can disappear.

Public debt comes about when the government spends money before the corresponding taxes have been levied. Today we pay a lot of interest on the Treasury bills that the state must issue to pay for these expenses. Bankers like to invest in these obligations, because they deliver interest virtually without risks. So, on one hand our governments had to raise their debts to rescue the bankers and on the other hand the bankers get paid interest on these debts. Yes, we live in a mad, mad world.

-Pension funds

Other profiteers from the interest on government debt are the pension funds that get part of their income out of it. Our pensionados are paid, for a consistent part, from this interest, which, in turn, is paid by the taxpayer. Another consistent part is paid directly by the premiums from the working population. So, behind the facade that people put money aside for when they are old, most of the money that the pensionados get is money that the working population pays them through premiums and taxes.

In fact, that is quite logical. If you would simply stock money and release it decades later, the release would only cause inflation. It would not magically create the goods and services that are wanted at that moment. What you can do with your money when you’re old depends highly on the workforce and productivity at that moment.

Another part of the income of pensionados comes from foreign investments, or to put it more clearly, from the workforce of people in other countries. Ethically it is like financial colonialism. Nothing to be proud of.

Therefore, it would be much more logical, to have a state pension fund, managed by the state bank. Or, to put it another way, the working population must simply accept they have to take care of the elderly. Citizens, who want to transfer their pension rights from their private pension funds to the state pension funds, should be allowed to do so.

-Interest

Many people consider interest unethical. However, when a part of this interest is used to absorb the losses on loans that can’t be paid back, and when the rest goes into the public means of the country, I don’t see objections. The latter part of the interest would reduce the amount of taxes to be levied.

The government could implement a variety of interest rates according to the fields or types of investments it wants to privilege. Rather than steering bluntly one leading interest rate, like central banks do now, the government could steer loans and investments more in the needed directions.

Interest is also a useful tool to incite borrowers to pay back in time.

-Poor and rich

Today, when supplying loans, banks demand collateral they can seize if the borrower doesn’t pay his debt. This way rich people can always borrow and invest more easily and thus become richer more easily. The ever-increasing gap between poor and rich is a danger for society. The state bank won’t need collateral. The loans that it supplies can be compared with a tax debt. When it is not paid back, it can be handled similarly. Principally, the poor would be able to borrow and invest as easily as the rich.

As explained earlier, in an environment without inflation, it is more difficult to pay back loans. However, this will be compensated by the fact that the interest rates can stay lower, because we don’t have to contribute to expensive and useless capitalizations by private banks anymore. Besides, when needed, tax policies can offer further compensations to borrowers.

-Is leaving the euro expensive?

Some politicians try to frighten people by pretending that leaving the euro would be excessively expensive, that it would throw back economic development for many years and so on and so forth. Well, to start with, countries will not stop trading with a country simply because it has left the euro and has a new currency. And if that country switches to state money, then the costs of the switch are mostly organizational and rather minor compared with the gained advantages.

All needed money involved in the switch can simply be created out of the blue by the state bank. All euros in circulation in the country can be bought by the state bank through the issuance of new money. These euros can be put aside by the state bank as strategic reserve and for the payment of imports.

The government will be able to buy back the essential infrastructures and public services. Rebuilding national enterprises from the many fragmented energy, post, telephone, railway and other services will surely enable more reliable services. In these essential services quality and service should be the leading principle. That doesn’t mean a return to the dusty state enterprises of the past. State enterprises can be modern and well managed, and, why not, supply much better public services than any private, profit chasing company can.

I don’t say that all these changes are easy. But if we want to create a sustainable society, in which democracy and freedom will still mean something when our children and grand’children grow old, this is the path we should take.

-Overview

The reform, the way I would recommend it, can be summarized in the overview below. Please note the observations added below it.

