Most businesses use some kind of commercial real estate. Leasing property has been a bargain in the past year. Prices for buyers are very favorable, though commercial mortgages are still subject to pretty tight underwriting. Many commercial tenants have renegotiated their leases to lower their rents. Going forward, though, good deals are going to be more difficult. 2011 is the year to lock in current rents. If you are going to need more space in the future, you might want to commit this year while landlords are still feeling desperate.

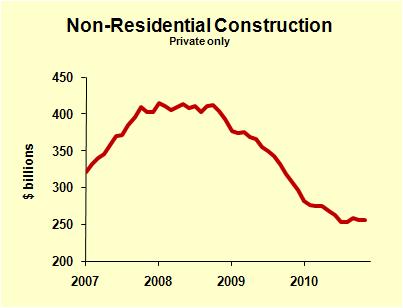

This turn in the real estate market may seem strange, given continued talk about low real estate prices and continued foreclosures of commercial property. The key to this challenge is two-fold: construction is minuscule, while the economy is gradually improving. These generalizations apply in most areas, but you’ll want to look at your local markets before making a decision. In the last year I’ve been asked to help a company understand three different metropolitan area real estate markets. Here’s what I saw in each: virtually no new buildings under construction. Vacancy rates have stopped rising. Any improvement in occupancy will lead landlords to remove some of their discounts.

How do you play this turnaround as a tenant? Consider offering to renew your lease ahead of schedule, so that you extend for ten years or so. Bargain hard on rental rates and you should be able to come out well prepared for the coming decade.

What if your business is growing and you expect to need more space, but not until 2012? Bargain now. Offer to sign a firm contract to begin in 12 months. In normal conditions, you landlord will not want to keep space vacant a year. In current conditions, though, a firm commitment for a year from now is going to sound fairly decent. Note, however, this offer will only make sense if the landlord is convinced of your ability to fulfill the terms of the new lease.

If you are in strong financial position, consider buying the property you now rent. Purchase prices are relatively low and financing costs are cheap—for those companies with sound financials. If you’re skating on thin ice in terms of equity, forget this plan. But if you have solid capital and your long-term plan involves your current property, then buying could be a great deal.

Caution could be justified, however, on the grounds of flexibility. In my articles about economic contingency planning, I’m always harping on the value of being able to change your cost structure in the future. All of the techniques I’ve mentioned in this article lock you into a commitment. I wouldn’t give up flexibility without getting a good deal in return, but the good deals are out there. However, if your business’s future is a little dicey, then hold off on long-term commitments as much as you can.

So true. I was in commercial insulation manufacturing for many years (based in Florida). The last few years our business was down around 75%! Many contractors went belly up. I baled last year and don’t expect a turnaround for another few years.