Solar companies are suddenly hot again but even with a big surge in share prices many of them are still dirt cheap. ReneSola Limited (SOL) is trading with a forward P/E of just 7. With big earnings growth, it also is a rare value and growth stock.

ReneSola is a Chinese-based manufacturer of solar wafers and provides OEM solar module services throughout the entire solar chain, including polysilicon feedstock, monocrystalline and multicrystalline ingots and wafers, solar cells and modules.

Founded in 2005, it has grown quickly and now has customers around the world.

ReneSola Posted Record Q3 Results

The dark times are officially over for ReneSola. On Nov 5, the company reported its third quarter results and saw record revenue of $358.7 million, up 41% from $253.9 million in the year ago period.

Revenue was boosted by higher average selling prices and big growth in the module business.

The company also shipped a record 324.9 megawatts (MW) of solar wafer and modules, up 25.8% from just the previous quarter and 122% from a year ago.

You can really see the turnaround in the company’s fortunes in just the last year in the earnings per share for the quarter.

It made 70 cents per share this quarter compared to a loss of 14 cents in the third quarter of 2009. The fourth quarter of 2009 was also a money losing quarter.

It beat the Zacks Consensus by 40%, which was its third surprise in a row.

Bullish Outlook for Q4 and 2011

The company expects the demand for its products to continue through the end of 2010 and into 2011. It increased its solar wafer and module shipments to the range of 310 MW to 330 MW.

The full year shipment range is projected to be between 1.13 GW and 1.15 GW.

Great things are expected in 2011, however, as ReneSola expects a surge between 42% and 48% in solar wafer and module shipments to the range of 1.6 GW and 1.7 GW.

Zacks Consensus Estimates Jumping

Given the big beat and the continued bullish outlook, it’s not surprising that analysts scrambled to raise estimates for 2010 and 2011.

6 estimates have been revised higher in the last week for 2010, pushing the Zacks Consensus up to $1.74 from $1.48 per share.

That is astounding earnings growth of 301.9% over 2009, where the company lost 86 cents per share.

The growth projections are a little less bullish for 2011. Analysts expect earnings growth of just 14.7% as the 2011 consensus has jumped to $1.99 from $1.65 per share.

The Magical Combination: Value and Growth

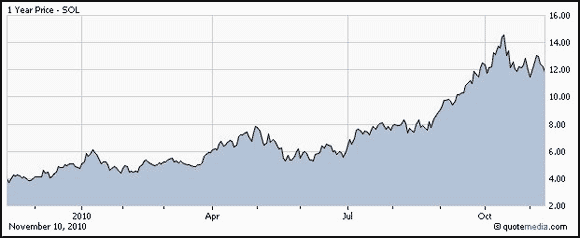

Shares of ReneSola have been on a tear over the past year as earnings have improved.

But even with the share gain, the stock is still a value.

With double digit earnings growth expected in 2011 and a low P/E, ReneSola sports a PEG ratio of just 0.4, which is cheap by any metric and is also under its peers at 0.6.

The company also has other value metrics with a price-to-book ratio of just 1.1.

It has a stellar return on equity (ROE) of 21% which is higher than its peers at 15.4%.

ReneSola is a Zacks #1 Rank (strong buy) stock.

Leave a Reply