Caterpillar, Inc. (CAT) just reported another awesome quarter that handily beat expectations, sending shares to within striking distance of the multi-year high at $81.19. With strong demand coming from both developed and emerging markets, this Zacks #1 rank stock has plenty of upward momentum.

Company Description

Caterpillar, Inc. manufactures and sells construction and mining equipment worldwide. The company was founded in 1925 and has a market cap of $50 billion.

We just got an update on CAT’s business when the company reported solid Q2 results on Oct. 21 that came in well ahead of expectations.

Third-Quarter Results

Revenue for the period was up 53% from last year to $11.1 billion. Earnings also looked great, coming in at $1.22, 12% ahead of the Zacks Consensus Estimate and more than double last years 64 cents in the same period. The company now has an average earnings surprise of 25.5% over the last four quarters.

The company noted that it continues to see robust demand from emerging markets, where its machinery division saw sales in Latin America increase 121% from last year. Domestic demand has been strong too, with North American machinery sales up 89% after showing steep declines in the recession of 2009.

Balance Sheet

CAT also continued to pay down its debt during the quarter, with its total debt load falling $1.5 billion to $20.3 billion.

Guidance

With a solid quarter in hand on surging demand, Caterpillar went ahead and raised its 2010 outlook. The company now expects revenue between $41 and $42 billion, up from the previous $39 to $42 billion, with a new earnings range between $3.80 and $4.00, up from the previous range of $3.15 to $3.85.

Valuation

With a forward P/E of 21.5X, CAT trades at a premium to its peer average of 18X. But with a next-year estimate calling for 39% growth that will most likely be revised higher on the good quarter, CAT’s PEG ratio of .55% is deep in value territory.

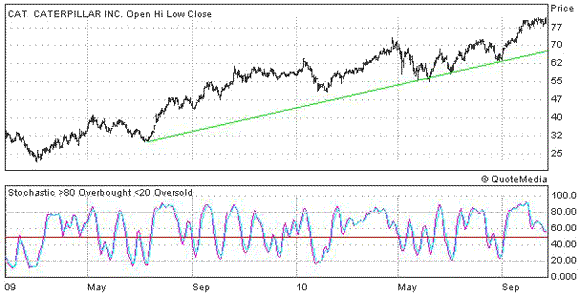

2-Year Chart

CAT has been strong for the last 18 months as the global economy has strengthened, recently moving within striking distance of the multi-year high at $81.19. But in spite of the nice gains, the stochastic below the chart is signaling that shares are trading safely away from over-bought territory, take a look below.

Leave a Reply