Deferring to the faltering economy, the Federal Reserve stepped up its policy efforts last week. Barely. Almost imperceptibly. Indeed, it is almost as if the Fed could muster nothing better than throwing a bone to its critics. Will they throw more bones in the coming months? In this environment, I suspect the Fed will continue to do more than I expect, but less than is necessary.

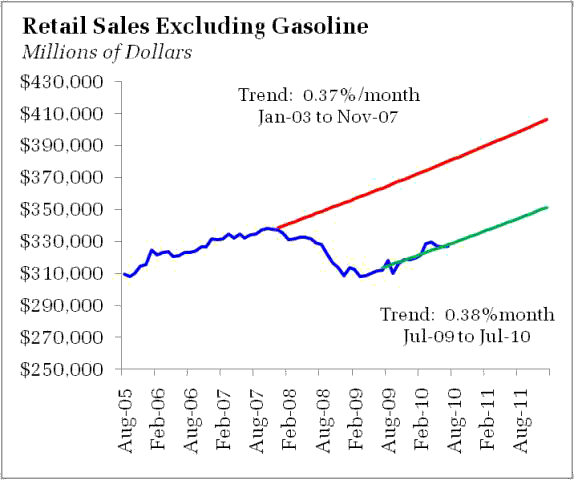

The few data releases since the FOMC meeting have not been particularly encouraging. The trade deficit expanded, implying a downward revision to the Q2 GDP numbers. Initial unemployment claims continue to hover at levels consistent with weak job growth. University of Michigan consumer sentiment ticked up, but signals that households remain under severe pressure. Retail sales edged up in July, reinforcing the long standing trend of this recovery – an inability to grow fast enough to reestablish the previous trend:

One can argue that the previous trend was unsustainable, driven on the back of a clearly faulted debt-fueled asset bubble dynamic. But even accepting that hypothesis, that spending was critical to ensuring full employment. If consumers fall back, some other sector needs to step up to the plate. Otherwise, the economy will continue to limp along a suboptimal growth path.

Will FOMC members continue to accept that path? Acceptance is dependent on the inflation outlook. And on that point, the July CPI release, which revealed a slight increase in core inflation, leaves me unsettled. Given downward nominal wage rigidities, it is not that difficult to imagine an economy stuck significantly below potential output, but with just enough price pressures to sustain a slightly positive inflation rate. Absent a substantial output decline, would the Fed be inclined to significantly expand quantitative easing in the face of low, but positive, inflation, combined with positive inflation expectations? Apparently no, as this is a description of the current situation. More of the same is likely to produce little drips of monetary easing here and there, but it is difficult to see, for example, a commitment to purchase $200 billion of Treasuries each quarter until unemployment stands at 7%.

Is dramatic action necessary? I believe so, which, ironically, brings me to last Friday’s speech by arch-hawk Kansas City Federal Reserve President Thomas Hoenig. Hoenig is stepping up his public criticism of the FOMC, lambasting his colleagues for setting the stage for another financial crisis. In short, Hoenig sees parallels to the deflation scare of 2003, which prompted the Fed to lower rates to 1%. Shortly thereafter, economic activity accelerated on the back of the housing bubble. We all know how that story ended. In Hoenig’s view, this was essentially a repeat of the experience of the late 90’s equity bubble and subsequent collapse. Hoenig concludes that it is important to break the cycle; he suggests dropping the “extended period” language, moving the Federal Funds rate to 1%, pausing, and then make a final move to 2%. He does not view this as tight policy, but instead accommodative yet firmer policy. Tough love.

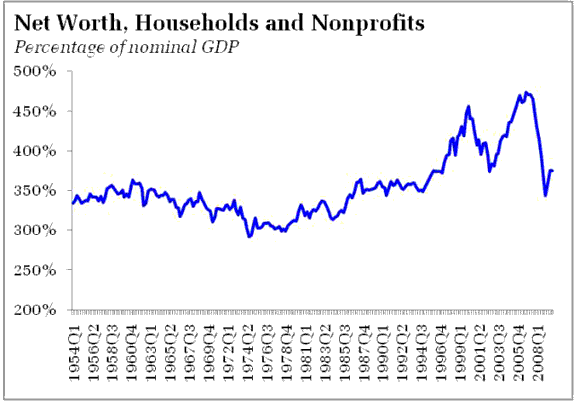

Hoenig’s story of policy induced bubbles is certainly not new. Indeed, the fluctuations in household net worth appear to be intimately related to the business cycle since 1995:

We tend to view these asset bubbles as “bad,” but I think this pattern also poses an interesting question. If you remove the asset bubbles, what is left? It sure looks like nothing more than an economy stuck in a subpar equilibrium. Perhaps rather than diverting capital from productive investments, capital flowed into asset bubbles due to a lack of investment opportunities. It is not so far fetched; we know that firms are sitting on nearly two trillion dollars of cash yielding low returns.

In other words, were the asset bubbles critical to maintaining full employment? And if so, how can we reflate the economy in their absence? Hoenig believes we will restructure the economy over time, but his story is woefully incomplete:

… then how might GDP and important components perform? Let me start with consumption, which for decades amounted to about 63 percent of GDP. During the boom it rose to 70 percent. It seems reasonable that the consumer will most likely return toward more historical levels relative to GDP and then grow in line with income. If so, the consumer will contribute to growth but is unlikely to intensify its contribution to previously unsustainable levels….

