It’s day two of the “Micro Man” investment regime, and Macro Man can only say that these “second derivative” guys are on to something. Why, he nearly broke even yesterday; coming after a seemingly endless skein of poor performance, Macro Man felt wonderful after registering such a small down day yesterday. Or……… b).

Regardless, he’s plowing on while removing the detritus of the wreckage from a few thematic macro trades from his portfolio. Still, he is keeping more than one eye on macroeconomic developments, because that is, after all, his stock and trade.

He was intrigued by the results from the recent equity sentiment poll, which showed that 70% of you are bearish to one degree or another through the end of next month. He found that surprising, given that his own informal polling of market contacts suggests a much higher degree of optimism.

Anyhow, this got Macro Man to thinking: what will it take for him to become more structurally bullish on equities? Such a topic could be the subject of a dissertation, which he sadly doesn’t have time for this morning.

The short answer, therefore, is a twofold one: profits at an attractive level for a bounce, and a cyclical economic recovery that is felt on the street.

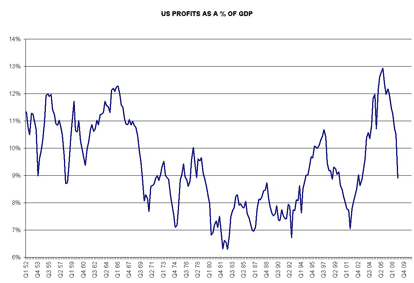

The previous three economic downturns have seen profits as a percentage of GDP trough somewhere between six and seven percent of GDP. Given the distress of the consumer and the global nature of this downturn, Macro Man sees no reason why similar levels should not be reached in this cycle. However, the figure was at roughly 9% at the end of last year. While this is admittedly lagging data, the magnitude of the correction required remains very substantial; Macro Man estimates that it will require a profit drop of roughly 25% from the end of last year to reach a reasonable level. Naturally, in SPX terms, this would represent a rather disappointing out-turn from the consensus: hence, Macro Man’s view that an ongoing bearish mantle is warranted.

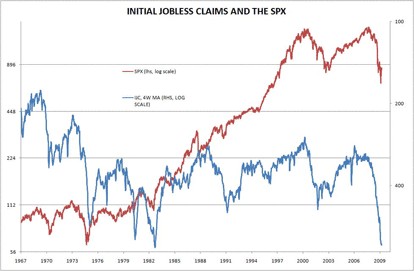

As for a cyclical measure, Macro Man likes to use jobless claims. They are high-frequency and represent the sort of second derivative, rate-of-change datapoint that the market seems to love. As the chart below (kind of) demonstrates, jobless claims have peaked at roughly the same time as a number of previous mmarket bottoms. Sometimes claims peak first, and sometimes the market bottoms first, but ion aggregate they are pretty close to contemporaneous.

As for the “green shoots” of yesterday’s Empire survey? Well, a record low capacity utilization figure is hardly reason for optimism. But even if you’re willing to consign that figure to the dustbin of history (“March data is soooooo last quarter, dahling”), it’s worth bearing this little historical nugget in mind: the SPX reached its last cyclical low in mid-July 2002. Where was the ISM that month? 50.2, having been as high as 53.6 a month previously and first breaching 50 five months earlier.

Indeed, the trough in ISM came a full nine months before the trough in equities. There is of course no guarantee that the same outcome will occur this time around, but if it did, that would put the low in the seasonally weak September/October period.

But hey, that’s enough of my yakkin’. Back to the charts….

Leave a Reply