I’m listening to some “pundit” guy on tv talking about the equity market. Among the eight or ten things that he thought were “constructive” was the fact that bond prices have stabilized and as a result there was one less thing to worry about. The absence of a negative being a strong positive.

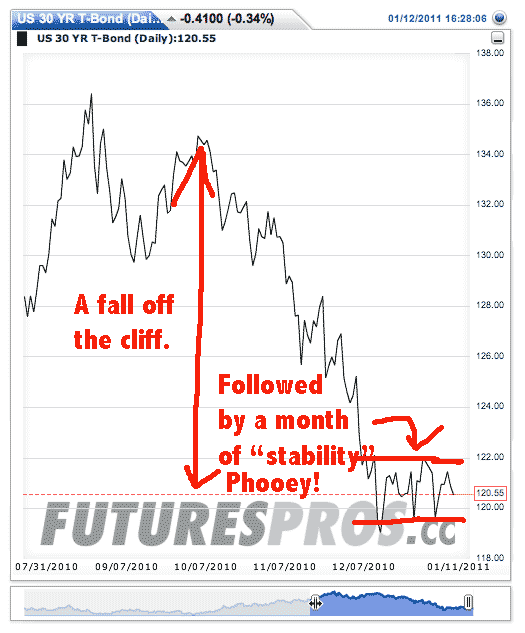

The fellow has a point. It depends on your perspective. Look at this graph that covers the QE2 effect (Sept. to-date). Sure enough, after an agonizing eight-week meltdown, LT bonds have come into a trading range. Its been about a month now of “stability”.

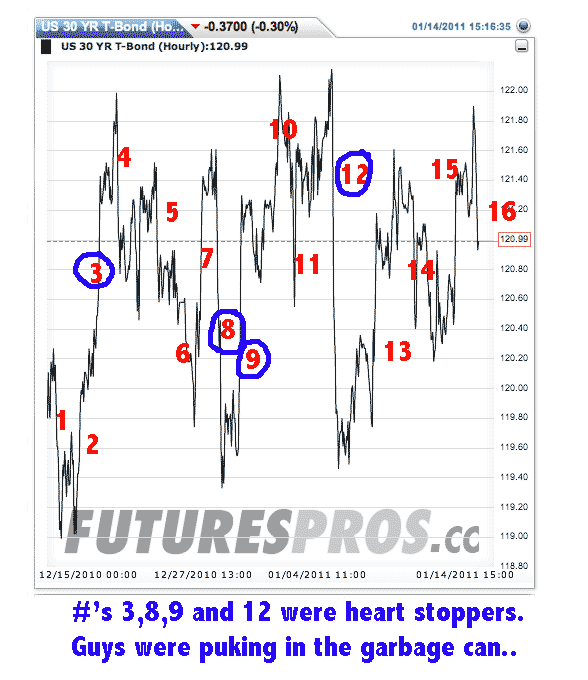

Bullcrap. Look at a close-up of this “stability”. Not stable at all. 16 moves greater than 1 big figure. Look at those highlighted in blue. That’s a lot of action. These are all gap moves. One after the other where there is a big step in a very short period. I think of bonds as less volatile on average than broad stock indexes. If there were twelve days in a month with 200 Dow point moves and another three/four of 400 pointers the smart guys on tv would not be using adjectives like “stable”. They might say, “nervous”, or even better “illiquid”.

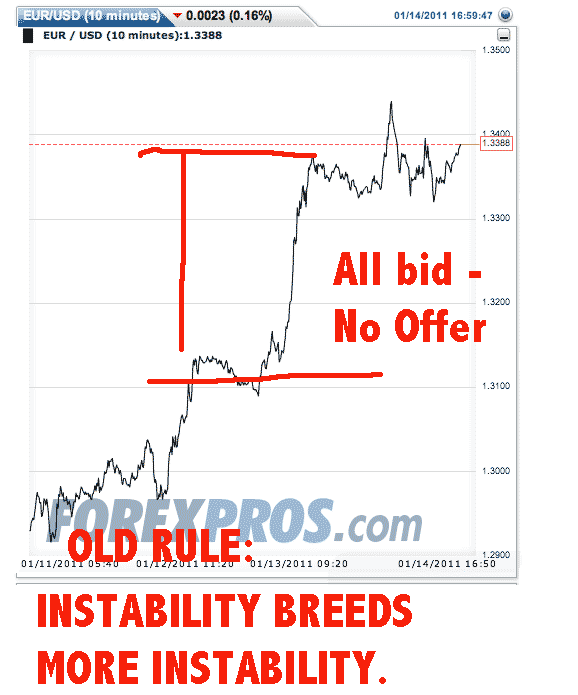

Another recent example of a market “gap” that looked (to me) like a liquidity issue (not justified by the news flow):

Student loans are bullet proof. Or so they say. There’s no way out. Bankruptcy does nothing for these loans. Think of it this way; Student Loans (“SL”) are debtors prison. The flip side is if bankruptcy were a ticket out of SLs, there would be no SLs. So the rules aren’t going to change.

With that in mind, I found the following report of interest. (actually it is the most boring/endless read ever, don’t go there) (PDF-Link)

‘Bankruptcy Tourism’ under the EC Regulation on Insolvency Proceedings: A View from England and Wales

What will they think of next? Tourism that promotes/facilitates bankruptcy. You gotta hand it to the sharpie lawyers and tour operators who thought this one through.

It’s really quite simple. A German citizen who has some creditors chasing after him can go BK in Berlin. But it will result in six years of garnished wages. The alternative? Move to Wales for a bit, spend a day or so in court, and come out pretty clean.

How good is the credit protection available in ‘debtor friendly’ Wales? Very good:

An automatic and generous discharge of bankruptcy debts. The scope of the discharge is generous, extends to tax debts and is subject to few exceptions.

Tax debts? If it covers tax liabilities it should cover student loans. How hard is it to do this? Easy.

The only substantive eligibility requirement that debtors must satisfy before petitioning for bankruptcy in England and Wales is that they are unable to pay their debts.

The only procedural requirements that have to be met are the filing of the petition and statement of affairs together with the payment of the court fee. It is common for debtors to make an appointment to attend court, complete and file the paperwork and obtain a bankruptcy order all on the same day.

Who is doing this? (link)

One German debt expert based in Kent said that he was helping management consultants, doctors, accountants, dentists and lawyers to discharge their bankruptcy.

“They come from all over the European Union. They like the tax laws here as they are better than the ones in their country.”

Sorry to tell you, but this will not work for SLs if you continue to live in America. The US courts will not recognize the English BK petition. But then again, staying in America is not such an obvious choice anymore.

Leave a Reply