_______________________

Roman Horvath and Lubos Komarek in “OPTIMUM CURRENCY AREA THEORY: AN APPROACH FOR THINKING ABOUT MONETARY INTEGRATION” (2002)

“It is possible to distinguish two major streams of the optimum currency area literature. The first stream tries to find the crucial economic characteristics to determine where the (illusionary) borders for exchange rates should be drawn (1960s-1970s). The second stream (1970s-till now) assumes that any single country fulfills completely the requirements to make it an optimal member of a monetary union. As a result, the second approach does not continue in the search for characteristics, identified as important for choosing the participants in an optimum currency area. This literature focuses on studying the costs and the benefits to a country intending to participate in a currency area.”

http://wrap.warwick.ac.uk/1539/1/WRAP_Horvath_twerp647.pdf , page 7.

Friedman put forward the advantages of flexible exchange rates between countries as follows: As it is commonly observed, the country’s prices and wages are relatively rigid and factors are immobile among the countries. As a result, under the negative demand or supply shock the only instrument to avoid higher inflation or unemployment is the change in the flexible exchange rate (that means appreciation or depreciation of the currency). This brings the economy back to the initial external and internal equilibrium. (…) Under the fixed exchange rate regime there would always be the unpleasant impact on unemployment or inflation.

http://wrap.warwick.ac.uk/1539/1/WRAP_Horvath_twerp647.pdf , page 8.

[2] Yrd. Doç. Dr. Hüseyin Mualla YÜCEOL, Mersin Üniversitesi İktisadi ve İdari Bilimler Fakültesi, Maliye Bölümü, in “WHY THE EUROPEAN UNION IS NOT AN OPTIMAL CURRENCY AREA: THE LIMITS OF INTEGRATION”Europe is not an optimal currency area. Although, On January 1, 1999, 11 EU countries initiated an EMU by adopting common currency, the euro, the EU does not appear to satisfy all of the criteria for an optimum currency area. Then, joining the EU is not identical with joining the euro for both old members and new members.

http://eab.ege.edu.tr/pdf/6_2/C6-S2-M6.pdf , page 66

[3] Paul de Grauwe, excerpts of speech“With up to twenty-seven members instead of the present twelve, the challenge for ensuring a smooth functioning of the enlarged Eurozone will be daunting. The reason is that in such a large group the probability of what economists call ‘asymmetric shocks’ will increase significantly. This means that some countries may experience a boom and inflationary pressures while others experience deflationary forces. If too many asymmetric shocks occur, the ECB will be paralyzed, not knowing whether to increase or to reduce the interest rates. As a result, member countries will often feel frustrated with the ECB policies that do not (and cannot) take into account the different economic conditions of the individual member countries. This leads us to the question whether the enlarged EMU will, in fact, be an optimal currency area.” (…)

“If a country is hit by negative shocks brought about by agglomeration effects, the wage cuts necessary to deal with these shocks will inevitably be very large. To give an example: If Ford Motor were to close down a plant in Belgium and to invest in Poland instead, the wage cut of Belgian workers that would convince Ford Motor not to make this move would have to be 50% or more given that the wage not feasible, then flexibility dictates that the Belgian workers be willing to move.”

http://mostlyeconomics.wordpress.com/2010/06/21/were-europes-curent-problems-never-imagined/

[4] NRC Handelsblad, 3 June 2010“De Europese Commissie heeft op dit moment tegen 20 van de 27 EU-landen een procedure lopen omdat deze landen de interne begrotingsregels van de Europese Unie overschrijden.”

“The European Commission has started procedures against 20 of the 27 EU-countries because they transgress the internal budgetarian rules.”

http://www.nrc.nl/economie/schuldencrisis/article2558281.ece/Ambtenaar_betaalt_bezuiniging

[5] Julius Horvath in “Optimum currency area theory: A selective review”Ghosh and Wolf (1994), for example, conclude the US is not an optimum currency area and tentatively suggest separate currencies for different parts of the United States.

http://www.bof.fi/NR/rdonlyres/5C4E3CE4-0386-4FDB-886B-C276040CD183/0/dp1503.pdf , page 7

