AutoNation, Inc. (AN) analysts are raising estimates following the latest earnings surprise. Industry sales continue to improve and AutoNation is making the most of it.

Company Description

AutoNation, Inc. owns about 250 automotive retail locations. The company sells new and used cars in addition to providing services, financing, body work etc.

Beat the Street

On Jul 22 AutoNation reported quarterly results that showed a 20% increase in revenue, to $3.1 billion. Auto sales are making a comeback in the U.S. with sales rising 12%.

Net income came in at $62 million, up from $50 million one year ago. The company earned 38 cents per share, up a dime over the past year. That mark topped expectations by 2 cents, making it the sixth earnings surprise in the past 7 quarters.

A couple weeks later AutoNation reported a 22% sequential increase in unit sales for July, which up 5% year-over-year.

Bullish Comments

AutoNation’s CEO commented on the improving industry. “We expect third quarter new vehicle industry sales will equal or surpass third quarter 2009 new vehicle industry sales even though the prior year included the highly successful Cash for Clunkers program. We continue to see a solid automotive recovery going forward.”

Estimates Rising

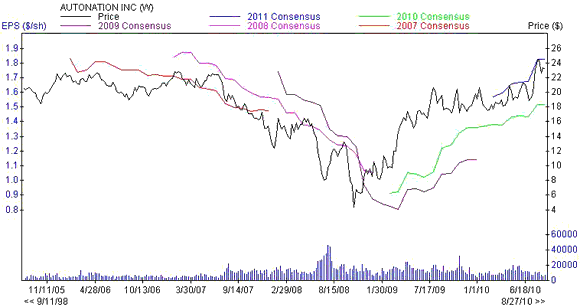

Following the quarterly report, analysts raised full-year estimates for 2010 and 2011. The Zacks Consensus Estimate for this year is up 8 cents to $1.52.

Next year’s forecasts are up 15 cents on average, to $1.83. Given 2009 earnings of $1.15, projected growth rates are 32% and 20%, respectively.

The Chart

As you would assume, earnings expectations for AutoNation took a nose dive as we headed into the recession, but they have snapped right back to 2007 levels.

Leave a Reply