China continues to reject price hike pressures from Companhia Vale do Rio Doce (RIO), the world’s largest producer of iron ore, and has openly expressed its discontent on the matter, emphasizing they would rather not have Brazilian iron ore imports than have to pay extra 11.0% to 11.5% price increase, to align prices with those in Europe.

In February, ’08, Companhia Vale do Rio Doce [Vale] and several European steel companies agreed on an ore price hike of 65%, which pushed up the ore price to $1.898 per dry metric ton iron ore unit.

In a very direct written letter to the Brazilian-based company, China’s Iron and Steel Association [CISA], last week asked the world’s leading iron ore producer to give up its persisting attempts to raise iron ore prices. The letter said: “one-sided price raising not only violated international iron ore price negotiation rules, but also led to huge losses in Chinese steel enterprises. This damaged the win-win relationship in bilateral iron ore trading.” Beijing threatened to cut back or even boycott imports of iron ore from Brazil’s Vale. The CISA also regarded the move by the Brazilian company to be extremely ill-considered and asked the iron ore producer to give up its price hike decision and come back to a normal price negotiation with China.

Earlier on Friday (Sept, 26), the Chinese Industry Group said China’s stainless steel output will reach 8 million tons, while demand will be 7 million tons, indicating it would not have much need for Brazilian ore.

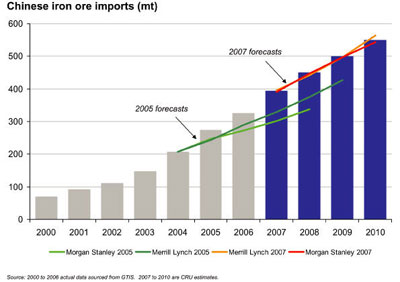

Irrespective of these ultimatums or negotiating tactics, there is a strong probability, if not a certainty, this is not going to be a permanent measure by China, but more of a short-term move. China may want price reduction, or at least keep the existing one at current levels. However, as iron ore demand increasingly outstrips supply, China’s argument not only weakens but at the same time becomes in a way rather unrealistic. The fact of the matter is most of the world’s iron-ore is extracted in the opencast mines of Australia and Brazil. China itself consumes over 50% of the world’s iron ore production, which translated into steel production reaching the 489-million-ton mark in ’07. As mainland’s ongoing construction of infrastructures continues to accelerate, the rapid increase in steel consumption and production will unavoidably create extra demand for iron ore, making China even more reliant on the top mining multinational corporations. In addition, China’s domestic iron ore producers are simply not able to meet demand based on the increasing marginal cost of production, higher-quality Chinese iron-ore resources that keep depleting, and an increasing portion of Chinese mine supply of iron-ore coming from low-grade underground mines. These factors have led to mainland’s import of iron ore doubling between fiscal ’03 and ’06, increasing by more than 68 million metric tons from a year ago.

With domestic iron-ore production not meeting expectations, iron ore inventories in China will eventually run low, forcing the Chinese side back to the negotiating table. Vale’s chief executive, Roger Agnelli, said talks with Chinese buyers are continuing but he doesn’t believe that China’s steel industry can survive without Brazil’s iron ore. Agnelli said that “the Chinese market is Vale’s” and that if “Vale shipments to China were stopped and suspended,” China’s steel industry would crumble.

The fact that Chinese steel-makers have bought stakes in Australian iron ore miners, clearly reinforces the notion of how anxious mainland is in securing supplies of an essential raw material that is in short supply.

China is projected to double its imports in the next five years, becoming world’s largest importer of iron ore. By 2010 its dependence on imported iron ores will reach to 63% compared with 52% in 2005.

I am sick and tired of the Chinese. They always want everything for FREE. No more, PAY UP.