Today’s data flow suggests ongoing expansion, but should also send a note of caution. Industrial activity continues to respond to firming demand, but capacity has yet to show solid gains. Firms are still not sufficiently confident, or lack sufficient demand, to justify widespread investment. Similarly, consumer spending continues along its upward trend, although the increase in energy costs are likely constraining the pace of that growth and keeping a lid on consumer confidence. Something of a mixed bag largely consistent with the general concensus view.

Start with the better than expected industrial production report, via Bloomberg:

Industrial production in the U.S. rose in December more than forecast, boosted by gains in business equipment and home electronics that indicate factories remain at the forefront of the recovery as the new year begins.

Output at factories, mines and utilities climbed 0.8 percent, the most in five months, after a revised 0.3 percent increase in November, figures from the Federal Reserve showed today in Washington. Economists forecast a 0.5 percent gain, according to the median of 82 projections in a Bloomberg News survey. Manufacturing climbed 0.4 percent, and utility output increased 4.3 percent as snowstorms swept parts of the nation.

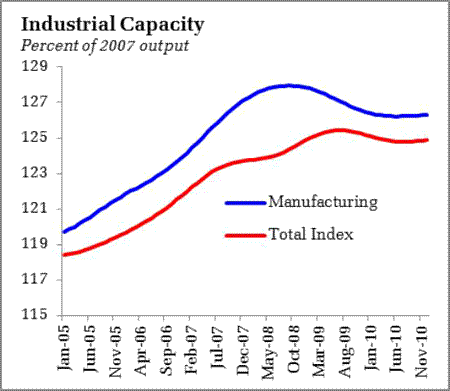

I have taken to looking at the capacity data for signs of a solid, self-sustaining recovery. Here we see the most tenative signs of improvement, or at least stabilization:

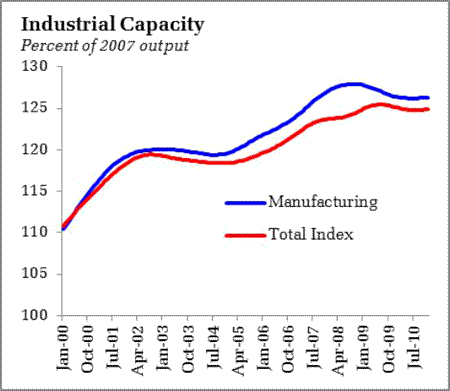

Looking back at the decade, capacity gains really took hold in late-2004 as the economy finally shook off the post tech-bubble doldrums on the back of the building housing bubble:

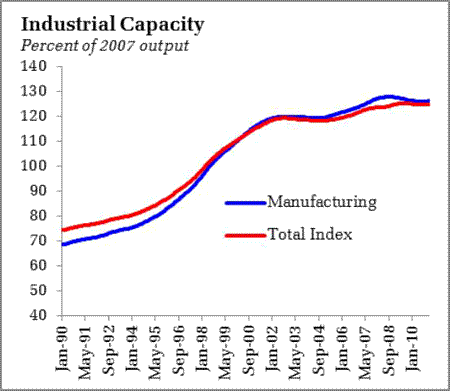

Before one gets too excited at the possibility, we can take a look back at the pace of progress during the 1990s.

We should be hoping for a recovery more like the 1990s than the 2000s, but it is challenging to find a story that allows for that kind of growth. I am not even sure how we get the recovery of the 2000s without an asset price bubble.

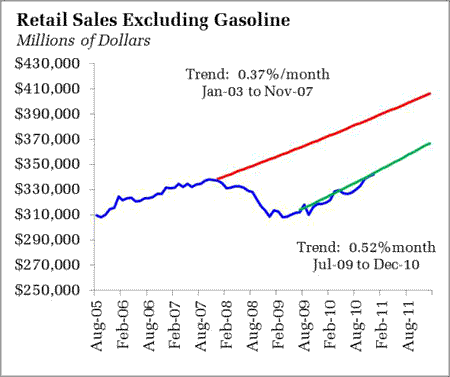

Moving on to retail sales, the numbers fell short of the outsized expectations that developed in the run up to the Christmas season. Still, the overall trend looks intact:

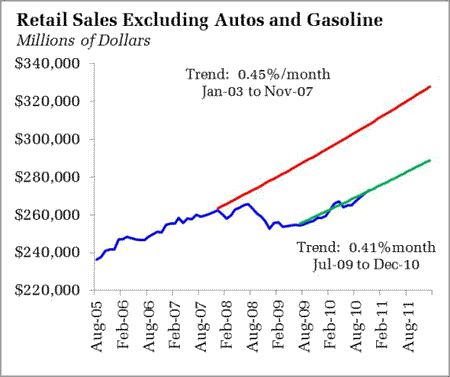

That said, I think you get a cleaner picture of underlying consumer trends by stripping out auto related sales:

Here the rebound looks less impressive, but the trend remains in the right direction. That said, there was a noticable decline in the rate of monthly growth during the final quarter, 0.77%, 0.59%, and 0.36% for October, November, and December, respectively. I think it is safe to say that the consumer has some momentum, especially with rising nonfarm payrolls, but higher energy prices are likley to constrain the pace of growth going forward.

Similarly, rising energy costs were a culprit behind the decline in consumer confidence. And those higher costs clearly showed up in the consumer price index. Bloomberg has a curious introduction:

The cost of living in the U.S. climbed more than forecast in December, led by higher fuel and food prices, while other goods and services showed the smallest annual increase on record.

Looking at the the CPI release, one gets something of a different story:

The energy index increased in December. The gasoline index rose sharply and accounted for about 80 percent of the all items seasonally adjusted increase. The household energy index, which declined in November, increased as well. The food index increased slightly in December, with the fruits and vegetables index rising notably.

The headline increase was driven by energy, not food as Bloomberg reports. Core prices increased just 0.1% for the month and 0.8% compared to last year. So far, higher energy/commodity prices have yet to work their way through to final prices, not surprising given persistently weak labor markets and consistent with the Beige Book story.

Finally, Richmond Fed President Jefffrey Lacker offered up the possibility of reviewing the large scale asset purchases:

“While the outlook may not have improved enough yet to warrant adjusting our purchase plans in the near-term, I anticipate earnest re-evaluation as economic developments unfold in the months ahead,” Lacker said today in prepared remarks of a speech in Richmond, Virginia.

I am not surprised that some policymakers would point to better data as a reason to reevaluate the program. But I would think about the timeline on this. Lacker says decribes the process in the months ahead. But how many months do we have left? The current program is expected to end by the second quarter of this year, just about 5 months. Unless growth explodes, by the time FOMC members would feel comfortable disrupting the plan, it will be almost complete anyway. Even other traditionally hawkish policymakers expect the plan to concluded as planned.

Bottom Line: Data generally in line with a sustainable growth, but expectations that the economy is about to take off remain premature. Inflation fears still appear overblown given that inability to pass higher commmodity prices through to consumers. Energy prices, however, do appear to be contraining consumer spending. Overall better data will continue to be reflected in Fedspeak, but time is running short to change the current asset purchase program.

Leave a Reply