[6] In spite of the apparence, we can’t and we don’t pay with fake money. With the tiny little bit of real money that is left, bankers succeed in executing our payment orders. For a simplified explanation, see “Debit, credit, banco!”, item “Juggling with payments” http://www.courtfool.info/en_Debit_credit_banco.htm [7] Inflation and interest rates vary very strongly over time. See overview US rates 1940-1999 http://www.courtfool.info/US_inflation_1940_1999.htm These rates do not show the extra costs that customers often have to pay to get their loan, like insurances. Insurances reduce the risk for the banker, so he has more profit out of his loan. So even if you pay such insurances to an insurance company and not to your banker, they form a hidden form of interest. [8] Price inflation leads to dissatisfaction of the population. That is why a lot of countries use a Consumer Price Index, which shows more pleasant figures.http://www.mw.ua/2000/2020/52764

“… the reference value (4.5%) of m3 growth on an annual basis. This reference value for monetary growth is based on a potential economic growth of 2.0% to 2,5%, an inflation of less than 2.0% in the medium term and a long-term decline of the velocity of money by 0.5% to 1.0%, per annum.”

http://www.dnb.nl/dnb/home/file/ar03_tcm47-146939.pdf (page removed / not accessible anymore)

“In 2003, the money supply (m3) in the euro area grew at a rate of 8.0%, well above the official reference value of 4.5%.”

http://www.dnb.nl/dnb/home/file/ar03_tcm47-146939.pdf (page removed / not accessible anymore)

Keep in mind, when politicians, officials or the central banker talk about “inflation” to the public, they mean the changes in the Consumer Price Index.

The index is based on a yearly price comparison of a basket of products, that an “average” household would need. The content of the basket varies from country to country and so do the rules to calculate the index. One country may include the cost of food, fuel and housing; another country may leave these costs out.

http://bigpicture.typepad.com/comments/2005/09/the_history_of_.html

http://www.goldandsilverexchange.info/consumer-price-index.html

Some countries publish the categories of products they have in the basket , but the exact products usually remain secret. Nevertheless, some statistics bureaus disclose some tricks they use to obtain flattering indexes. For instance, they change the content of the basket periodically. Products that rise in price too much are taken out and replaced by cheaper ones. Or, when the price of a product remains stable, but quality improves, they count the quality improvement as a price reduction. So, for the computer in the basket, the Dutch Central Bureau for Statistics (CBS) counts a 64 percent price reduction between 1998 and 2003! And down goes the index!

http://www.cbs.nl/NR/rdonlyres/AB3F1E9D-EFED-4FD9-9393-E59F762D5C9B/0/2007gevoelsinflatieart.pdf

graphic page 6

So, the content of the basket is adjusted periodically. The justification is: “when prices rise, households adjust their purchases too.” And what does this policy means for the index? Well, since the defined household cannot spend more than it earns, the price-increase of the CPI-basket is automatically limited to the increase in earnings. The defined household cannot pay higher prices.

In a large heterogeneous area like the euro zone, countries will never be hurt equally by big shocks like the financial crises or others. It will be impossible for the ECB to react to such shocks by setting an interest rate that would suit all countries. For some the set rate will result in low inflation, for others the same rate will result in high inflation. This cannot be avoided in a heterogenous area. The CPI will mask as much as it can.

[9] The central banker makes sure that inflation always continues by steering the interest rate. [10] The office of the European Central Bank is in Frankfurt. This is the historical town of the Rothschild. Representatives of the Rothschild and the Morgan families stood at the basis of the creation of the Federal Reserve in the US, back in 1913. (G. Edward Griffin in “The Creature of Jekyll Island”) [11] Ownership ECB:http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2009:021:0066:0068:EN:PDF , article 2.