…While businesses need to rebalance as well, they are essential to the strength of the recovery. Fortunately, they are in the early stages of doing just that. Profits are improving and corporate balance sheets for the nonfinancial sector are strengthening and are increasingly able to support investment growth as confidence in the economy rebuilds. Also, although credit supply and demand may be an issue impeding the recovery to some extent, a shortage of monetary stimulus is not the issue. There is enormous liquidity in the market, and it can be accessed as conditions improve.

Finally, the federal government needs to rebalance its balance sheet as well. Federal and state budget pressures are enormous, and uncertain tax programs surely are a risk to the recovery. This adds harmful uncertainty upon both businesses and consumers. However, while these burdens are a drag on our outlook, they are not new to the U.S. and, by themselves, should not bring our economy down unless they go unaddressed.

It appears Hoenig believes both consumer and government spending are set to become less important to the growth mix. Yet, he also believes in such an environment, firms will continue to invest in new capital as confidence grows. But how are we to expect that firms will have any confidence in the absence of a strong consumer outlook or a government backstop? Indeed, the strains of such a dynamic emerge already. From Bloomberg:

Weaker-than-forecast sales at Cisco Systems Inc. and International Business Machines Corp. may signal a slowdown in the corporate spending that has led the U.S. recovery.

“It’s been business investment, particularly technology, that’s been in the driver’s seat,” said Stuart Hoffman, chief economist at PNC Financial Services in Pittsburgh. Should equipment spending slow significantly, “unless something else picks up the pace, it means the outlook for the economy is going to be that much dimmer.”

Note too that he conspicuously offers no mention of the external sector – perhaps no surprise given that an external impetus has been noticeably absent during this recovery. Simply put, if we take consumer, government, and external spending off the table, I don’t see any path that leads to Hoenig’s promised land.

Nor do I see a path to the promised land in the current stance of monetary policy. Nor do I see a path in what I suspect is the likely path – drips of easing here and there. Moreover, given the propensity of firms to offshore productive capacity, I am wary that even aggressive easing will stimulate investment activity. I think the latest trade release clearly show that stronger domestic demand is likely to get translated straight into imports. The same goes for consumer spending – the recession has ravaged credit ratings, leaving the pool of potential borrowers shriveled. And even if we can induce households to buy more flat screen TV’s, such stimulus is more of a economic boost for the Port of Long Beach than anything else.

So, increasingly I worry the most effective policy paths are less than palatable for policymakers. And I can’t say that I am particularly comfortable with said paths as well. But, at the risk of oversimplifying channels of monetary transmission, if future quantitative easing is to work, I suspect it needs to flow through one of two channels. The first is the via an explosion of net worth. In other words, a fresh asset bubble. I don’t think this will happen spontaneously. Via financial reform, policymakers are in the process of injecting enough glue into the financial markets to keep asset bubbles at bay, at least for the time being. The other channel is via a sharp decline in the value of the Dollar. Undoubtedly, this would stimulate export and import-competing sectors (I tend to think the latter is actually the most important). The rest of the world, however, would be likely to lean against such a decline.

This is a depressing outlook, as it suggests that even aggressive monetary easing might not be enough unless such easing can be induced to work along one of two channels policymakers will resist. Indeed, I think it would be most effective if the Fed could eliminate the middleman of Treasury purchases. Accumulate equities to drive up net worth and thus sustain consumer spending, enough of which would be spent on nontradables (the beauty of the housing bubble, by the way) that the stimulative effect would remain in the US. This option, however, is not legally available to the Fed. But the Fed could accumulate foreign sovereign debt, thereby inducing a decline in the value of the Dollar. Alas, that option might as well be illegal as well, and it will never happen. It would be seen as a.) stepping on Treasury’s turf, b.) risking retaliatory devaluations, and c.) setting the stage for an actual currency crisis.

Bottom Line: The Fed took a baby step forward last week. It is natural to interpret that step as a signal that more easing is coming. On the surface, however, such an interpretation is premature. If the economy continues to produce more of the same – steady growth with minimal inflation – policymakers are likely to keep additional policy responses to a minimum, more as an effort to placate critics than to affect meaningful changes to the economic path. Such meaningful policy might simply be a bridge too far for policymakers, especially if the asset bubbles during the past two business cycles were key to generating full employment. In such a framework, the Fed would either need to accept, and even support, a fresh asset bubble or a sharp decline in the value of the Dollar. Neither option looks acceptable at this time.

Update: Tim, who is on a camping trip, emails an update (he wrote the post before he left):

One could argue that government backed debt is the latest bubble supported by the Fed. But, in the context of the ongoing disruptions in lending channels, at least relative to what is necessary to hold the economy near potential, it is not a particularly effective bubble, absent a more committed fiscal complement.

things are bad now, s*** wait till next year, housing is in freefall, autos sales are collapsing at warp speed, and don't even mention unemployment, omg.we're in freefall mode (and no parchute)