Shares of Tesla Motors Inc. (TSLA) fell the most in the Russell 1000 Index during Thursday’s trading session, sinking 6 percent to $30.72. The equity was rated “Sell” by Capstone Investments analyst Carter Driscoll, who put a $22 price target on the ticker, saying it is “priced for perfection.”

Driscoll argues in a research note to investors that the market for electric vehicles “will not grow in the time frame anticipated..because of the lack of recharging infrastructure, range limitations versus conventional vehicles and lack of a brand name.” Driscoll also says that hybrids will continue to dominate the green vehicle market.

Technically speaking, the shares of TSLA have been moving largely higher since the co.’s July initial public offering, gaining more than 100% per share. However, short seller-interest in the name continues to compound (IPO lock up period ends Monday 12/28). During the past month, the number of TSLA shares sold short increased by nearly 12% to 7.4 million. Short interest currently stands at 18% (float $39.85 mln), and that’s a lot.

In terms of TSLA’s financial position ; the co. has an average revenue growth of negative 32.38%, operating margin of negative 111.82%, and an average profit margin of negative 119.26%. EPS stands also negative at $0.38.

The co.’s total cash position in the most recent Q was at $96 million vs. $57 million in total debt.

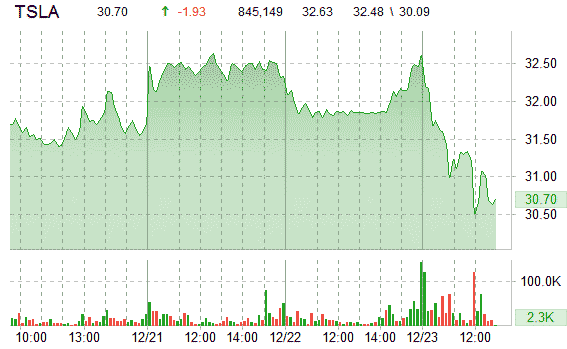

Tesla Motors is currently trading above its 50-day MA of $27.88. Shares are seeing significant volume; less than 3 hrs into the session TSLA has already traded more than 845,000 shares, compared to a daily average volume of about 893,000 shares.

Since its IPO, TSLA has traded as high as $36.42 and as low as $14.98 p/share.

At last check, TSLA shares were trading down $1.85, or 5.67, to $30.78. Day’s range: $30.09 – $32.48.

Disclosure: No Position

Leave a Reply