[12] For instance, the Dutch central bank is De Nederlandse Bank N.V. (DNB), where N.V. stands for Naamloze Vennootschap, Nameless Liability Partnership. This is a common juridical form in the Netherlands for private companies with stocks. These companies have the obligation to always mention N.V. behind the company’s name. In 1929 a special law dispensed De Nederlandse Bank N.V., from printing N.V. on the Dutch banknotes, thus letting it conceal from the population, that the Dutch money belonged to an N.V.http://www.dnb.nl/binaries/wo0649_tcm46-145952.pdf

The 4 members of DNB’s governing board, the day-to-day direction, are appointed by the Crown.

http://www.dnb.nl/en/about-dnb/organisation/governing-board/index.jsp

Of the 10 members of the supervisory board one member is appointed by the government.

http://www.dnb.nl/en/about-dnb/organisation/supervisory-board-and-bank-council/index.jsp

All these members have strong bonds in the economy.

http://www.dnb.nl/binaries/Raad%20van%20Commissarissen_tcm46-185323.pdf (in Dutch)

Of the 14 members of the bank council, one is the member of the supervisory booard who is appointed by the government. (Nevertheless, he is as independent from government as all others.)

http://www.dnb.nl/en/about-dnb/organisation/supervisory-board-and-bank-council/index.jsp

Note, that central banking is about power, influence and increasing the balance sheet, and generally not that much about making profits. Many central banks have to hand over the profits to the Treasury.

[13] Independence of central banks: http://www.ecb.int/press/key/date/1997/html/sp970513.en.html [14] Central bankers have (and want to keep) control over the money system. One reason is, that they desperately need inflation, because otherwise the abusive bank system cannot work. As explained, without inflation banks would quickly go bankrupt. So central bankers want full controll over the interest rate. However, for the outside world they pretend, that governments would not be able to follow a consistent policy over time. They refer to negative past experiece where a government created excessive inflation. Central bankers would be more responsible (!), so they should have full control over the money system without any interference of the government whatsoever. Here an example of how they present things.Alexandre Lamfalussy, President of the European Monetary Institute, at the Oesterreichische Nationalbank, Vienna, 13 May 1997

“Modern economic theory emphasises the inflationary bias in economic policy, which relates in particular to the so-called time-inconsistency issue, i.e. the problem of convincing the public that the monetary authorities will resist the temptation to stimulate output growth in the short run by creating “surprise inflation”. Against the backdrop of negative past experience, the public is unlikely to have much faith in the authorities’ promises to maintain low inflation. Unless these promises are underpinned by a credible form of pre-commitment, the equilibrium inflation rate will be higher than needed, with no better performance in terms of output and possibly even a deterioration. As a solution to this problem, it has been suggested that responsibility for monetary policy be separated from political control and to enshrine this in legislation. According to this view, central banks should be given the freedom to formulate and execute monetary policy in line with their primary objective as determined by the legislator, to whom they are accountable. Accountability may involve either a legal obligation for the central bank to give reckoning for the conduct of monetary policy or a commitment to explain its actions, for example, in regular reports and to parliament. This allows central banks to take a medium-term orientation and not to be distracted by short-term political motives, an approach which benefits the credibility, transparency and efficiency of monetary policy.”

http://www.ecb.int/press/key/date/1997/html/sp970513.en.html

[15] Pierre Werner was a banker in Luxembourg and a very influential person. In 1944 had attended the Bretton Woods Conference that set up International Bank for Reconstruction and Development (IBRD), the International Monetary Fund (IMF) and the General Agreement on Tariffs and Trade (GATT). In 1970 he was also Minister of Finance and Prime Minister of Luxembourg. On top of that, in 1969, he had presided EEC’s Council. http://www.terra.es/personal2/monolith/eu.htm [16] John Perkins in an interview on Talkstick TV (link here below)“The fact of the matter is our job was to convince other countries to take very large loans [given by the World Bank]… Let’s say a billion dollars to Ecuador to build big infrastructure projects: power plants, … ports, highways, industrial parks. Things that didn’t benefit anybody except the very wealthy people in those countries who were quite corrupt, and we corrupted them… 90% of that billion dollars would come back to the United States to pay for Halliburton, Bechtel, these types of companies to build the infrastructure.

