Ann Taylor (ANN) analysts are looking for explosive growth from the women’s retailer. The company has posted solid sales results and continues to improve efficiency.

Additionally, this Zacks #1 Rank (Strong Buy) is trading with attractive valuations, given the fantastic earnings trajectory.

Company Description

Ann Taylor Stores is a women’s retailer in the U.S. with almost 900 locations under the names Ann Taylor, Ann Taylor Factory, LOFT and LOFT Outlet. Merchandise is also available through the company’s website.

Growing Hand over Fist

The Zacks Consensus Estimate for fiscal 2011 is currently $1.16, which is more than 3 times the 32 cents earned in the previous year. Ann Taylor analysts are expecting EPS of $1.40 in 2012, which is 20% higher than the estimates for the current year.

Coming Off of a Solid Quarter

On Aug 20 Ann Taylor reported quarterly earnings of 32 cents, which met the Zacks Consensus Estimate, which is up sharply from the 6 cents a year before. Net Sales rose $13.3 million, to $483.5 million.

The company also showed strength in the all important same-store sales figures, which grew just over 6%, compared to a sharp decline a year ago. Efficiency improved as well, with the gross margin rising 260 bps, to 55.0%.

Valuations

Shares of ANN are trading with pretty good multiples as well. While its P/E ratios are at the higher end compared to its peers, the growth rates are producing some value. The PEG ration is coming in at 0.95 compared to the 1.35 its peers are showing.

Ann Taylor’s price to sales ratio is a solid 0.69, easily ahead of the space’s average of 1.04 times.

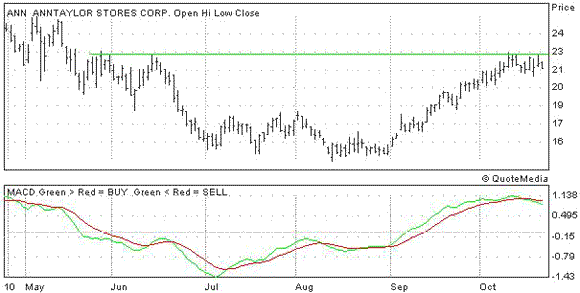

The Chart

One concern does come when you look at the chart. Shares are bumping up against a potential resistance point and given the MACD, they may not have enough momentum to punch through that level. However, if we do see the stock push though, there will be quite a bit of upside.

Leave a Reply