Paul Krugman claims that the commodity markets are telling us that we’re living in an Ehrlich-like finite world of resource scarcity where “the rapid growth of emerging economies is placing pressure on limited supplies of raw materials, pushing up their prices.”

And what are the implications of the recent increase in certain commodity prices? According to Krugman, “It’s a sign that we’re living in a finite world, one in which resource constraints are becoming increasingly binding.”

Don Boudreaux responds and suggests that Krugman study resource economist Julian Simon, and points out that:

“It’s not true that vigorous economic growth necessarily makes resources more scarce. In fact, history shows that, because of human ingenuity, the opposite is not only possible but prevalent. Since the dawn of the industrial revolution in the mid-18th century, available supplies of coal, petroleum, iron ore, and most other resources have increased significantly – and, as a result, their real prices have fallen.”

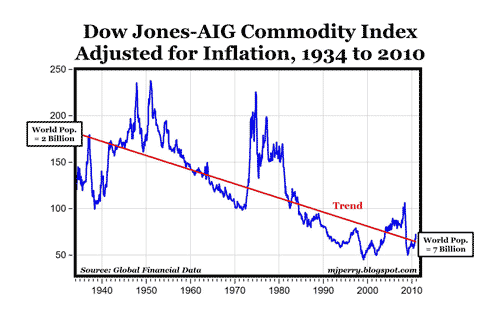

MP: The evidence is working against Krugman and in favor of Boudreaux on this one. The chart above shows the monthly, inflation-adjusted Dow Jones-AIG Commodity Index back to January of 1934 (data from Global Financial Data, paid subscription required). The DJ-AIG index is composed of futures contracts on 19 physical commodities in five categories with the following weights (individual weights are listed here):

- Agriculture (coffee, corn, cotton, soybeans, soybean oil, sugar, wheat): 34.37%

- Energy (crude oil, natural gas, heating oil, unleaded gas): 27.28%

- Industrial Metals (aluminum, copper, nickel, zinc): 17.65%

- Precious Metals (gold, silver): 14.60%

- Livestock (lean hogs, live cattle): 6.10%

(Note: According to Global Financial Data, data in the index from 1933 to 1989 are from the Dow Jones Futures Index, and data from 1990 are from the Dow Jones-AIG Commodity Index.)

Bottom Line: Over a very long period of time (76 years), the real prices of commodities have fallen continually and significantly (see red trend line in graph), and the decline in commodity prices has taken place during a period when the world population increased by more than three times, from 2 billion in 1934 to the current population of 7 billion in 2010. Don asks the right question:

“If economic growth since the industrial revolution coincided with increasing resource supplies, why should we expect that continued economic growth will suddenly start to have the opposite, dreary effects predicted by Mr. Krugman?”

Of course innovations can be found to exploit finite resources, however, it is worth pointing out the fact that these remedies can only work to increase finite resource exploitation if the initial procedures employed in their exploitation were not close to being optimally efficient, and there is a sufficient reservoir of untapped finite resource that can be exploited with new innovations. It could easily be argued that we have been in a special period of history in which a regime of increasing efficiency cna keep the price of commodities down as shown in your plot. There is no guarantee that the regime will not change in the future. If the basic conditions for innovation-based increase in extraction are not met, production will peak, and prices will inevitably rise. Even if advances in finite resource exploitation can be found, they will only temporarily delay the inevitable depletion of that resource to the point where economic growth that depends on them will suffer (unless we can exploit another planet, which seems unlikely). There will inevitably be a peak in production for finite resources, we’re only kicking the can down the road a bit further each time there is a new innovation.

Also, the intellectual capacity and expertise of people working in the field to find new breakthroughs is absolutely necessary; discoveries can only be cultivated through public investments in education and research. Innovations don’t magically happen. One could easily argue that we’re doing a very poor job of cultivating the kind of intellectual powers that will be able to overcome the technological challenges of the future that would be necessary to sustain production of many kinds of finite resources.

The situation with respect to resources today is very different to any time since the Industrial Revolution began. Humans now number almost 7 billion. We are very close to some very real resources limits we have not previously encountered because we were fewer in number and earlier in the era of global extraction of those resources. Looking in the rear view mirror isa notoriously bad way of forecasting when the fundamentals are changing.