Then the country would be stuck with this huge debt, which over time would continue to be refinanced and get larger and larger and larger. So that in fact today Ecuador owes more than 50% of its national budget just to pay down its debt service which means there’s very little money left to pay for education and health services for the poor people who are the ones who suffer from these projects. It was their rivers that were destroyed when we built these hydro-electric plants, it was their land that was destroyed…

Now they’re saddled with this incredible debt that they can’t possibly pay. And so we go in and demand our pound of flesh, very much like the mafia… We need Ecuador’s oil… We tell Ecuador, ‘Since you can’t pay off your loans, what you need to do is to turn over your Amazon to our oil companies… What it is all about is building empire. We’ve done this in every country around the world that has resources that we covet, often this is oil in places like Indonesia, Nigeria, Ecuador, Venezuela, and. Colombia. But sometimes its other resources, for example in Panama it was the Panama Canal. ”

YouTube: http://www.youtube.com/watch?v=yTbdnNgqfs8

Joseph E. Stiglitz, in an interview in 2001:

“As the chief economist at the World Bank from 1997 to 2000, I have seen firsthand the dark side of globalization; … how so-called structural-adjustment loans to some of the poorest countries in the world ‘restructured’ those countries’ economies so as to eliminate jobs, but did not provide the means of creating new ones, leading to widespread unemployment and cuts in basic services..”

http://secret-of-life.org/the-World-Bank-and-IMF

See also: THE IMF AND IRELAND: WHAT WE CAN LEARN FROM THE GLOBAL SOUTH

http://www.dublinopinion.com/downloads/Afri_Report_on_EU_IMF_Loan_Deal.pdf

[17] David C. Korten, in “One World–One World Government Bretton Woods or The United Nations?”“It was all so simple. The World Bank trained cadres of young economists, teaching them to believe that rapid development depends on foreign borrowing to supplement investment based on domestic savings. Few seemed to notice the obvious — that when you borrow abroad you are borrowing foreign money that is only useful to buy foreign products, thus increasing your economy’s dependence on imports. You are also building up foreign debts that can only be repaid by exporting ever more of your domestic resources and production. Almost inevitably you end up at the mercy of foreign lenders — like the World Bank.”

http://www.ratical.com/co-globalize/ifg041400DK.html

[18] The Basel Accordshttp://www.parl.gc.ca/information/library/PRBpubs/prb0596-e.htm

[19] NRC Handelsblad, 11 February 2010VVD-Kamerlid Frans Weekers zei dat Griekenland de problemen volledig aan zichzelf te wijten heeft. Volgens hem hebben de Grieken de Europese Unie „jarenlang belazerd en bedonderd” met verkeerde cijfers over de financiële positie. „Dit is de straf van de markt voor Griekenland”, aldus Weekers.

Liberal party parliamentarian Frans Weekers said that Greece had to blame itself for the problems. According to him the Greek “have taken in and cheated” the European Union with fake numbers about their financial position. “This is the punishment of the market for Greece” said Weekers.

http://vorige.nrc.nl/economie/article2481429.ece/Kamer_Geen_Nederlandse_steun_aan_Griekenland

Well, if Weekers had taken a little trouble to inform himself, he would have known following:

Nikolaos Salavrakos, Member of the European Parliament in “The Greek Fiscal Crisis: Is there a way Out?”

“In 1974 Greek public debt was just 22.5% of GNP, and in 1979, when Greece signed its entry in the EEC, it was 31.7%. This by 1981 was increased to 36.1% and by 1989 it was 85.3%. The public debt continued to rise and thus by 1993 it had reached the astonishing level of 110.1% of GNP. This was slightly reduced to 106.6% in 2001 and to 102.4% by 2003.[2] Thus, even with the official statistics of the 2000-2003 period, the Greek debt was still high. However, Greece entered the EMU from January 1st 2001 as its twelfth member state. It is obvious that everyone (markets, politicians, EU Commission) knew that a country was becoming a member of the EMU with a debt above 100% of its GNP.”

http://www.efdgroup.eu/news/99-the-greek-fiscal-crisis-is-there-a-way-out.html

By 18 December 2010 the IMF has supplied over 10 billion euros of loans to Greece. Apparently, the conditions have not been made public.

[20] C. van Ewijk & L.J.R. Scholtens in “Geld, Financiële Markten & Financiële Instellingen” (in Dutch.) See item “Money multiplier”

Leave a Reply